Joke Du Jour:

Joke Du Jour:

A mother and son go out for lunch at a diner. The waitress says, "Cops and kids under-5 eat for free!” The mother discreetly nudges her 6-year-old. The little boy says, "I'm a police."

Great Movie:

For Mother's Day, our three adult kids gave Cisca a $100 gift certificate to Flix Brewhouse, that upscale movie theater which serves food and beer right to your movie seat. It was a great experience.

We saw Equalizer III, starring Denzel Washington and Dakota Fanning. You will recall that Dakota Fanning was the precocious little blonde child actress - now all grown up - from the movie, Man On Fire. Interesting note: The Equalizer series and Man on Fire are not related, but Denzel Washington brought over Dakota Fanning to the Equalizer series. She did a good job.

Sooo? How was the movie? Fantastic! The movie was directed by Antoine Fuqua, so it's no surprise that the movie was both fast moving and violent. A bomb goes off during the movie that was so powerful that everyone in the theater flew back in their seats, checking to make sure that their hands were still attached and that their intestines were not spilling out.

Robert Heinlein:

Robert Heinlein, the famous science fiction writer from the 1960's, once predicted that eventually we would have feelies rather than movies. If it was raining, a light mist would fall on our head. The wind would blow through the theater. You might smell the scent of gun powder. Your arm rest would create all sorts of feelings and sensations.

Anyway, that explosion scene in Equalizer III was the closest thing I've ever seen to a feelie.

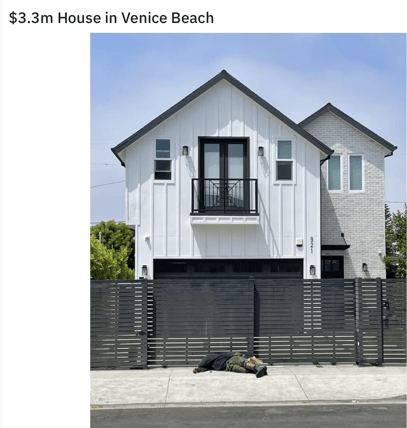

Prime Rate:

Did you know that the prime rate is 8.5% today? Holy poop. Since most commercial bank loans are written at prime plus 1% to 2% floating, some folks are paying 9.5% to 10.5% interest on their bank loans. Those are almost hard money rates. Just eighteen months ago, Blackburne & Sons, our commercial hard money shop, was writing loans at 10.9%. Yikes.

Commercial Loan Lesson:

Try to grasp this concept. Banks are herd animals. They tend to charge the same interest rates, and they tend to all move in and out of markets together.

A permanent loan is a first mortgage on a commercial property that has a term of at least five years and at least some amortization. A commercial first mortgage loan with a term of less than five years is considered to be either a bridge loan (two years or less) or a mini-perm (three or four years).

Most permanent loans (commercial first mortgages) has an amortization of 25-years and a loan term of either five or ten years. In other words, they have balloon payment after five or ten years.

Banks - remember they all pretty much charge the same interest rate - price their permanent loans at 2.75% to 3.5% over five-year Treasuries. Since five-year Treasuries are a 4.21% today, that means most new commercial permanent loans are being priced at around 6.96% to 7.71%.

It's pretty hard to make commercial deals cash flow at 7.75% interest rates.