Many investors, when valuing similar apartment buildings in a similar area, use the Gross Rent Multiplier. The Gross Rent Multiplier is defined as the Market Value divided by the Gross (Annual) Rents of an apartment building.

Many investors, when valuing similar apartment buildings in a similar area, use the Gross Rent Multiplier. The Gross Rent Multiplier is defined as the Market Value divided by the Gross (Annual) Rents of an apartment building.

Put another way, you can roughly value an apartment building by multiplying the Gross (Annual) Rents by the correct Gross Rent Multiplier. For example, let's suppose the Gross Rents of an apartment building are $100,000; and apartment buildings in that area are selling at a Gross Rent Multiplier of 9. Then $100,000 time 9 equals a Market Value of $900,000.

Let's look at this valuation method algebraically and then at how you can compute the appropriate Gross Rent Multiplier yourself. And guys, please don't zone out on me here just because we are using some 7th grade algebra. Twelve-year-old's get A's in Introduction to Algebra! (Heck, some pre-schools in New York City are probably already teaching algebra. I'm kidding, right?)

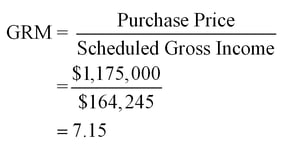

Gross Rent Multiplier = Market Value of the Apartment Building / Gross Annual Rents

Example: What is the Gross Rent Multiplier for apartments in southwestern San Jose, California? After looking at an old listing, you see that a particular 63-unit apartment building had a Gross Annual Rent of $1,512,000. You also discover that the building eventually sold for $16,632,000. At what Gross Rent Multiplier ("GRM") did this 63-unit apartment building sell?

Gross Rent Multiplier = Market Value of the Apartment Building / Gross Annual Rents

GRM = $16,632,000 / $1,512,000

GRM = 11.0

After looking at several other apartment buildings, you discover that an inferior apartment building sold at a GRM of 10.5 and a superior building sold at a GRM of 11.5. You conclude that the GRM of this area of San Jose is approximately 11.0.

Example: You are told by experienced commercial brokers in the area that small apartment buildings in Palo Alto, California (home of Stanford University) are selling at Gross Rent Multipliers of 12. You are informed that a six-plex in a nice area of Palo Alto has a Gross Annual Rent of $252,000. What is this six-plex worth?

Gross Rent Multiplier = Market Value of the Apartment Building / Gross Annual Rents

Multiplying both sides of the equation by Gross Annual Rents gives you -Market Value of the Apartment Building = Gross Annual Rents x GRM

Market Value of the Apartment Building = $252,000 x 12

Market Value of the Apartment Building = $3,024,000

Confused? Just multiply the Gross Rents by the appropriate GRM to get the Market Value of the apartment building. Local commercial brokers will tell you the appropriate GRM for any area.

What triggered today's lesson on the Gross Rent Multiplier was a seminar put on by a major apartment lender. Their rate sheets talk about a super-low interest rate for Tier I apartment buildings, a low rate for Tier II apartment buildings, and a higher rate (and lower LTV) on Tier III apartments. But, geesch, how does one know whether an apartment building is a Tier I, II, or III property?

They gave some very helpful guidelines using GRM's:

Tier I Apartments:

Buildings selling at a GRM of 10, 11, or higher.

In my examples above I used apartment buildings in Silicon Valley, California, arguably the most desirable real estate in the world. Cap rates of 11 and 12 are almost unheard of in any other areas, outside of Long Island, New York, Washington, D.C., and the best areas of Chicago. Most apartment buildings in the real world will sell today at GRM's of 6 to 8.

Tier II Apartments:

Buildings selling at a GRM of 7, 8, and 9.

Tier III Apartments:

Buildings selling at a GRM of 4, 5, and 6.

The lesson to be learned here is that the nicer the building and the more desirable the area, the higher the Gross Rent Multiplier.

Have you visited our latest commercial real estate loan portal? It is far-far easier and faster than C-Loans.com and it offers four times more commercial lenders:

When should use C-Loans.com? The advantage of C-Loans is that you can create a simple commercial loan application form in just four minutes and then submit it to 750 different commercial lenders. The hungriest commercial lenders are also usually found on C-Loans.com. Both of our portals are free to borrowers and brokers.

Do you need a non-recourse loan? Do you need a commercial loan with no prepayment penalty? Is your client's commercial property partially vacant? Do all of your commercial leases run out in the next 18 months? Do you need a lender who will allow a negative cash flow? Do you need a lender who will also look at the borrower's global income - income from salaries, other investments, etc.? Do you need a lender who will allow the seller to carry back a second mortgage? Does your client have a balloon payment coming due on his commercial property? Has your bank offered him a discounted pay-off? Does your borrower have less-than-stellar credit? Is your client's company losing money? Is your borrower a foreign national?

On the entire planet, there may not be a better deal. We'll trade you the contents of the business card of just one banker making commercial loans for a free directory of 2,000 commercial lenders.

Are you just kicking tires today?

What is more valuable - a $200,000 degree in liberal arts or a nine-hour video course that will teach you the entire profession of commercial mortgage brokerage? The course includes marketing, underwriting, packaging, placement, and fee collection - all taught with enthusiasm, humor, and juicy war stories. When I recorded this course, I was on my game. In one dedicated weekend, you could emerge as a near-expert in the profession.

Did you learn something today? Want to receive two free training lessons in commercial real estate finance every week?

Got a buddy or a co-worker who would benefit from learning commercial real estate finance?

Let's look at another example, but this time let's use the gross rent multiplier to compute the likely sales price or value of an apartment building. Suppose we're now looking at a 10-unit apartment building located just a few blocks away from the 12-plex (the above example) that sold last week for $1,350,000. We calculated the gross rent multiplier on the 12-plex to be 9.4, and let's assume the two buildings are roughly comparable (same neighborhood, similar condition, similar appeal).

Let's look at another example, but this time let's use the gross rent multiplier to compute the likely sales price or value of an apartment building. Suppose we're now looking at a 10-unit apartment building located just a few blocks away from the 12-plex (the above example) that sold last week for $1,350,000. We calculated the gross rent multiplier on the 12-plex to be 9.4, and let's assume the two buildings are roughly comparable (same neighborhood, similar condition, similar appeal).