Joke Du Jour:

Joke Du Jour:

I'm at my boss's funeral, kneeling and whispering to the coffin... "Who's thinking outside the box now, Gary?"

Mortgage Applications:

Holy crap, mortgage applications are at a 28-year low. How are you residential loan brokers surviving?

Quick Commercial Loan Lesson:

A cap rate is simply the return on his investment that an investor would earn if he bought an investment property for all cash. For example: If you bought an industrial building for $1 million all-cash, and the net rental income was $100,000 - then you would be earning a 10% return. You have bought the building at a 10% cap rate.

With rates on certificates of deposit so high, commercial property values are facing downward pressure. Why even buy a commercial property when you can earn such handsome returns on C.D.'s. On the other hand, inflation is dramatically increasing the replacement cost of any existing commercial building; so sideways we go.

Fun Stuff:

Amazon Prime just released an 8-part mini-series entitled, The Consultant. OMG. You will be shocked and mesmerized. Your brain will explode. Good stuff, Maynard.

Right now you're starving, while my hard money company

enjoys substantial loan servicing fees every month.

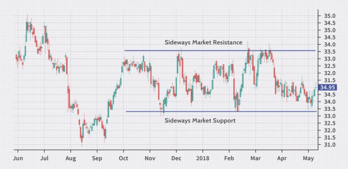

Sideways Stock Market II:

Three weeks ago, I wrote to you suggesting that the stock market may be trading sideways for the next ten years. For example, if you buy $10,000 worth of stock today, three years later that stock might still be worth only $10,000.

You might also remember the part where I asked myself, “What about the gains in the past two weeks?” I then replied to myself, “If we come back in a month, we may find ourselves right back where we are today.” After that recent 700-point rout, we are indeed right back where we started.

So why are we having this big financial tug-a-war? First all, there are a lot of positive developments going on out there. We start with my pet economic theory that no news is good news. When the government is not interfering with and terrorizing small businessmen, those hungry, energetic, and brilliant little engines of economic progress are unleashed.

I guarantee I will double your income... for just $30.

For an example of a government interfering with and terrorizing small businessmen, one only has to look at what President Xi has done in China over the past three years. Talk about killing the golden goose. Other than the threat posed by 8,000 new IRS agents, no one is terrorizing small businessmen in America right now. They are confident enough to hire and expand their businesses.

After all, the Ukrainians are holding back the Russians. Because their troops are too sick, it looks like the Chinese will miss a critical window to invade Taiwan this April. (Get ready for my "George is Retarded Zoom Beer Party in May.") Soon the U.S. will have its own missiles, which will triple the cost to China of any future invasion. The mullahs in Iran are highly unpopular, although 84% enriched (bomb grade) plutonium was found by inspectors this week in Iran. And while Little Rocket Man keeps playing with his toys, the world continues to ignore him.

American small businessmen are also unleashing the massive energy they built up during COVID. “When I finally get back to my business, I’m going to do this, that, and that.” Go-go-go is the battle cry of small businessmen right now. “To be rich, all a country must do is to leave its small businessmen alone.” What a powerful force!

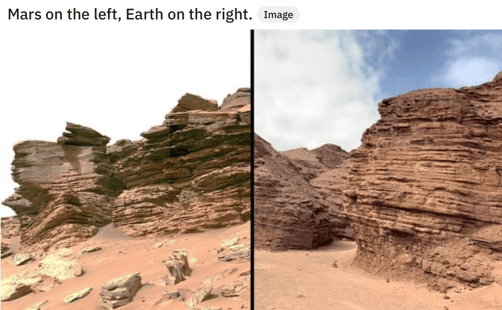

Our Final Invention - No Wonder Why Elon Musk is

Trying to Get a Handful of Survivors to Mars

Hundreds of nations and companies are developing AI. Thinking

that ALL of them will get the ethics right is a pipe dream.

Opposing the optimistic and industrious spirit of American small businesses are higher interest rates. An investor can now buy a risk-free CD that pays around 75% of the inflation rate. All other investments must compete against those CD’s.

The good news is that any business that needs a loan will find be greeted by his bank with a smile. U.S. banks are confident, flush with cash, and happy to lend. This is important: Any business with a good expansion plan should easily be able to handle a four percent increase in interest rates.

But here’s the deal. U.S. corporations have over six trillion dollars in debt maturing over the next three years. That’s a whole lot of debt to refinance, especially with the budget deficit projected to be $1.4 trillion dollars this year and with the Fed conducting quantitative tightening to the tune of another trillion dollars.

I am not saying that our investment bankers will be unable to raise the money; but there is no way that the Treasury will be able to sell all of its Treasury bonds at today’s interest rates. Our corporate controllers will also have to dramatically increase the yields they are offering to sell their commercial paper (short term bills) and corporate bonds.

Interest costs will soon become the hot new buzz word on the Wall Street business shows. There is no way that I can see that the stock market rising dramatically in the face of rising interest costs and the competition offered by bonds. So sideways we go.