Before we go any further, please click on this link and listen a beautiful rendition of the song, Hallelujah, played on a cello, on a gorgeous, snow-covered mountaintop. You can listen as you read.

Before we go any further, please click on this link and listen a beautiful rendition of the song, Hallelujah, played on a cello, on a gorgeous, snow-covered mountaintop. You can listen as you read.

I just have created for you a wonderful new tool, our Commercial Loan Resource Center. There you will always find the latest interest rates being quoted by banks and by conduits on their commercial real estate loans.

You will be able to apply directly to 750 commercial lenders in just four minutes. Going forward, you need to appreciate that it is going to be very difficult - but not impossible - to find a bank willing to make a conventional commercial real estate loan.

You may have to submit your bank-quality commercial loan request deal to scores and scores of banks before finding just one willing to take a chance during the severe recession that will surely follow gate Coronavirus Crisis. C-Loans.com is ideal way to quickly submit your deal to fifty banks, six banks at a time. It takes just four minutes to create the mini-app, and all 750 of our commercial lenders will accept it.

Next you will find four different databanks of commercial lenders. You don't need to go anywhere else to find thousands of commercial lenders to whom you can submit your deal.

Next you fill a glossary of commercial of real estate finance terms, like senior stretch financing, mezzanine loans, preferred equity, B-pieces, venture equity, defeasance, CTL financing, lockout clauses, Bad Boy Acts, the debt yield ratio (different from the debt service coverage ratio), shadow banking, standby takeout commitments, and hundreds of other very sophisticated commercial real estate finance ("CREF") subjects. This is all free in our Commercial Loan Resource Center. I urge you to bookmark the page right now.

Lastly, we have extensive answers to about a dozen Frequently Asked Questions relating to commercial real estate finance. No matter how experienced you are, the industry is constantly new types of commercial real estate financing and new terminology.

Very short video - Lion grabs his hand.

Special Note to Wealthy to Investors:

Now is the time to jump in with both feet into our 8% to 13% commercial first mortgage investments. Why? Because just about every competing commercial mortgage lender in the country is now out of the market. Where else are good borrowers going to go?

Investing in commercial real estate first mortgages will always involve substantial risk. You definitely need to read our Offering Circular and study the Risk Factors section carefully before investing; BUT never again will we get to dance with such beautiful girls. By beautiful girls, I mean, of course, less-risky loans: stronger borrowers, better-credit borrowers, and nicer properties. We never, ever use the word "safe"; but some first trust deeds are certainly less risky than others. We get to cherry pick only the less-risky loan right now.

Special Reminder to Commercial Loan Brokers:

Instead of sitting around at home watching Netflix, I know that you commercial loan brokers are hard at work calling at least thirty nearby business owners every working day, looking for guys who own their buildings.

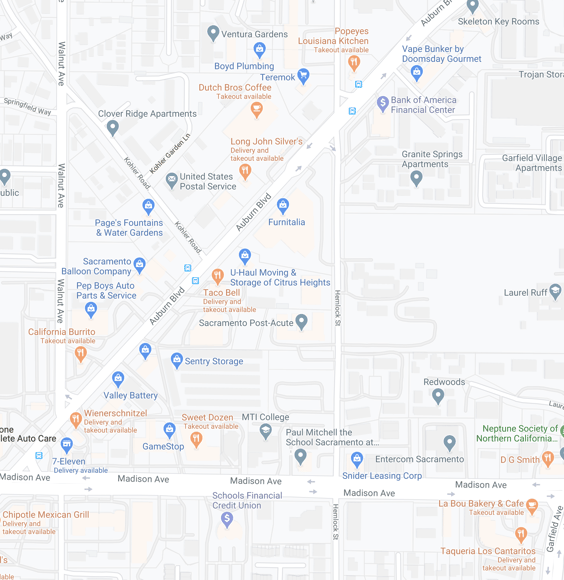

You find them on Google Maps. Start by typing in your company address. You'll see the nearby businesses listed right on the map. See the example below:

You don't have to ask these small business owners whether they need cash. Duh! Of course they need cash! Every business owner in the country needs cash right now, and you know one of the only commercial lenders in the entire country who is still in the market - Blackburne & Sons.