A reader asked George a commercial loan question, "Do you have access to commercial lenders who do not require income verification?"

A reader asked George a commercial loan question, "Do you have access to commercial lenders who do not require income verification?"

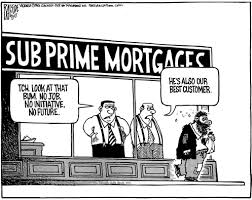

First let's agree on some terminology. A commercial loan to a borrower who cannot, or will not, provide the documentation needed to verify his income is called a stated income commercial loan. The borrower will always be required to "state" on his commercial loan application a certain amount of income. He will just not be required to provide the documents to verify that income.

Not all stated income commercial loans, also known as liar loans, are absurdly risky loans. We here at Blackburne & Sons see a lot of commercial loan requests from restaurateurs. They will often drive nice cars, have good credit, and owe little on their credit cards and homes. But their tax returns will show their restaurant only earning $20,000 per year. What's going on? They are probably running most of their household expenses through their restaurant, and they are not reporting to the IRS much of the cash that they receive from diners.

Okay, let's get back to the question at hand. Do stated income commercial lenders still exist?

The answer is yes! Unfortunately stated income commercial loans are relatively more expensive than they used to be. Prior to the Great Recession, you could get a stated income commercial loan, if your credit score was high enough, at an interest rate that was just 3% higher than a best-rate commercial loan. Today a stated income commercial loan will cost you 4% to 6% more than a best-rate commercial loan.

A best-rate commercial loan is a commercial loan on a 95%-occupied, standard type of commercial property to a borrower with good credit and a sizable income that is verifiable. By standard commercial property type I mean one of the four major food groups - multifamily, office, retail, or industrial.

Prior to the Great Recession, a new group of commercial lenders emerged that I call the Wall Street Non-Prime Lenders. These commercial lenders serve those borrowers who are not quite bankable (maybe they allowed their cash reserves to decline too low before they applied to the bank) but who are far too clean and strong for a hard money commercial lender.

All commercial lenders need to get their dough from somewhere*. Banks get their dough from deposits. Life companies get their dough from insurance premiums. Most hard money lenders today operate a pool. These Wall Street Non-Prime Lenders get their dough by putting, say, $200 million worth of non-prime commercial loans into some pass-through trust and then selling bonds backed by these loans. This process is called securitization.

* Mortgage brokers, listen very carefully to the answer when some new, so-called lender answers your question, "Where does your dough come from?" These crooks and blowhards will often bust themselves by saying something lame like, "We represent several investors." Run!

Let's not get caught up in the details. Suffice it to say that Wall Street Non-Prime Lenders are more expensive than banks but cheaper than hard money lenders. Now sometimes a borrower cannot qualify at the bank because his financial records are a mess or his accountant is in the hospital; but if you look at his bank statements, this business owner is clearly making money. One Major Wall Street Non-Prime Lender has developed a unique formula whereby they will assume that 35% of the borrower's bank statement deposits are net profit. This clever lender is listed on C-Loans.com, and you can apply to him by clicking the red button below.

Now I have a third type of stated income lender - the hard money commercial lender. There are 150 hard money commercial lenders listed on C-Loans.com, and you can submit the same short mini-app to all 150 of them in just four minutes, six lenders at a time. Just click the red button above.

The fourth and final type of stated income commercial loan is what I jokingly call the Ax Murderer Lender; i.e., he will still lend to you if you are an ax murderer. Blackburne & Sons is an example of an Ax Murderer Lender. Really?

During the Great Recession Blackburne & Sons made a number of commercial loans to companies that had lost $1 million or more in the prior calendar year. I think of these financially staggering companies as ax murderers. But here's the thing: Many of these companies had been in business for 20, 30 or even 50 years. Their bank of corporate knowledge in their industry was immense. And they often owned their factory buildings free and clear. They had paid off their buildings during their good years. During the Great Recession, Blackburne & Sons ended up making ten or so first mortgages based solely on the equity in the property. I am pleased to report that almost all of them paid, albeit slow at times.

Do you need a business loan that will not be secured by real estate? Examples include accounts receivable loans, inventory loans, equipment loans, leases, lines of credit, etc.

If you run across a banker who makes commercial loans, you can parlay that banker lead into a free directory of 2,000 commercial lenders.

Got a commercial loan question? Rodney asked me this question this morning, and I wrote a blog article in response before the end of the day.

Are you ready to learn the profession of commercial real estate finance?

Are you just browsing today?

Hey mortgage broker, how many times are you going to be shafted out of a large loan fee? You need an economically enforceable fee agreement. My one-hour video training class explains why economically enforceability is just as important. Includes a sample fee agreement. For just $199, this is a no-brainer. Heck, for just $199, this is a bona fide Darwin Award test. Ha-ha! Why don't we ever see those Darwin Awards anymore?

Do you own any type of real estate web site?

Want to learn the profession of commercial real estate finance for free? I write two blog articles every week.

Got a buddy or co-worker who would benefit from learning commercial real estate finance?