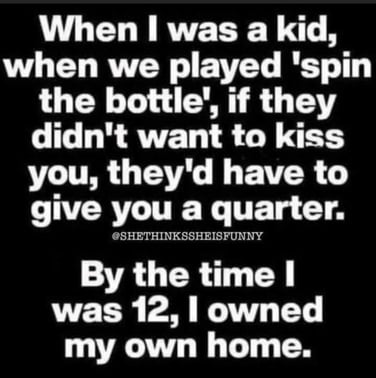

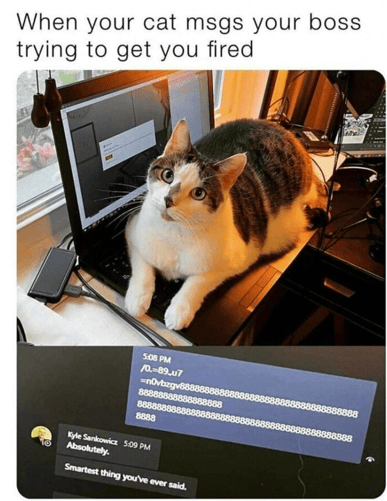

Joke Du Jour:

Joke Du Jour:

An actual conversation a friend of mine had this morning with her son:

Her: "Eat your breakfast."

Him: "Why?"

Her: "You want to grow up to be super smart, don't you?"

Him: "No. I want to grow up to be like daddy."

Fun Stuff:

My wife and I watched a strange but captivating free movie on Netflix this week, Hold The Dark. Children are being dragged off by starving wolves. When a naturalist arrives to hunt down the wolves, really weird and violent events erupt. The wolves may not be the guilty parties. Close your blinds and build a fire. I promise you will shiver. Wow-zowie, you will never see this "stuff" coming. [Nothing supernatural]

The Miracle of Fractional Banking:

When the Federal government creates $100 in new money, that $100 quickly increases the U.S. money supply by a whopping $2,000. That's a 20:1 growth rate. This is the miracle of fractional banking.

Life is much easier during periods of easy money. Banks have more money to loan. Companies have money to expand, increase production, and hire more workers. Wages often even rise, as expanding companies compete for workers.

Five-hour Practice Course only $29

Here is how most new money is really created: The government spends more than its revenue. [Gasp, really?] It borrows the difference, but that is a subject for another day. The point is that the government spends money. Let's say $100.

That $100 ends up deposited in a some bank. We'll call this bank, Bank A. Bank A keeps 5% in reserve, per banking regulations, and then it lends out $95 to say, Joe's Barber Shop to add another chair. Joe pays $95 to Steve's Barber Chair Company for that new barber chair.

Steve eventually deposits that $95 in some different bank, say, Bank B. Bank B keeps 5% of $95 in reserve and loans out the remaining $90.25. That $90.25 ends up in Bank C, which keeps 5% in reserve and loans out the remaining $85.74.

The process continues until that original $100 has grown to $2,000. When the reserve requirement is 5%, the money multiplier or deposit multiplier is twenty.

What if, in order to cool down bank lending and the rapid growth in the money supply, the Fed increases the reserve requirement from 5% to 8%? The money multiplier falls to 12.5.

How did we reach this money multiplier of 12.5? The formula is one divided by the reserve requirement of 8%, expressed as a decimal. Therefore 1/.08 = 12.5.

Amazing Industrial Story from Iceland:

Iceland??? Yup. Talk about being in Bum Flowers, Egypt - the middle of nowhere. Haha!

The Wall Street Journal had a fascinating story this week about a small company in a suburb of Reykjavik, Iceland, that builds machines to process fish. Until recently, vast loads of fish were frozen and shipped to China to be processed.

When the pandemic hit, and shipping went to hell, fisheries across the world were in a world of hurt. Suddenly this tiny company in Iceland starts selling a large number of amazing machines for the fisheries to process the fish right on site.

This manufacturing plant in Iceland must be huge, right? Nope. This tiny manufacturing company merely has seven 3D printers that print metal parts.

You can print metal parts? Yup. In a process called additive manufacturing, the machines spray metal dust in layers into the molds. The metal dust is then treated with intense light. This changes its composition to a hardened metal in a perfect shape.

This fish processing machine manufacturer is running its 3D printers 24-hours per day, seven days per week.

Three-D printing is the future of manufacturing. No longer do parts need to be manufactured in China. Instead, companies possessing a LiquidMetal machine only need the design and specifications of any desired part. Then they can simply make any parts needed right on site.

GM and other auto companies are now winding down their huge inventories of auto parts for older vehicles. Instead, when needed, the auto makers can simply manufacture any older parts needed. Wow.