Wrap your head around the concept that every business owner in the entire country needs cash right now. His bank is definitely not going to loan it to him. Banks today are terrified. Here is exactly how to find some small commercial real estate loans during this Coronavirus Crisis.

Wrap your head around the concept that every business owner in the entire country needs cash right now. His bank is definitely not going to loan it to him. Banks today are terrified. Here is exactly how to find some small commercial real estate loans during this Coronavirus Crisis.

I want to emphasis the word, "small" commercial loans. Small commercial loans close. Commercial loans larger than $1.5 million have a closing rate that is 1/20th of smaller deals. One-twentieth (1/20th)! You are foolish to work on commercial loans larger than $1.5 million right now, when every large commercial lender in the country is hunkered down in his bunker.

Go to Google Maps and type in the address of your office. You will notice on the map a number of businesses plotted close to your office. Ignore the big businesses, like the huge car dealerships and the huge national banks, like Chase.

Instead, focus on the small restaurants, the mobile home parks, the auto repair shops, the hairdressers, the RV parks, and the little retail shops.

Then call them up and ask to speak with the owner. At first the receptionist might try to protect him from you, thinking that you are a salesman. Explain to her that your company loans money to businesses, and right now her boss' business almost certainly needs money. You might also mention that you are located right around the corner from her boss' business.

Perhaps the first time you will be sent to voicemail, but that's okay. Make your pitch and leave your phone and email address. You might call the receptionist back and explain that you left your name and number on his voicemail; but if she will please give you her boss' name and email address, you can send him more information about a coronavirus business support loan.

I just invented that term tonight. Sounds pretty good, huh? A coronavirus business support loan. If the receptionist fights you, you might politely remind her that her job might depend of her boss getting some business support cash right now.

Now the first time you reach out to the boss of the auto repair shop, he might not respond. Keep leaving messages. Make a call list, and try to call thirty small, nearby businesses every day. Explain that your mortgage company is located right just down the street, but that you are working from home right now due to the crisis.

Send the business owner a new email every four days, personally addressed and referencing his particular business. "Hey, Steve, this is Don from Jackson Mortgage, right around the block from you. I drive by your auto repair shop there on Madison Avenue almost every day. You must need cash right now, and I may be able to help."

As the days go by, slide left and right on Google Maps to find even more businesses to solicit. It is important that your potential customers - and their receptionists - understand that you are located very close to them. You are not some call center located in the Philippines.

When you get a deal, please do NOT call or email me. I'm retired. Phew! Stressful times. Haha! Instead, please call Alicia Gandy, our largest commercial loan originator, at 916-338-3232 x 310. We call Alicia our Loan Goddess. Yes, she's that good. You can also call my wonderful, first-born son, George Blackburne IV, at 916-338-3232 x 314.

Remember, because you know Blackburne & Sons, you know one of the only conventional commercial lenders in the entire country still making commercial real estate loans. We just closed a $1.65 million commercial loan on a hotel in the heartland on Friday.

Final lesson: Alicia Gandy - we call her our Loan Goddess - will be absolutely killing it over the next two years. Her fastest and best service will go to those commercial loan brokers who brought her deals when the market was saturated with competing hard money mortgage funds. These loyal commercial loan brokers have a relationship with her.

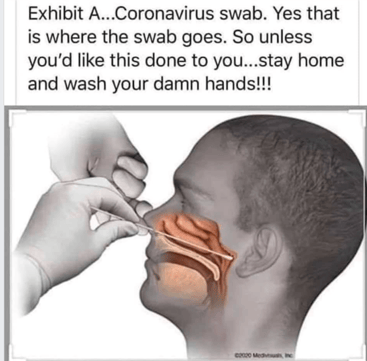

Haha! My own hair is getting as long as a hippy, but I don't dare

go to a stylist because I am 67 and have high blood pressure.

High blood pressure is what is the death sentence for us old farts.

If I do die, remember my immortal words.

"It's the loan servicing income, sillies!"

Those competing hard money mortgage funds are all gone now - along with the dinosaurs and the dodo birds. Going forward, you also need to develop a relationship with Alicia and George IV, so they will be especially loyal to you when the proverbial stuff hits the fan.

Remember, Blackburne & Sons put together a fresh syndicate* of wealthy private mortgage investors on every deal. There are always savvy investors willing to invest when blood is running in the streets. It's just a matter of price (interest rate). Therefore, we were able to stay in the market every single day of the S&L Crisis, the Dot-Com Meltdown, and the Great Recession.

We are a small family company, and only a handful of brokers know us. That's huge for you! So get out there and feast. Every business owner in America needs money right now.

*Hard money mortgage funds rely on fresh deposits to make new loans. When the financial markets are in turmoil, not only do new deposits dry up, but existing investors line up to withdraw.

Remember, every business owner in America needs money right now.