So many borrowers are going to need a commercial loan over the next two years to refinance a balloon payment that at some point bankers and conduit commercial loan officers may refuse to accept new loan applications. It won't be the first time in history.

So many borrowers are going to need a commercial loan over the next two years to refinance a balloon payment that at some point bankers and conduit commercial loan officers may refuse to accept new loan applications. It won't be the first time in history.

We start from the general proposition that most commercial loans have a balloon payment every five, seven or ten years. Wow. Stop for a moment and think about that. Just about every owner of a commercial-investment property will have to refinance his property every five to ten years. As a commercial loan originator, I find this greatly reassuring. It means that even during recessions there will still be some commercial loans that need to be closed, so we can earn loan fees and eat.

By the way, a commercial-investment property is a property that can be easily leased out, be turned over to a management company, and serve as a passive investment, much like a bond. Examples of commercial-investment properties include multifamily properties, office buildings, row and free standing commercial buildings, strip centers, shopping centers, industrial buildings, and some of the nicer mobile home parks.

Many of the other types of commercial properties are more like businesses, like hotels and motels, self storage facilities, owner-occupied restaurants, and older trailer parks. These latter properties are too management intensive to be deemed a commercial-investment property. The guys who buy and run them are not passive investors, but rather business owners. It is interesting to note that many owner-operated business properties qualify for SBA loans, and if they are financed using the SBA 7(a) program, they have no balloon payments.

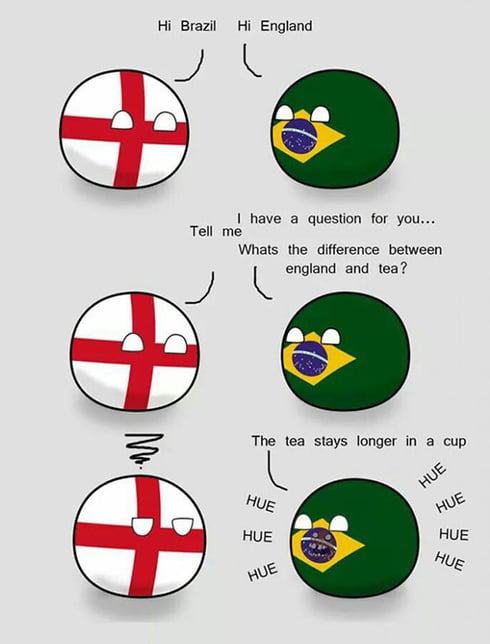

By the way, Brazil, the English women just did MUCH better than yours in the World Cup, and they almost made it the finals. So there! Neener-neener-neener.

Okay, back to the subject of rationing commercial mortgage money. In 2005, 2006, and 2007 commercial real estate lenders made a ton of commercial loans. Ten years later those commercial loans - totaling hundreds of billions of dollars - are now coming due.

To complicate the matter, the commercial loan origination profession has shrunk by at least 50% since the heyday. There is an actual shortage of trained conduit and bank commercial real estate loan officers. When Busy Season starts in late August of this year, the phones are going to ring off the hook, and there will not be enough trained commercial loan officers to field all of the calls.

Now to my third point. The best commercial real estate lenders cream the market. It's not like residential mortgage finance, where if a deal meets a lender's minimum requirements, it gets approved. No. Commercial mortgage finance is more like high school. The quarterback dates the head cheerleader. The star running back dates the second prettiest girl, and so on. The life companies - because they have the lowest interest rates - take the absolute most desirable commercial loans. Typically life companies finance the huge trophy deals, like the biggest lifestyle centers or the newest, tallest, shiniest office towers in the city.

By the way, a lifestyle center is a huge shopping center where the shoppers can drive right up to the store of their choice. Do you know why indoor malls suddenly fell out of favor? This is probably tactless of me to say, but so many Americans are now so overweight that its hard for them to walk the length of some huge indoor mall. At a lifestyle center, shoppers can drive right up to Target, pop in, pop out, and then drive away.

Okay, back to commercial lenders cherry-picking and how it compares to dating in high school. After the life companies choose the largest, shiniest commercial loans, the conduits get to pick over the deals. They typically take the more bread-and-butter commercial loans over $5 million. The banks, S&L's (not many left), and credit unions choose a huge percentage of the rest. Next comes the nonprime commercial lenders and finally the hard money lenders.

Now here is what is going to happen. We are not going to be issued ration cards. We are not going to have to stand in long bread lines. However, as the lenders at the top of the food chain get inundated with commercial loan applications, they are going to get very, very picky. Surprisingly strong borrowers with attractive commercial properties are going to get pushed down the food chain to lenders with less desirable rates and terms. Put another way, an average-looking guy like me might actually get to date the 6th cutest cheerleader. (Okay, she's probably not that desperate, but maybe I might get to date one of the cuter pom-pom girls).

Although it is not strictly rationing, the nation's cheapest commercial lenders are only going to be able to handle a limited amount of business. Even if a lender had an unlimited amount of commercial mortgage money - like a conduit - the limiting factor is going to be a limited amount of trained staff to handle the commercial loan demand tsunami.

"Okay, George, so what's a boy or girl to do?"

- If you are a commercial real estate investor, if you have a balloon payment coming due in the next three years, and if you don't have some horrible prepayment penalty, apply for your refinance immediately.

- If you are a commercial mortgage broker, you better go out of your way to build a personal relationship with your bank and conduit loan officers. Take your banker to lunch. Invite him over for a football game and/or a barbeque. Take him and his wife out to dinner. Your favorite commercial s loan officer is going to get extremely busy during the tsunami. You better be a good friend if you expect him to process one more commercial loan. He is going to be exhausted.

- And always remember that imaginary story I wrote about getting hit by a bus. As I lay on the pavement bleeding out, I told my two wonderful sons, "Sons, always remember the most important lesson in all of commercial real estate finance. Commercial lenders close loans for their friends!"

If you should meet a banker who makes commercial loans, don't forget that you can parlay the contents of that one business card into a free directory of 2,000 commercial real estate lenders.

If you have a commercial real estate loan request on a standing commercial property (sorry, but we don't make construction loans), you would be very, very wise to submit it to Blackburne & Sons. We'll issue a Loan Approval Letter for free. You can then use that "commitment letter" to troll for a cheaper loan from a bank. Just like girls are attracted to boys with a pretty girl on their arm, so too are bankers attracted to commercial loans that other lenders have already approved.

Got a commercial loan larger than $2 million (or otherwise unsuitable for Blackburne & Sons)? Remember, C-Loans.com is free!

You can now submit business loans - loans like inventory loans, equipment loans, accounts receivable financing, equipment leases, and secured lines of credit - through C-Loans.

Click on the red button immediately below and then forward the page to any bankers you know who make commercial loans. If the banker signs up to join C-Loans as a lender, we'll give you a free training course of your choice, as well as $250 every time he closes a loan for us..