The good folks at George Smith Partners, in their FinFacts newsletter dated May 13, 2020, wrote:

The good folks at George Smith Partners, in their FinFacts newsletter dated May 13, 2020, wrote:

"Some more green shoots are visible as the bridge lenders are starting originations also. The warehouse lending market (big banks lending to debt funds) has started up again, with more cautious leverage. The warehouse lenders will also monitor loan collateral more closely."

George Smith Partners is an old-time commercial mortgage banking firm. The difference between a commercial mortgage banker and a commercial mortgage banker is that commercial mortgage bankers service many of the loans that they originate, normally for life companies.

The money in commercial real estate finance ("CREF") is in loan servicing fees. As I often say, "It's the loan servicing fees, silly." An easy way to remember this is that mortgage bankers are rich, and mortgage brokers are poor. Want to start earning huge loan servicing fees?

So where do debt funds get their dough their large commercial bridge loans. We are talking here about bridge loans from $5 million to $100 million.

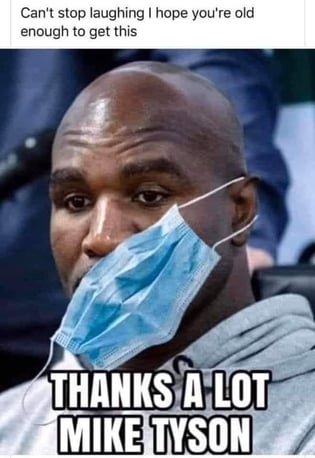

You may recall that this is Evander Holyfield, the former world

heavyweight champion. Mike Tyson bit off part of his ear.

The general rule is that the sponsors of a debt fund will put up several million dollars of their own dough. Then they will go out to wealthy individuals that they know, using a private offering, to raise, say $200 million. They will make, say, $160 million in bridge loans.

Then they will go to a commercial bank and pledge the first mortgages in their portfolio for a $200 million to $250 million line of credit, giving them $400 million to $450 million in lending capital.

As the debt fund makes a profit, some of the earnings are retained as equity, giving the debt fund the ability to borrow even more.

But where do the sponsors of the debt fund go to raise their original $200 million? Who invests equity into a debt fund? The answer is mostly wealthy investors, family offices, hedge funds, and opportunity funds.

But what is a hedge fund? A hedge fund is a limited partnership of investors that uses high risk methods, such as investing with borrowed money, in hopes of realizing large capital gains. Investopedia defines a hedge fund as an aggressively managed portfolio of investments that uses leveraged, long, short and derivative positions.

There are two cool things about a hedge fund. First of all, these public offerings do NOT have to be registered with the SEC. Registration is a phenomenally expensive process, required before a company can go public, that involves extensive audits going back several years and immense legal documents. The process can take almost two years, and the up-front cost is well in excess of $1 million There are also ongoing legal costs of another $1 million per year. Yikes.

Geez, I hope this was photoshopped.

Now remember, hedge funds do NOT have to be registered. Why? Because every investor in a hedge fund needs to an accredited investor, i.e., have a net worth, exclusive of his personal residence, of at least $1 million. The SEC assumes that accredited investors are either smart enough to understand the risk or can afford to pay an advisor.

The second cool thing about a hedge fund is that a hedge fund can publicly advertise for more investors. They just need to make sure that every investor is accredited. This freedom to advertise is a huge deal.

So what is an opportunity fund? An opportunity fund invests in companies, sectors or investment themes depending on where the fund manager anticipates growth opportunities. In plain English, the manager invests wherever the opportunities lie.

Important note: Opportunity funds often buy shares of stock in companies, known as equities. In contrast, most hedge funds invest primarily in debt instruments.

Another difference between a hedge fund and an opportunity fund is that hedge funds investments are not publicly-traded investment instruments. Opportunity funds, in contrast, are public offerings, offered to the general investing public. In other words, you don't have to be accredited to invest in an opportunity fund. Interests in opportunity funds are typically offered by insurance plans, mutual funds, and other investment firms.

Some opportunity funds focus on real estate itself, REIT's, and real estate debt instruments, such as mortgages, debt funds, mezzanine debt, and preferred equity.

Another concept to grasp is the concept of one fund investing in another fund. A hedge fund might invest in a debt fund. An opportunity fund might invest in a debt fund. Therefore most debt funds are a fund of funds.

Now where the debt fund makes its dough is that it can often borrow for as little 3.5% to 4.0% and then make loans at 6% to 9%, plus loan fees.

Clearly debt funds are leveraged, and if the bank holding its credit line gets freaked out and calls its line of credit, the debt fund could be forced into liquidation. The recent report by George Smith Partners that the warehouse lending market is loosening up is great news for debt funds and the availability of large commercial bridge loans.

This quarantine has been hard for everyone.

Commercial Mortgage Rates Today:

Here are today's commercial mortgage interest rates on permanent loans from banks, SBA 7a loans, CMBS permanent loans from conduits, and commercial construction loans.

Be sure to bookmark our new Commercial Loan Resource Center, where you will always find the latest interest rates on commercial loans; a portal where you can apply to 750 different commercial lenders in just four minutes; four HUGE databanks of commercial real estate lenders; a Glossary of Commercial Loan Terms, including such advanced terms as defeasance, CTL Financing, this strange new Debt Yield Ratio (which is different from the Debt Service Coverage Ratio), mezzanine loans, preferred equity, and hundreds of other advanced terms; and a wonderful Frequently Asked Questions section, which is designed to train real estate investors and professionals in the advanced subject areas of commercial real estate finance ("CREF").

Did you bookmark it?

Beer Drinking With George:

Two weeks ago I held my first Zoom beer drinking session to just chat, share, and gossip about the amazing happenings in commercial real estate finance. There was no cost to attend, but each of our 38 attendees was required to hold up a beer, a wine, or a mixed drink to show that he or she grasped the spirit of the occasion.

I was thrilled to see - one hour and forty minutes later (it was only supposed to last 40 minutes) - that 31 guys and ladies were still on the line. I hope you guys had as much fun as I did. Oh, the hangover...

I'm getting ready to hold another Zoom beer drinking meeting in the coming days. If you would like to attend, please write to me, George Blackburne III (the old man), at george@blackburne.com for your Zoom instructions.

I literally get 1,350 emails every single day, seven days per week, so it is please VERY important that your subject line read, "Beer Drinking With George."