The bad guy - the black hat - in this drama is Xi Jinping, the paramount leader of China. Xi holds three key positions: General Secretary of the Chinese Communist Party (CCP), Chairman of the Central Military Commission (CMC), and President of the People's Republic of China.

It was Xi who destroyed China economically. By telling the world that China intended to invade Taiwan, he scared the heck out of his own people. Consumers greatly reduced their spending, and the average Chinese citizen began hoarding his money like crazy. The Chinese domestic market for manufactured goods dried up like a raisin. The velocity of money - how quickly money circulates in an economy - took a nosedive. This was a boneheaded economic disaster.

Soon American and foreign investors realized that Xi was serious. "China has become uninvestable." Foreign investors pulled their investments out of China at a record pace. China lost hundreds and hundreds of billions of dollars in investments.

The coup de grace was when foreign manufacturers pulled their factories out of China, laying off millions of Chinese workers and cutting off China from the latest commercial technologies.

Xi Jinping destroyed China. The party elders wanted him out; but they wanted a peaceful exit, like a retirement or the end of a political term. Xi refused to go, and he still controlled enough power to prevent his own sacking.

Enter now Zhang Youxia - the white hat - who was the highest ranking general in China. Xi tried to make Zhang retire, and Zhang said, "No, thank you."

Zhang took over the People's Liberation Army ("PLA") and started to sack all of Xi's most loyal generals. In one day, during the Fourth Plenum, Zhang deposed nine of Xi most important generals. Some "died of a heart attack during questioning."

If Zhang couldn't shoot Xi, he could at least strip Xi of all of his supporters. The purge took out the top 100 or so generals loyal to Xi. You and I support Zhang because Zhang has been holding Xi back from attacking Taiwan.

So why is Xi so desperate to invade Taiwan? At first, the conquest was Xi's egotistical quest for a lasting legacy. Then Xi destroyed the Chinese economy. The economy there is just horrible. Unless he does something to unite and inspire the people, Xi was soon going to be deposed. He would be accused of corruption and hung.

The rule is 100%. Only those mortgage companies

with servicing income survive great recessions.

Servicing small commercial loans is easy-peasy.

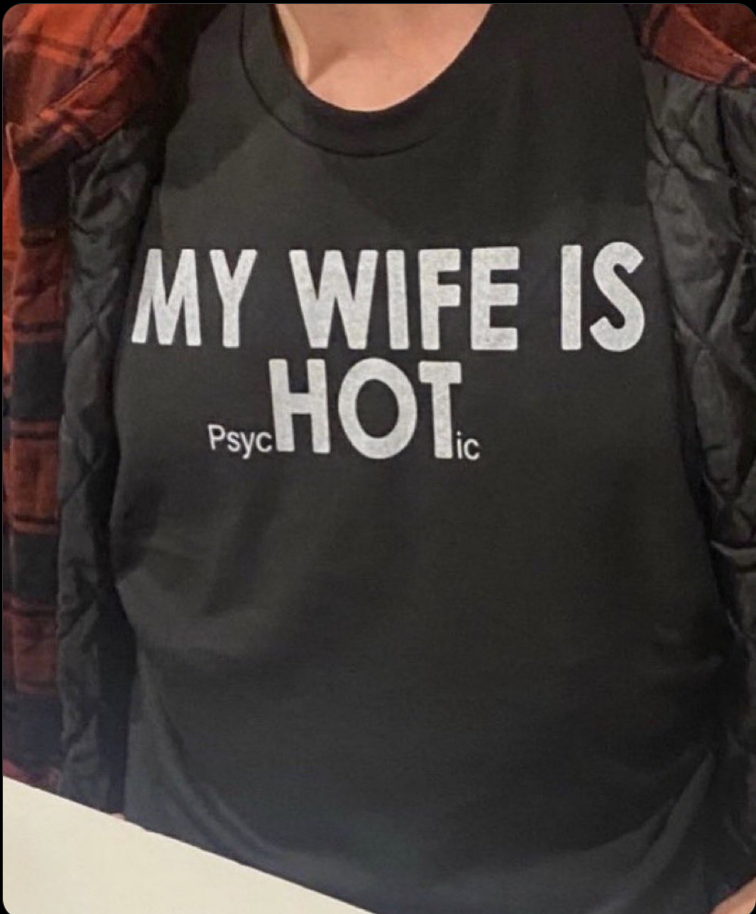

Corruption? All of these high-ranking CCP officials and generals are incredibly corrupt. It's like accusing a red-blooded, heterosexual, American man of ogling Sydney Sweeney. We're all guilty. Haha!

Now back to Zhang. Remember this adage:

"Whoever controls the PLA controls China."

But the CCP elders made a huge mistake. They did not immediately depose and arrest XI. Xi hatched a plot with his Imperial Guard. Xi claimed that he was deathly sick, and he was seen being driven to a hospital in an ambulance. The rumor quickly spread that Xi was near death.

Jimmy Carter was President when we were founded.

Any day in 46 years you could have invested

$20,000 in a particular first mortgage you have chosen.

Zhang normally travels with twenty guards, but since Xi was in the hospital, he attended a public event with only four guards. Oops. One hundred Imperial Guards surrounded his men, shot them, and then allegedly took Zhang prisoner.

Within hours Zhang's number two was captured, along with a dozen of so top generals loyal to Zhang. Xi also went after their families. Orders went out to the Central Military Commission ("CMC") - the Chinese equivalent to our Joint Chiefs of Staff - to hold all units in place.

Four Army Groups - about 30,000 men each - ignored Xi's orders and marched on Beijing. I guess these lower-ranking generals figured it makes no sense to sit around at home and await an arrest by the goon squad. Beijing is now surrounded, and only Xi's Imperial Guard remain loyally guarding him.

Are you a new commercial mortgage broker?

You're refarted* if you don't invest $29 in this.

*It is politically incorrect to say the proper word. Haha!

This morning I read where seven other Army Groups are on their way to Beijing to join in the siege. (This could just be propaganda by the good guy's side.) Matters are now at a standstill, as the siege continues, and as the party elders try to negotiate a way to save the Chinese Communist Party.

Did Zhang really sell the Chinese nuclear launch codes to the US? Of course not. Xi just needs an excuse to quickly hold a trial and execute Zhang. Xi is not stupid. I'll bet Zhang and his number two have already been shot.

Will Xi come out of this still in command? All day yesterday, Xi has been issuing orders to the CMC, and the CMC has been ignoring them. The common soldiers have taken to calling XI a baozi, a steam bun.

My best guess is that Zhang is already dead, but Xi will be allowed to flee the country. I just can't see the junior generals surrounding Beijing allowing themselves and their families to be rounded up and murdered.

This could be good for us if Xi is finally deposed. Xi needs to invade Taiwan to keep the sans-culottes from demanding his head.

During the French Revolution, culottes (fancy silk knee-breeches) symbolized the aristocracy, while the common people, called sans-culottes ("without culottes"), proudly wore long trousers (pantaloons) as a sign of their working-class status and their opposition to the elite. The sans-cullotes became the radical, driving force for republican ideals, direct democracy, and economic equality.

It was the sans-culottes who demanded so many heads.