If you are a well-heeled real estate investor or a commercial real estate broker, you really need to pay attention to today's article. I am going to show you how to use a USDA commercial loan to obtain 90% leverage on a rental property (not just on an owner-occupied property) in an Opportunity Zone. For once, the Federal government is going to help you, even though you had the selfishness to work hard and build wealth.

If you are a well-heeled real estate investor or a commercial real estate broker, you really need to pay attention to today's article. I am going to show you how to use a USDA commercial loan to obtain 90% leverage on a rental property (not just on an owner-occupied property) in an Opportunity Zone. For once, the Federal government is going to help you, even though you had the selfishness to work hard and build wealth.

Commercial loan brokers: Please sit up and focus. You can make some serious money brokering USDA commercial loans, and very few borrowers and competing mortgage brokers know much about the program. Yesterday we got a loan approval on a $5 million USDA Business and Industry loan. Our fee will be $25,000. That's gonna pay some bills.

Quick Joke:

An old farmer wins the ten-million dollar lottery and is being interviewed. The reporter asked what he is going to do with all the money. "Oh, I reckon the first thing I'll do is go and pay a few bills." "And what about the rest?" the reporter continued. The farmer shrugs. "Well, I guess they'll just have to wait."

Now on to USDA Commercial Loans:

Many of the poorest people in America live in small towns or in very rural areas. In order to help these people get better paying jobs, the USDA has developed a commercial loan program that is very similar to the SBA loan program. It's called the USDA Business and Industry (“B&I”) Guaranteed Loan Program.

The USDA Business and Industry ("B&I") Guaranteed Loan Program is a loan guarantee program designed to assist credit-worthy rural businesses obtain needed credit for any legal business purpose. The intent is to save and create jobs in Rural America.

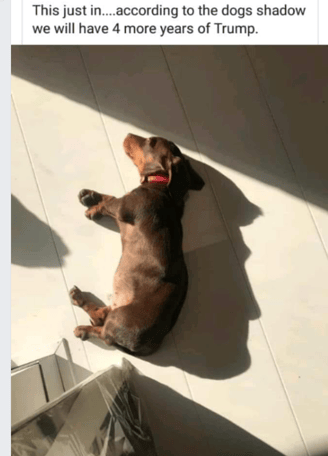

Business headquarters located in cities or towns with a population of less than 50,000 qualify as Rural America. A quick glance below will show you just how much of the country is eligible for a USDA B&I loan. White means eligible:

In most cases, a borrower who qualifies for an SBA loan will also qualify for a USDA commercial loan, but why bother with a USDA commercial loan? Why not just apply for an SBA loan?

- The maximum loan amount for a USDA loan is a whopping $25 million, and this loan amount can sometimes even be increased. The maximum loan amount for an SBA 7a loan (the 25-year adjustable loan program) is just $5 million. The maximum loan amount on a SBA 504 loan (the fixed rate program) is just $10 million.

- USDA B&I loans are amortized over 30 years, rather than just 25 years. This means that they have lower monthly payments.

- The USDA will guaranty 15-year commercial loans on equipment, rather than just 7 years on SBA loans. This significantly frees up cash flow.

- USDA B&I loans have no balloons, which saves new loan fees, new closing costs, and new third-party property fees. In contrast, the underlying first mortgage on an SBA 504 loan has a term of just ten years. Tick-tock.

- USDA commercial loans do NOT have to be owner-occupied!!! Wealthy investors can qualify for B&I loans. Suppose an investor wants to renovate an old, vacant industrial property in the Boonies (see picture at the top) and lease it to a manufacturing company willing to move to a rural area. The USDA will guarantee such a loan, even though the loan is arguably a subsidy to the wealthy investor.

- The USDA will guarantee commercial loans of up to 90% loan-to-value, even to investors. If the loan-to-value ratio is going to be a full 90%, the tenant has to be an existing, experienced company.

- Imagine a wealthy investor combining the the high-leverage and low interest rate of a USDA B&I loan with a property located in an Opportunity Zone! Wow. $$$.

- Unlike SBA loans, where the interest rate is set by rule and long-custom, the interest rate on USDA commercial loans is individually-negotiated between the parties.

- The interest rate on a USDA B&I loan can be fixed or adjustable.

- Individual investors, rather than just for-profit companies, can qualify for a USDA-guaranteed B&I loan.

- Non-profits, cooperatives, Federally-recognized tribes, and public bodies are also eligible for USDA commercial loans.

- Few SBA lenders are enthusiastic about making large commercial loans in very rural areas. Remember, only a portion of an SBA loan is guaranteed by the Federal government. SBA lenders therefore have a piece of their own tushes exposed and at risk on every deal. SBA loans in Bum Flowers, Egypt are not terribly appealing to most banks. The USDA B&I loan fills this void.

- A single lender will usually makes the entire USDA commercial loan. There is no need to bring in a community development corporation to make the second mortgage and a conventional lender to make the underlying first mortgage. Anyone who has ever gotten an SBA 504 loan can testify that the complicated SBA 504 process can be slow, buggy, and maddening.

If you need a USDA commercial loan of less than $1 million, you will want to enter the deal into C-Loans (just click the blue button below). It's free, and it will take just you just four minutes to create your C-Loans app.

You can then shift your C-Loans app from USDA lender to USDA lender in seconds, until you find one willing to do your deal. Remember, because each USDA lender will have some of his own money at risk (the USDA only guarantees a portion of the loan), the Loan Committee of each bank will look at the deal differently. The secret is to just keep submitting your deal until you find the right fit. This is the secret of C-Loans.

By the way, after you have created your C-Loans app, be sure to click on the button, "Create a PDF", at the bottom of the page. You will then have a gorgeous PDF of your deal that you can then submit to your own USDA lenders.

And be sure to write to Tom Blackburne afterwards and claim your two free commercial finance training courses - something you earn every time you enter a new commercial loan into C-Loans.com. There are four courses / tools from which to choose.

But if you need a USDA loan of greater than $1 million, would you please send a brief summary (just a few sentences), along with your contact information, to me, George Blackburne III? Thanks! I am hungry to close a few more of these big puppies. I get 1,350 emails every day (no kidding), so please be sure to make the subject line read exactly, "I Need a Big USDA Loan." You might even text me at 574-360-2486 and say, "Just sent you a USDA loan." Thanks!