Long before a mezzanine lender or equity provider will issue a term sheet, the sponsor first has to attract the lender's interest. By the way, the sponsor is the investor-owner of a standing commercial property or the developer of a proposed commercial real estate development project.

Long before a mezzanine lender or equity provider will issue a term sheet, the sponsor first has to attract the lender's interest. By the way, the sponsor is the investor-owner of a standing commercial property or the developer of a proposed commercial real estate development project.

So how do we attract a lender's interest? Answer: We prepare an Executive Summary Package on the deal. The Executive Summary Package is a sort of mini-package, and it should contain only the following items in the exact order described below:

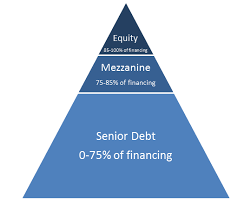

- Executive Loan Summary that states the size of the request; the type of request (mezzanine loan, preferred equity, or venture equity); the details on the existing first mortgage / proposed construction loan (lender name, loan amount, interest rate, monthly payments - if any, and maturity date); a-one paragraph description of the existing property or the proposed development; the value of the project either now or upon completion; the loan-to-value ratio of the first mortgage / construction loan; the combined loan-to-value ratio, including either the mezzanine loan, the preferred equity request, or the venture equity request; the debt service coverage ratio (with and without the proposed junior financing); the current value of the land; the amount owing on the land; the hard costs; the soft costs, including the loan points, construction period interest, and closing costs; the contingency reserve (5% of hard and soft costs); the total cost; the combined loan-to-cost ratio; a paragraph called Special Issues that addresses why the land that was purchased for $1MM is now worth $2MM (assemblage or change of zoning or the construction of a nearby highway or Wal-Mart); and lastly a borrower's section, the name of the borrower and the name of the guarantors, including the annual income, the net worth, and the percentage of ownership of each.

- Color Architect's Rendering. Behind the rendering you might include some current street photo's and an aerial view.

- Pro Forma Operating Statement, including a reserve for vacancy and collection loss of exactly 5%, professional property management fees of at least 4% to 6% of effective gross income, and reserves for replacement of at least 2% of effective gross income. New multifamily projects should not have an operating expense ratio of less than 36% of effective gross income; otherwise, the lender will disregard your pro forma and use 40% of effective gross income for expenses. Don't forget to include any laundry income, vending income, and/or parking income. The following training artilce will help you to prepare the Pro Forma Operating Statement.

- Cost Breakdown, including the current value of the land, hard costs, soft costs, and a contingency reserve of exactly 5% of hard and soft costs (but not 5% of the land costs).

- Curriculum Vitae (CV) on the developers. If the developers lack building and/or development experience, a CV on the General Contractor, Architect, and/or Engineer will help.

If attracted to the deal, the lender will immediately ask for financial statements and tax returns on the developers.

"But George, why not include the financial statements and tax returns right from the start?"

We need to keep the Executive Summary Package very thin at the start. Remember, all we are doing here is teasing the lender, getting his attention and interest. If a developer or broker tries to submit a complete package, the lender will never read it. We have to do this in steps.