"Poop, poop, poop!" screamed the commercial mortgage broker, as he and his borrower suddenly realized that they had been scammed out of a $50,000 "application fee" by a con man masquerading as a direct commercial lender.

Let's examine today where this commercial mortgage broker went wrong, why he could end up getting sued by his client, and how he could lose his license when he cannot repay the $50,000 application fee, plus the $127,000 in legal fees run up by his client.

The mistake that the commercial mortgage broker made was that the loan terms offered in the "commercial lender's" term sheet were too good. This should have sent up a red flag.

The offer from the so-called lender was for a $6.5 million construction loan at 5.25%. Hellooo? Banks are paying 5.25% just for deposits today. How could a bank possibly pay 5.25% for deposits, loan out money at 5.25%, absorb loan losses, pay for overhead, and then make a profit???

Is pot legal in your state? Have you been smoking it?

It's all about loan servicing rights.

Perhaps this broker and this borrower were thinking that some special lender exists - maybe some mystery lender from New York or maybe even from overseas - which makes commercial real estate loans at really low interest rates.

Let's explore this possibility. Let's suppose you manage the Saudi Sovereign Wealth Fund, and your orders are to win the best real estate loans in the United States. You are authorized to keep dropping your interest rate until you win the deal. Okaaay. [Deep inhale. This is good stuff, man. Is it Hawaiian? Haha!]

Even if this were true, my question is this. In light of the fact that residential mortgage rates today are around 7.25%, what is the name of competing bank or life company that is offering commercial loans at 5.5%? Why would any lender drop their rate to 5.25%?

There has to be a competing lender for the Saudi Sovereign Wealth Fund to lower its rate to 5.25%! Otherwise, why wouldn't the Saudi's just make all the commercial real estate loans it wants at 7.0%? After all, the Saudi's aren't giving their money away.

Please grasp the concept that there are only a handful of different types of commercial lenders. They are, in the order of best to worst, (1) Life Companies; (2) Conduits (CMBS lenders); (3) Commercial Banks; (4) Credit Unions; and finally (5) Private Lenders (hard money).

Yes, there are some hedge funds which make commercial real estate loans; but these are just private "partnerships" looking to earn a very high interest rate and a big handful of points. Loans from hedge funds are expensive.

Each of these commercial lenders has to get the money they use to lend from somewhere. After all, to be a commercial lender, you need money to lend. Victims of application fee fraud always forget this. To be a bona fide commercial lender, you need money to lend. The question then become, where does this so-called lender get its money to lend?

Life companies (life insurance companies) get their money from life insurance premiums. Conduits sell their completed loans into the bond market. Banks and credit unions have depositors. Hard money lenders raise their expensive money from wealthy private investors.

So how on earth is the advance fee scammer going to raise money at 3% so he can lend it at 5.25%? The idea doesn't make sense.

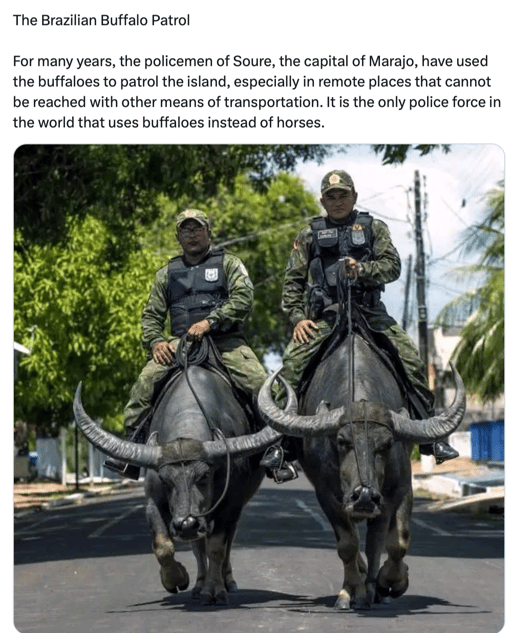

This is the pirate who helped General Andrew Jackson

at the Battle of New Orleans in 1814.

Bottom line: If some strange "commercial lender" has issued a term sheet for a commercial loan, look at the interest rate he is offering. Is it less than market? If so, drop this crook like a hot potato.