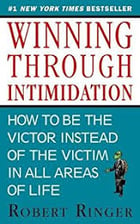

When I grow up, I want to be Robert Ringer. Mr. Ringer was the best-selling author of several business books. I last saw Robert Ringer in Playboy magazine, where he was sitting in a hot tub at a party at the Playboy Mansion with two gorgeous, topless Bunnies. It was lucky that I just happened to notice the picture because normally I only look at Playboy for the articles. Ha-ha!

When I grow up, I want to be Robert Ringer. Mr. Ringer was the best-selling author of several business books. I last saw Robert Ringer in Playboy magazine, where he was sitting in a hot tub at a party at the Playboy Mansion with two gorgeous, topless Bunnies. It was lucky that I just happened to notice the picture because normally I only look at Playboy for the articles. Ha-ha!

The book teaches you that the world is full of snakes. In fact, Mr. Ringer once wrote that there are only three types of people in business: (1) The type who will screw you; (2) The type who tell you in advance that they are going to screw you and then who will screw you; and (3) The type who will swear to high heaven that they are not going to screw you and then who will screw you.

So why am I confessing my sins (Playboy and lust) today? The answer is that Robert Ringer happened to be a hard money broker who specialized in making commercial loans on apartments! His book was read by hundreds of thousands of lawyers, accountants, salesmen, and widget manufacturers, and it became a #1 business bestseller. The really awesome twist is that all of his examples of people in business doing dastardly acts were from his real-life experiences in the hard money commercial loan business. Talk about relevant, huh?

One of the dastardly acts that Ringer wrote about was Rent Roll Fraud. You will recall that a Rent Roll is a long list, by unit number or letter, of all of the units in an apartment building, as well as the configuration (bedrooms and baths), the tenant's name, and the rent currently being paid by the tenant. Sometimes a Rent Roll will even include the square footage of the unit.

Rent Roll Fraud occurs when the owner of an apartment building applies for a commercial loan or lists his apartment building for sale. Either the owner or his broker submits to the commercial lender a Rent Roll with dummy numbers. Even a small increase in the Rent Roll can make a big difference in the valuation of the apartment building or the size of the commercial loan for which the borrower qualifies.

Robert Ringer learned about Rent Roll Fraud from painful experience. Dastardly borrowers? You betcha. He learned to knock on a few doors and to audit the Rent Roll. "Hello, Mr. Smith. My name is Robert Ringer, and I am doing an appraisal of the property. Would you mind please telling me what you pay in rent? Just $1,200 per month? The Rent Roll says $2,000. Hmmm." "Mrs. Rodriquez, how many bedrooms and baths do you have? Just two bedrooms and two baths? That's strange. The Rent Roll says you should have three bedrooms and two baths. Hmmm." [To himself: "This entire Rent Roll may be fraudulent. I better audit a half-dozen more units to confirm my suspicions."]

The reason why I am writing to you today about Rent Roll Fraud is because I got a call today from a reporter from the Wall Street Journal. He is writing a piece about a big criminal case involving mortgage fraud in the upstate New York area. According to the indictment, tens of millions of dollars in commercial loans on multifamily projects were fraudulently obtained, in part using fraudulent Rent Rolls. These defendants allegedly went as far as placing doormats and shoes in front of vacant units. They are also accused of placing radios in empty units and leaving the radios on in order to create the illusion of occupancy. Yikes!

The Wall Street Journal's reporter found me while researching Estoppel Agreements in connection with commercial leases. He found my blog article on estoppels. Pop quiz. What is an Estoppel Agreement or Estoppel Certificate (same thing)? An Estoppel Certificate from a tenant is a statement admitting the rent, the maturity date of the lease, the size of the unit, the fact that the tenant has NOT prepaid his rent, and that the owner has performed all of his obligations in connection with the lease.

When a tenant has a signed an Estoppel Certificate, he is estopped (fancy word for stopped) from later claiming, after a lender has foreclosed on his commercial loan, that the rent is $2,000 per month less than that listed on the Schedule of Leases. A Schedule of Leases is the commercial-industrial equivalent of a Rent Roll. A Schedule of Leases lists the units by address, the square footage, the name of the tenant, the monthly rent, and who (landlord or tenant) pays which expenses.

Here's a story that will raise the hair on the back of your neck. Blackburne & Sons, my private money commercial mortgage company, foreclosed on a row commercial building in the foothills of California. After we had taken possession of the property, we notified the tenant to send all future rent payments to us. At that point, the tenant notified us that he didn't have to make any more rent payments. In exchange for an 80% discount from the guy losing the property in foreclosure (I am shocked, shocked I tell you, that there exists snakes in business), the tenant had prepaid his rent for the next five years! Can you now see why Estoppel Certificates demand that the tenant disclose any prepaid rent? In this case, the tenant had made this rent prepayment after we had recorded our loan, so his claim to prepaid rent was cut off by our foreclosure. Phew!

Here's another issue in connection with Estoppel Agreements. A lender makes a commercial loan on an office building, and after the lender forecloses, the tenant tells him that he doesn't owe any rent until the landlord builds out the tenant improvements that the former owner had promised. These tenant improvements could cost 18 months worth of rent. This is why an Estoppel Certificate asks the tenant to admit that the landlord has performed all of his conditions precedent (the landlord has already completed everything that the landlord has promised to do prior) to payment by the tenant.

Its pretty obvious why commercial lenders, before making a commercial loan on a multifamily property, can't get an estoppel certificate from every apartment tenant. The paperwork would be impossibly enormous, and 90% of the tenants would have no clue as to how to fill out the Estoppel Certificate. Therefore commercial lenders have to rely on the appraiser to do an audit of some of the apartment units on the Rent Roll.

To my own staff, let's please try to ask our multifamily appraisers in writing to audit 5% to 10% of the units on the Rent Roll before completing the appraisal. Thanks!