If a restaurateur owns a successful restaurant, it is often surprisingly easy for him to obtain a new commercial loan from his own, local commercial bank. Bankers go out for lunch a lot, and they spend much of their time schmoozing with the wealthy elite of the community. They know from mere observation which restaurants in town are packed and which ones are almost deserted.

If a restaurateur owns a successful restaurant, it is often surprisingly easy for him to obtain a new commercial loan from his own, local commercial bank. Bankers go out for lunch a lot, and they spend much of their time schmoozing with the wealthy elite of the community. They know from mere observation which restaurants in town are packed and which ones are almost deserted.

Therefore, if a restaurateur has a thriving restaurant and a good financial statement, and if he maintains healthy cash balances on deposit with his bank, his banker will usually fall all over himself in an effort to supply any needed commercial loan.

But what about less-successful restaurants or restaurants wth unimpressive financial statements. Can these borrowers still obtain a commercial loan? It depends.

We all know from experience that restaurants suffer from a very high failure rate. The common belief, however, that 90% of all restaurants fail in their first year is just a myth. According to a 2005 research study by the Cornell Hotel and Restaurant Administration Quarterly, about 25% of restaurants fail in their first year. Another 20% fail in the second year, and another 15% fail by the third year. Therefore 60% of all new restaurants fail within the first three years. Clearly restaurants are a very risky asset class upon which to make commercial loans.

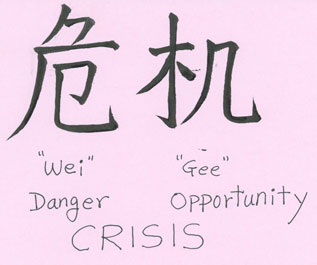

But the Chinese character for crisis is the symbol for danger next to the symbol for opportunity. For commercial loan brokers, there is money to be made helping restaurateurs find a commercial loan.

When might a restaurant commercial loan be do-able? We start from the basic proposition that if the restaurant owner's business is thriving, if he has a good financial statement, and if he maintains substantial cash on deposit with the bank, he doesn't need the help of a commercial loan broker. His own bank will do the deal.

Therefore, if you are looking at a commercial loan package on a restaurant, you can pretty much bet that the deal will be flawed. The restaurant will either be losing money on paper, the restaurateur will have sloppy or poor credit, and/or he will not have a lot of liquidity.

Here are some times when a commercial loan on his restaurant might still be do-able:

- If the borrower has pristine credit and substantial cash deposits, but his income statement and tax returns show him making very little money, many private money commercial lenders, like Blackburne & Sons, will still make him a commercial loan. The restaurant business is a cash business, and few veteran commercial loan underwriters would be terribly shocked to learn that every single cash sale is not making it into his bank account and/or on to his income statement. He is also probably running a lot of household expenses through his business. The guy clearly is making money. He is just cheating on his tax returns.

- This reminds me of the old joke: The owner of a small deli was being questioned by an IRS agent about his tax return. He had reported a net profit of $80,000 for the year. "Why don't you people leave me alone?" the deli owner said. "I work like a dog. Everyone in my family helps out. The place is only closed three days a year. And you want to know how I made $80,000?" "It's not your income that bothers us," the agent said. "It's these deductions. You listed six trips to Bermuda for you and your wife." "Oh, that," the owner said smiling. "I forgot to tell you - we also deliver.”

- If the restaurant business has been in business for ten years or more, under the same owner, a commercial loan underwriter will probably be more inclined to approve the deal, even if the business is losing money on paper. It's those dangerous first three years when the failure rate is so high - 60%.

- Can the building be used for anything else? A Denny's-style restaurant building, with a corner location and a large parking lot, probably is best used as a restaurant. In contrast, what if the propety is a garden-variety row commercial building. A row commercial building is simply a big box in a downtown area, where the neighboring buildings touch it on the left and right sides. It's basically like a townhouse, but its commercial space. Today it might be occupied by a restaurant, but in the past it was an office supply store, and before that it was a dress store. The key thing here is that the space is generic. A private money commercial lender could lend aggressively on such a commercial building because the property has multiple uses.

- Be wary of restaurant buildings whese several prior restaurants have already failed. Sometimes the location just sucks. Maybe the building is on a busy one-way street. Maybe there is a road divider (median), and there is no suicide lane for easy access to the restaurant building. Maybe its almost impossible to find a parking space. Some restaurant buildings are so poorly located that any restaurant that tries to open there is doomed to failure.