I have an exciting story for you today about the darkest hours of the Great Recession; but first some background.

I have an exciting story for you today about the darkest hours of the Great Recession; but first some background.

Something really-really weird is happening in finance. Interest rates just keep falling, and this affects us in the commercial loan business. This is actually quite positive for you and me.

I have written to you several times about how there are more than $16 trillion in Japanese and European bonds now selling at a negative yield. Can you imagine loaning $1,000,000 to the German Federal government, receiving no interest payments for ten years, and then only getting $970,000 back at the end? It seems unimaginable. Somebody pinch me. This can't be real.

Interest rates in the United States resumed their downward march this week. Ten-year Treasuries are known as the long bond (even though the U.S. Treasury also sells a 30-year bond). Yields on the long bond, after rising sharply three weeks ago, are once again approaching just 1.5%.

I predicted three months ago that ten-year Treasuries would fall below 1% within two years. Yields on the long bond may break below 1.0% even sooner than that - on their way down to negative yields. (The yield on the long bond was just 1.54% as of yesterday's close.)

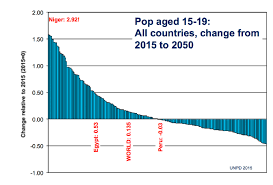

You might think that the reason why interest rates are falling is because of the Fed. You're on the right track, but the central bank that is really stirring the pot is the European Central Bank ("ECB"). The population of Europe is old, and it is shrinking. Most countries in Europe are desperate for workers, and Sweden, Germany, and Norway are actively recruiting them.

Because the counties of Europe are withering, at least in terms of reproduction, the ECB must constantly inject fresh Euros into the EU economy; otherwise, the European money supply would contract like a black hole. Without Central Bank intervention, the money supply in Europe could easily shrink by 40% in less than six months. We saw this happen in 2008, at the beginning of the Great Recession.

My Exciting Story:

Our Fed Chairman in 2008 was Ben Bernanke, and he was an absolute hero. By quickly injecting $4 trillion back into the U.S. economy, Ben replaced the $4 trillion that had disappeared from our money supply when U.S. banks stopped lending.

At one point, the commercial paper market had completely frozen up. Commercial paper is those 30-day IOU's issued by giant corporations to pay their bills. The Big Boys use commercial paper market, rather than borrowing from banks, because it is cheaper.

During the darkest hour of the Great Recession, investors stopped buying commercial paper. Suddenly General Motors, General Electric, Ford, John Deere and the other big corporations didn't have enough dough to make their payrolls. Millions of workers would have to be laid off, with no warning and no severance pay. Literally, the world was in danger of ending.

In stepped Big Ben, the superhero, with his hair (if he had any) and his cape blowing bravely in the wind. "The Fed hereby guarantees all commercial paper!" he boldly announced. Confidence was instantly restored to the commercial paper market. The financial world was saved, Widows and frightened kittens were rescued.

But here's the thing. Neither Big Ben, nor the Fed, had no the legal authority to make that announcement or to guarantee that debt. Big Ben saw what needed to be done, and he just did it. Swish.

Closing In On My Point:

In order to prevent the entire money supply of Europe from contracting into a black hole (the multiplier effect working in reverse), the ECB has been forced to constantly inject new Euros into the European economy. Many of these Euros end up in the hands of old gomers like me, and we hoard our savings because we are close to retirement.

Now old gomers are not going to keep one million Euros stuffed under their mattresses, so they take their cash down down to the bank and try to deposit it. "No, thank you," says the bank. "We have more than enough deposits right now. We don't have any place to invest them."

In fact, there are so many banks bidding to own German, Danish, Dutch, and Swedish treasury bonds, they have bid up the prices of the bonds so high that the yields are negative - say, a negative yield of 0.15% annually.

Get Commercial Leads For Less Than Two Cups of Coffee

Now back to our desperate old gomers. "You simply must take my cash, Mr. Banker. If bad guys learn that I am keeping one million Euros under my mattress, they will break in and kill me!" So the banker says to the depositor, "Okay, we'll accept your deposits; but we are going to charge you a negative yield of 0.5% per year." In other words, the old gomer is paying the bank one-half percent per year to hold his cash.

Then the banker invests in bonds with a negative yield of just 0.15%, and the banks profits off the 35 basis-point difference. A basis point is 1/100th of one percent.

Finally My Point - Phew!

European investors are going to keep buying U.S. Treasuries because our yields are positive. This will keep driving down U.S. interest rates for the foreseeable future. Sure, we'll have some periods when interest rates will spike back upwards; but the long-term trend for interest rates is still downwards.

The money in commercial real estate finance is in loan servicing.

We are living in an Age of Disappearing Income. I like that term - the Age of Disappearing Income. I didn't invent it, but it is very apt. Pretty soon retired investors will not be able to find any safe investments with a positive yield

Why This is Great News For You and Me:

Interest rates on commercial loans have fallen so far that most commercial property owners would be crazy not to refinance right now. If you use C-Loans.com, you can get a ten-year commercial loan with a yield of just 4.09% to 4.84%.

The danger in waiting for even lower rates is that we are headed for a garden-variety recession. During recessions, commercial property values fall and commercial lenders cut their loan-to-value ratios way-way back. Right now the porridge is just right. Climb out of that comfy, perfect bed and apply for a commercial loan using C-Loans.com right now.

The ten largest economies include (1) the United States; (2) China; (3) Japan; (4) Germany; (5) United Kingdom; (6) India; (7) France; (8) Italy; (9) Brazil; and (10) Canada. I was personally surprised to see that the economies of both Brazil and Canada made the top ten.

The ten largest economies include (1) the United States; (2) China; (3) Japan; (4) Germany; (5) United Kingdom; (6) India; (7) France; (8) Italy; (9) Brazil; and (10) Canada. I was personally surprised to see that the economies of both Brazil and Canada made the top ten.