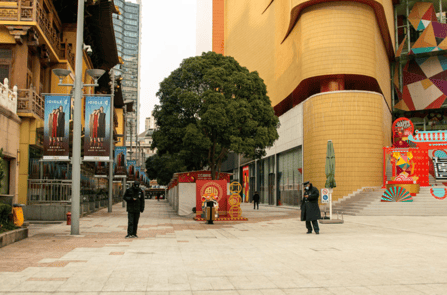

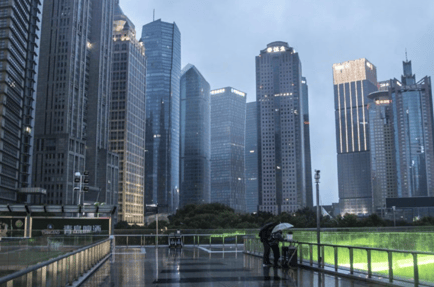

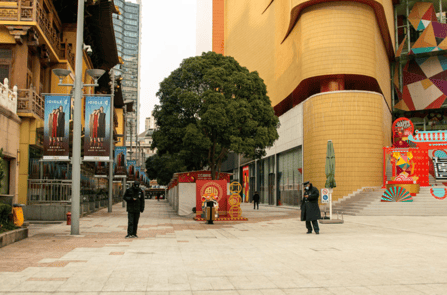

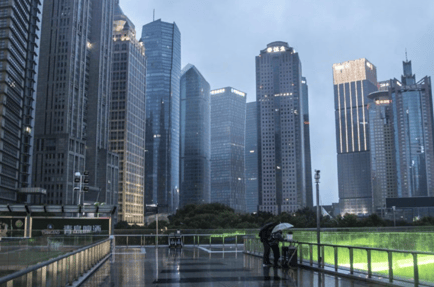

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

Obviously, if the coronavirus gets loose in the United States like its already loose in China, the U.S. economy is going to crumble. A lot of people - especially old 'gomers like me with a bad heart or with bad lungs - will be too afraid to go outside.

Please pay attention!

If your father and mother are over the age of 55, and they have a fairly serious pre-existing health condition, you may have to ground them for three or four months. "Go to your room!" This disease is killing well over 35% (50%?) of these older folks with pre-existing health problems.

This disease starts in the lungs, where it starts killing the cilia - the active little hairs in your lungs that work like oars to stir and to clean out the good mucous that protects your lungs.

In response, the immune system over-reacts (called an Immune System Storm) and floods the lungs with white blood cells. The patient starts to drown from his own immune system response, and breathing becoming increasingly difficult.

In many cases, the coronavirus also attacks the walls of the blood vessels in the lungs, and blood starts to seep out from the arteries and veins into the lungs, further drowning the patient.

In about twenty percent of cases, this evil virus moves on to attack the liver, and it interrupts the blood cleansing process. Not good. Seriously not good. And if the disease moves on to your father's or mother's kidneys, the fatality rate is over 91%.

The good news is that younger adults seem to survive the infection. I read today that in China, doctors are collecting plasma from young adult survivors and giving it to the very sick. It seems to help. Your own children? Don't be reckless, but very few young kids are getting the serious version of this disease. Thank God for that. Thank you, sir. Source for all this medical stuff: Article in the National Geographic.

So, of course, if the coronavirus runs rampant through the United States, the economy is toast; but today I am going to make the argument that even if the coronavirus stays predominantly in China, the U.S. may still suffer another Great Recession.

Pop Quiz:

Q: What's the difference between a Great Recession and an outright economic depression?

A: In a Great Recession, the Fed intervenes and keeps the banks from failing. That was the huge mistake that bank regulators made in the 1930's. We let 9,000 banks fail during the Great Depression - 4,000 in just 1933 alone.

Okay, so why would an economic slowdown in China crush the United States? Once again, it involves the multiplier effect kicking into reverse. You will recall from earlier articles that the multiplier effect is that virtuous cycle whereby a $100 deposit into a bank increases the country's money supply by a whopping $2,000.

In a world of fractional banking, a bank only has to keep a fraction of its deposits on hand in the form of cash, and it is allowed to lend out the rest. Therefore, if Bank A takes in a $100 deposit, it only has to keep $5 in reserve. It can lend out the remaining $95 at a profitable interest rate.

The proceeds of this $95 loan end up eventually as a deposit in Bank B. Bank B keeps $4.75 in reserve (5%), and lends out $90.25. This money eventually ends up in Bank C, which keeps 5% in reserve and lends out the rest. And so on.

The end result is that a whopping $2,000 in new money is created from that single deposit of $100. Twenty-to-one. One divided by the Reserve Ratio demanded by the regulators. 1 / .05 = 20.

Wow. Pretty cool, huh. But here's the problem. The multiplier effect can sometimes work in reverse, thereby destroying vast amounts of a nation's money supply.

Money then becomes tight, businesses fail, workers are laid off, resulting in fewer consumers, reducing demand, lowering prices as companies desperately try to sell their products at some price. Lower prices means lower profits, squeezing the budgets of the surviving companies, resulting in more company failures, more layoff's, and a general circling down the economic drain.

Now let's jump to China. Wong Chiang builds and sells parts for electric scooters. Fearing an economic slowdown due to the coronavirus, Mr. Wong decides not to replace much of his inventory of scooter parts (they might just collect dust on the shelf), so as existing scooter parts sell out, Mr. Wong stops borrowing more money on his inventory line of credit from the bank. In fact, he starts to substantially pay down his line of credit.

Shanghai Bank, his bank, receives a series of loan pay-downs from Mr. Wong totaling $100,000. Since Mr. Wong refuses to borrow more money, Shanghai Bank looks around for some other borrowers to whom it might lend; but it has no takers. Every other business owner in the Shanghai area is equally freaked out about taking on new debt.

Guess what happens? Since the reverse multiplier effect also works at 20:1, Mr. Wong's $100,000 loan pay-down results in the Chinese money supply shrinking by a whopping $2,000,000!

And other Chinese businessmen are also probably paying down their debt right now in anticipation of a recession. The Chinese money supply has to be contracting right now like the tailpipe of a man about to get a prostate exam. Hahahaha! In order to convince older men to get prostate cancer exams, there was once a terrific commercial showing a doctor wearing one rubber glove. "I have performed 2,332 and a half prostate exams." Some poor guy apparently ran out screaming from the exam room. [Oh, my goodness, laughing my tush off.]

With billions of yuan also flowing back to Chinese banks in the form of normal monthly loan payments, the Chinese money supply must be contracting severely right now (20:1). This is extremely deflationary.

Could we see U.S. commercial real estate fall by 45% again? If this epidemic drags on more than a few more months, then the answer is yes.

But wait, why does a contracting Chinese economy mean that the U.S. will soon go into a deflationary recession as well? Think about all of the products that we sell to China. Our exports to China will definitely be declining.

And let's talk about U.S. manufacturing. Parts. Our factories will not be able to get all of the Chinese parts they need to manufacture their own products.

Millions of Chinese are still not back to work after their Chinese New Year vacation. The Chinese Communist Party has closed thousands of factories in order to slow the spread of the virus. Over 50 million Chinese are effectively in quarantine in their own homes. Travel by private car in Wuhan was just banned today.

Is there any hope? The coronavirus does not like heat, humidity, or sunlight. There is some hope that the disease may burn itself out in the Spring; but there is no guarantee.

What can you do? Avoid taking on new debt. Stay liquid, including keeping some extra cash at home. Build up a supply of food. People are starting to go hungry in Wuhan. There were food riots at the supermarkets in Shanghai this week, hundreds and hundreds of miles away from Wuhan. Got a gun? Should you buy another one for your wife, each of your older kids, and your dog? I think so.

Dog and cat food. Some desperate Chinese people have been forced to hurl their sweet dogs and cats from twenty-story buildings because they were competing for the family's dwindling supply of food (and there was unfortunately an erroneous rumor that dogs and cats were acting as a reservoir of the virus).

Toilet paper. I kid you not; there was an armed robbery in China yesterday where the perpetrators stole a huge shipment of toilet paper. "Hey, man, did you get the goods? Yes, we got ten pallets of toilet paper."

But here is some good news. I no longer think the Chinese will be starting a war against us in less than four years. This epidemic must be traumatizing the Chinese people.

The year was 541 A.D. The Western Roman Empire had already fallen to the Visigoths; but the Eastern Roman Empire, headquartered in Constantinople (modern day Turkey), would survive for another 850 years. The Bubonic Plague, carried by fleas, was a pandemic that wiped out much of the population of the Byzantine (Eastern Roman) Empire, as well as that of the Persian Empire.

What I never knew until yesterday was that a horrible economic depression followed the Plague of Justinian (the Roman Emperor in 541). Just sayin'.

We may soon be going through an economic poop storm, and if we do, the banks will quickly exit the market. Please remember that Blackburne & Sons is NOT a mortgage fund. If you are invested in a hard money mortgage fund right now, get the heck out immediately. There is nothing worse than being invested in a hard money fund when the sponsor fails. You'll be lucky to recover 25 cents on the dollar.

Instead, Blackburne & Sons quickly assembles a new and different syndicate to fund every deal. There are always private investors willing to fund a good loan, even when blood is running in the streets. It's simply a matter of interest rate.

Blackburne & Sons was in the market, making commercial loans, every single day of the S&L Crisis, the Dot-Com Meltdown, and the Great Recession.

Commercial lending is all about relationships. Were you smart? When the everything was peachy keen, did you bring your good hard money deals to Blackburne & Sons, or did you foolishly try to establish a relationship with some hard money mortgage fund that will be out of business in the next nine months?

Most hard money mortgage funds are Ponzi Schemes. When new deposits stop flowing into the fund, and the sponsors lack the dough to make new loans and earn new loan fees, hard money mortgage funds fold like a cheap suit. But Blackburne & Sons will still make you a commercial real estate loan - every single day of the Coronavirus Crisis. We are always in the market.

You need to pay special attention to this article, especially if you intend to retire in the next fifteen years. The current stock market rally is just a temporary reprieve against the irresistible power of the second big decline (of three) in the US stock market.

You need to pay special attention to this article, especially if you intend to retire in the next fifteen years. The current stock market rally is just a temporary reprieve against the irresistible power of the second big decline (of three) in the US stock market.

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!