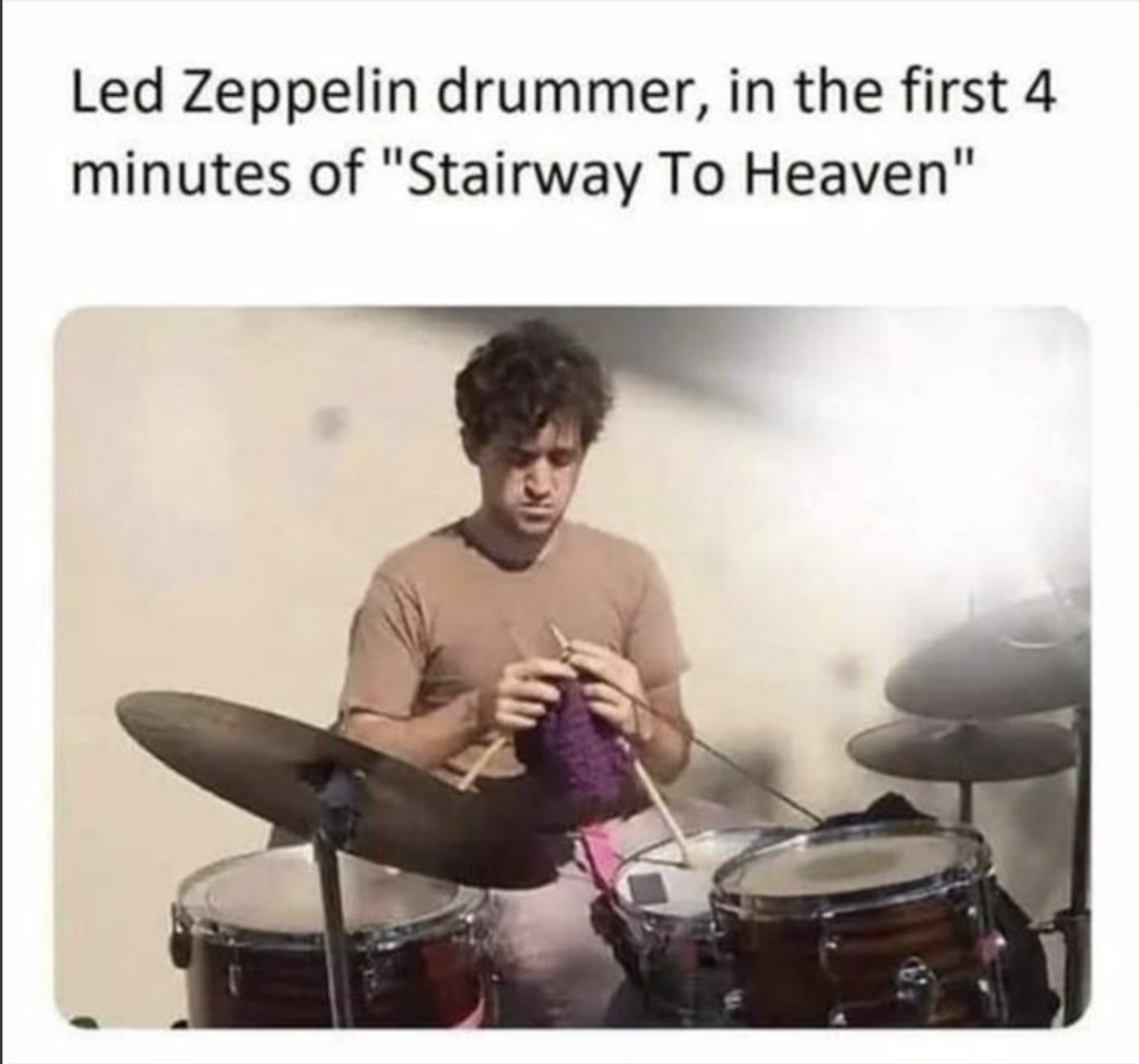

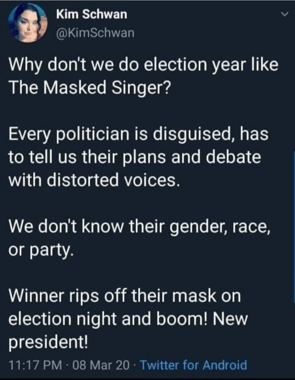

Joke Du Jour:

Joke Du Jour:

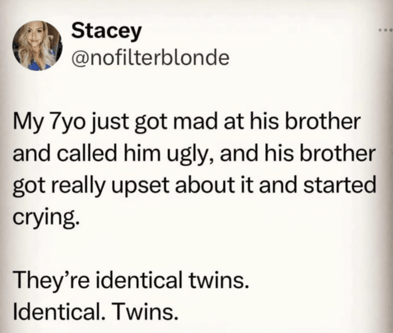

A small boy badly wanted a baby brother, so his dad suggested he pray every night for one. The boy prayed earnestly, night after night, but his prayers seemingly weren't answered. After a few weeks, he didn't bother to ask anymore.

Some months later, his dad said they were going to see Mom in the hospital, and he was going to get a big surprise. When they got to the room, the little boy saw his mother holding two babies. "Well, what do you think about having twin brothers?" his dad asked. The little boy thought for a moment and replied, "It's a good thing I stopped praying when I did."

Fun Stuff:

One of the funniest movies I've ever seen is, "We're the Millers." I watched it three times. I confess I did not hate the Jennifer Anniston strip tease scene. Oh, my. This is a very funny movie, and I promise that you will be rolling in the aisle. You can stream it on Amazon Prime for $3.99.

My news is that they are working on a sequel to be called "We're Still the Millers."

Commercial Loan Lesson:

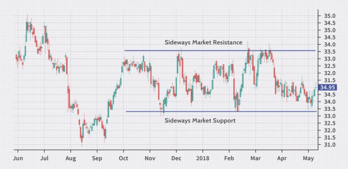

Commercial banks make about 60% to 70% of all commercial real estate loans (by the number of loans). As you will discover today, commercial banks are starting to dramatically slow down on their commercial real estate lending. In a major news publication, one bank loan officer described how his department had submitted thirty commercial real estate loans to Loan Committee in the past month. The bank turned down every one of them.

For you commercial mortgage brokers, this is fantastic news. Commercial borrowers now need you badly. You are reminded that Blackburne & Sons is not a fund. Instead, we instantly assemble a different syndicate of private investors for each new commercial loan. This means we are always in the market, even, for example, during the darkest hours of the Great Recession. Private investors always have money for deals. Apply to us here.

It's Time to Learn Commercial Real Estate Finance:

Residential mortgage banking is the slowest it has ever been in history. There just aren't many listings because no one wants to give up their 3% mortgages.

It's time to learn how to broker commercial real estate loans. In nine hours - one long day - you can learn the entire profession, including marketing, underwriting, packaging, placement (finding the right lenders), and fee collection. Just $549.

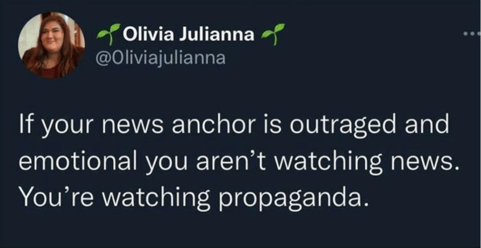

A HUGE Bank Run At The Speed of Light:

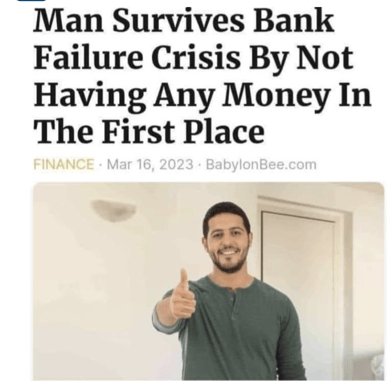

Most of the commercial banks in America have assets of less than $25 billion. On its final day of normal operations, $100 BILLION was withdrawn from Silicon Valley Bank. One-hundred billion dollars withdrawn in a single day. Wow.

There is no way for regulators to get ahead of such a fast-moving loss of bank confidence. Depositors weren't so much lining up. Instead, they were pushing computer buttons and making their deposits instantly disappear from the bank.

JP Morgan Chase, along with a small consortium of large banks assembled by Jamie Dimon, had to deposit $30 billion into a different bank, a regional bank named First Republic, to save the banking system.

During the Crash of 1907, the elder JP Morgan stepped onto the floor of the stock market, started shouting buy orders, turned back the stock crash, and saved the financial system. JP Morgan Junior tried to do the same thing in 1929, but it sadly didn't work. There were just too many sell orders. But here, once again, JP Morgan (the company) stepped in and was the hero. Atta-boy, Jamie.

I warned you last year to

get loan servicing income.

The speed at which deposits can disappear certainly must have the banks puckering. "We need to stay liquid. We don't need to make any more commercial real estate loans for awhile," they must surely be telling their staffs. Darn. I just hate it when half of my competition disappears. :-)

Quick Joke:

I’ve been feeling a bit moody and run down recently, so I googled my symptoms to see what I have. Kids… I have kids! Haha.

Back to the Banking Crisis:

There is a certain inertia in banking. Unsophisticated depositors build up their bank account balances, and the banks have historically paid them very little interest.

That has changed in the past two months. Around $121 billion left the banking system during the week of March 15 alone and flowed into money market funds, which are paying around 2.5%.

The banks are losing their cheap deposits, which is going to make holding the long-term, low-yield residential mortgages already on their books very painful. The loss of deposits is another reason why commercial real estate lending by banks is puckering. Banks don't have a lot of excess dough to lend.

Another Quickie:

Q: How many parrots does it take to screw in a lightbulb?

A: They say “toucan do it.”

The Capital of Most Banks is Getting Crushed:

When we talk about the capital of a bank, we are talking about the difference between their assets (loans, bonds, etc.) and their liabilities (deposits). This is the owner's equity. It is also the cushion that must absorb any losses.

You can think of bank capital as a way of keeping score. When banks are winning - when they are making lots of profitable loans - their capital is growing. When the world is kicking the snot out of the banks - when their loans are going bad and their investments are going sour - their capital will be contracting.

Far too many banks worldwide bought long-term, low-yield Treasuries in a desperate reach for yield. Imagine having a huge chunk of your bank's investment portfolio invested in 1.5% Treasury bonds, when you're forced to pay 2% or more for deposits. Those investment losses are coming right out of the bank's capital.

These investments losses may continue for years. The bank doesn't dare sell a $1 million Treasury bond today because it might get only $600,000 for it. The loss would immediately impair the bank's capital.

'Nuther One:

Not everyone uses or has access to a CVS Pharmacy, but they are known for their very long receipts, which are jam-packed with coupons.

Q: How far is it from the Earth to the Sun?

A: Ten CVS receipts.

Shrinking Bank Capital is Going to Kick This Economy in the Teeth:

It's not just the fact that bank capital is getting whittled away daily by their unfortunate investments in low-yielding Treasuries. Cheap deposits are also leaving the banks for high-yielding money market funds.

If that wasn't enough, please recall that $100 BILLION flew Silicon Valley Bank in just one day. Banks everywhere now have to constantly worry about liquidity. "We shouldn't make this new loan, even though it's sweet. We need to stay liquid."

When banks stop lending, bazzillions of dollars still flow back to the banks in the form of monthly loan payments. If more money flows back to the banks than what they are loaning back out, the multiplier effect kicks into reverse. Money is thereby destroyed at supersonic speed.

As money tightens, companies fail, bank loans go bad, loan losses skyrocket, their capital gets impaired, and banks pucker even more. This banking crisis has the potential to get very, very ugly.

One potential surprise: Inflation could suddenly slow... until the Fed capitulates, ends quantitative tightening, lowers interest rates, and imbeds inflation for the rest of our lives. As the Church Lady might say, "Well, isn't that special?"

Final Funny:

“Password is incorrect.”

“Password is incorrect.”

“Password is incorrect.”

*Clicks forgot password.*

*Changes password.*

“New password can’t be old password.”

Zoom Party Soon:

Zoom Party Soon:

Joke Du Jour:

Joke Du Jour:

Joke Du Jour:

Joke Du Jour:

Joke Du Jour:

Joke Du Jour:

Joke Du Jour:

Joke Du Jour: