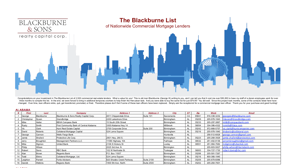

Every two-and-a-half years, I suck it up and write a check for thousands of dollars to my staff to update The Blackburne List. The Blackburne List is a huge list of commercial real estate lenders.

Every two-and-a-half years, I suck it up and write a check for thousands of dollars to my staff to update The Blackburne List. The Blackburne List is a huge list of commercial real estate lenders.

It's a Herculean task to update a list of 2,500 commercial lenders, and it takes weeks. If you need a commercial loan, this is the tool for you! The list contains the name of the commercial loan officer, the name of commercial loan company, their address, the commercial loan officer's phone number, and his email address.

It used to be that most bank branches had their own commercial loan officer, someone trained in both commercial finance and commercial real estate finance. Commercial finance includes secured and unsecured lines of credit, equipment loans and leases, inventory loans, and accounts receivable financing.

Commercial real estate finance includes commercial loans on income properties, mezzanine loans (banks very seldom ever make them), and preferred equity investments (banks never make such investments).

Modernly, banks typically assign a single commercial real estate loan officer to cover four or five branches. The modern commercial real estate loan officer, working for a bank, seldom comes into the office; but rather he is usually out in the field calling on good bank customers and prospective customers. A good bank customer - a very important term of art for us in the commercial loan business - is someone who regularly maintains large cash balances at the bank.

A very good way to get your commercial loan closed is to tell the commercial loan officer that your borrower is willing to transfer all of his bank accounts to the bank. Please read this last sentence again. It is hugely important.

This offer to create a deposit relationship works great with community banks and regional banks. The larger money center banks, however, couldn't give a hoot. They have more than enough money to lend and a severe shortage of good borrowers.

A community bank is a commercial bank that derives funds from, and lends, to the community where it operates, and it is not affiliated with a multi-bank holding company.

A regional bank is a depository institution; i.e., a bank, savings and loan, or credit union, which is larger than a community bank, which operates below the state level, but smaller than a money center bank, which operates either nationally or internationally.

A money center bank is similar in structure to a common bank; however, its borrowing and lending activities are with governments, large corporations, and regular banks. These types of financial institutions (or designated branches of these institutions) generally do not borrow from or lend to consumers.

I was talking with my own commercial loan officers this week, and I made the point that a commercial loan broker will often submit his deal to as many as fifteen different commercial lenders. Armed with The Blackburne List, you will never again have any more trouble finding fifteen commercial lenders to whom to submit your deal.