I am often asked, "Where can I get some commercial loan origination software?" This sounds like an intelligent question. After all, there are dozens of vendors who sell similar software for residential mortgage loan originations.

I am often asked, "Where can I get some commercial loan origination software?" This sounds like an intelligent question. After all, there are dozens of vendors who sell similar software for residential mortgage loan originations.

In real life, however, commercial loan origination software makes little sense. First of all, there is no such thing as a Uniform Commercial Loan Application - similar to the FNMA 1003 residential loan application - used by thousands of commercial lenders across the country. Every commercial lender in the country uses its own commercial loan application.

Secondly, in real life, most commercial lenders don't ask the borrower to fill out a commercial loan application until the commercial loan has essentially been pre-approved. What? Huh?

Yup. Completing a commercial loan application is one of the last steps in the commercial loan closing process. Remember, commercial real estate loans are based primarily on the property's cash flow, the value of the property, and the strength of the tenants.

The borrower himself is surprisingly unimportant - as long as he has good credit, he has some liquidity, and his net worth is larger than the loan amount. See the Net-Worth-to-Loan-Size Ratio.

When a commercial loan officer for a bank is reviewing a commercial loan package, he might spend ninety minutes studying the appraisal and reviewing the leases. He then might spend only three minutes scanning the borrower's financial statement to verify that the borrower has some liquidity (cash and marketable securities) and a net worth at least as large as the loan amount.

The commercial lender will NOT pour over the borrower's budget to analyze his top and bottom debt ratios. A quick, three-minute scan is all he will do. "Frankly, my dear, I don't give a hoot."

During the commercial loan application process, the bank's commercial real estate loan officer will typically ask for an old financial statement, as well as the actual income and expenses of the property and the leases. Right before he takes the deal to Loan Committee, and only after he has essentially pre-approved the deal, will he ask the borrower to complete an updated financial statement on the bank's forms.

Get dozens of commercial loan referrals for the cost of two cups of coffee.

Marsha-Marsha-Marsha. Property-property-property. It's all about the property. Therefore, in order to close commercial real estate loans, a commercial loan broker needs software that showcases the property, not the borrower.

Now the good news. Please take a gander below:

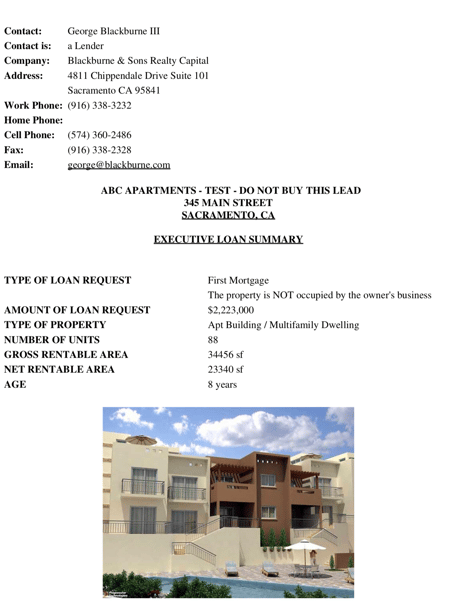

This is page one of a four-page Executive Loan Summary of a commercial loan application prepared as a PDF. The software automatically computes the Loan-to-Value Ratio, the Debt Service Coverage Ratio, and if the deal is a construction loan, the Loan-to-Cost Ratio. Armed with this attractive and concise summary, you can quickly submit your commercial loan application to dozens of banks to find the one in the mood to lend today.

Open and view a sample PDF of a commercial loan.

Remember, folks, banks and credit unions make the vast majority of all commercial loans today, and banks are extremely fickle. One day a bank is moody, fickle, and impossible to satisfy. Three weeks later that same impossible bank is making crumby commercial loans like a drunken sailor.

The key to success as a commercial loan broker is to find out which bank - because of excessive liquidity - is making commercial loans like a drunken sailor today.

And once you have a beautiful PDF of your deal, submitting your commercial loan to dozens of commercial lenders is easy. You just blast out an email to 12 banks, maybe six at a time, and include this beautiful PDF in the email.

So where do you go to get access to this wonderful software? How much does it cost? You will find this software on C-Loans.com, and the cost is... get ready... it's expensive... ready? Nuthin', honey. The cost is zip-zero-zilch.

"But, George, I have been to C-Loans.com before, and I don't remember ever seeing it."

When you visited C-Loans.com, you probably got distracted by the enticing blue call-to-action ("CTA") buttons on our home page offering a free commercial loan placement kit or a free list of 200 commercial lenders. (The buttons below are not live.)

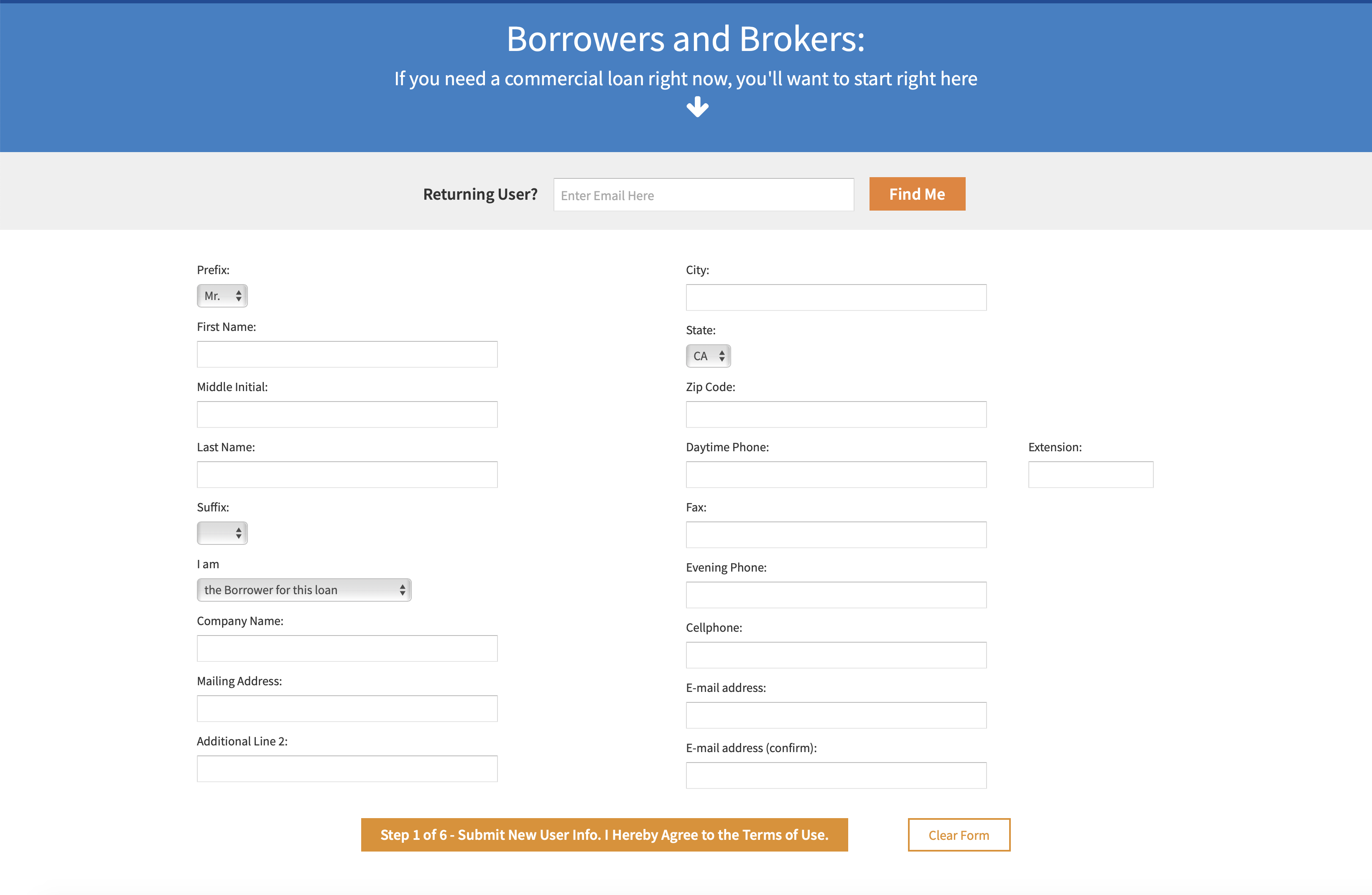

Because you probably got distracted buy these CTA buttons, you may have never actually entered a commercial loan into the six-step C-Loans System:

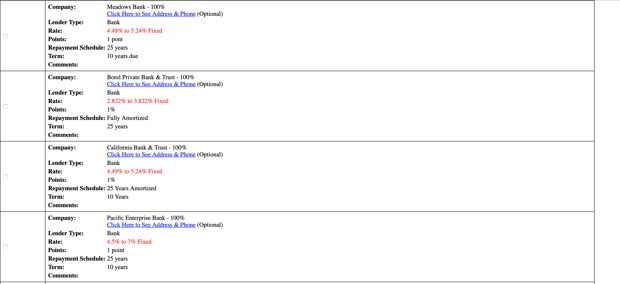

Had you done so, you could have placed a checkmark next to six lenders and pressed, "Submit". Within minutes, hungry commercial lenders would have been contacting you with offers.

After submitting your commercial loan to six banks, you are given a chance to make your C-Loans app into a PDF:

Voila! It's that simple. Now you have a PDF of your commercial loan package that showcases the property. There was no cost, and perhaps a C-Loans lender will make you an offer that you cannot refuse.

There are additional benefits to submitting your commercial loan through the six-step C-Loans System. You also get to choose TWO of the following gifts. (1) Income Property Underwriting Manual; (2) Commercial Mortgage Marketing Course; (3) Fee Agreement prepared by an attorney (me); and (4) The Blackburne List of 750 commercial lenders.

After you have submitted your commercial loan using the six-step C-Loans System, you can click on the purple call-to-action button below to collect your thank-you gifts.

A lot of you guys are missing out on a wonderful land rush. If you introduce us to a new bank or credit union, and we later convince that bank to join C-Loans.com, we will pay you a 20% referral fee on the first three closings for us by that bank.

You don't have to make the sale. Just send an email to the commercial real estate loan officer at a bank or credit union, "Hey, Steve, have you heard about C-Loans.com? They send you carefully filtered commercial loan applications. It costs nothing to join. There is no monthly fee. You simply bump up your normal loan fee from 1.0 point to 1.375 points, and after the close, C-Loans sends you an invoice for their 37.5 bp. software licensing fee."

Then please just send us the contact information for the banker, and we'll continuously tempt him with attractive real deals. Eventually he will see the perfect deal, and he will join so he can work the lead. Arnold Taylor of Northeastern Funding Group now has 145 banks that have joined C-Loans.com, and other brokers have brought in bankers as well. Each of them will, in time, enjoy some huge referral fees.

Handel was a famous German composer.

Almost done. Because banks and credit unions have been joining C-Loans in droves, we have over 200 new commercial lenders. You need to come check them out. When you submit a commercial loan using C-Loans.com, the system limits you to just six submissions at a time. I now want you to come back to C-Loans, log back in, and put a check mark next to six more lenders, for a total of 12.

Remember, banks are extremely fickle. One day a bank is impossible to satisfy. Three weeks later, that same impossible bank is making crumby commercial loans like a drunken sailor. The key to success as a commercial loan broker is to find out which bank - because of excessive liquidity - is making commercial loans like a drunken sailor TODAY.

So please come back to C-Loans and start using this wonderful commercial loan origination software to make yourself a handsome PDF of your deal. Our software also teaches you what information you need to collect - for example, pictures of the property - in order to create the ideal Executive Loan Summary.

Then, after you have submitted your deal to 12 banks, be sure to contact us for your free rewards - a choice of TWO from (1) an Income Property Underwriting Manual; (2) a Commercial Mortgage Marketing Course; (3) a Fee Agreement; and (4) a copy of The Blackburne List of commercial lenders.