If the world's money supply starts to contract again, like it did in 2008, commercial real estate investors and those of us in the commercial loan business are going to be painfully affected

If the world's money supply starts to contract again, like it did in 2008, commercial real estate investors and those of us in the commercial loan business are going to be painfully affected

First of all, please grasp the concept that the biggest risk facing mankind is not global warming, a nuclear war, a conventional world war (World War III with no nukes), or some new viral pandemic.

No, the biggest risk facing mankind - because it is far, far more likely - is another global deflationary depression.

Imagine a world where huge corporations go bankrupt by the thousands, where the unemployment rate soars to 40%, and where one-hundred-million Americans wander listlessly like Zombies, trying to survive on the tiny Welfare payments provided by the government. This is what a deflationary depression looks like.

Could it happen? Easily. All it would take would be for the banks to stop lending. Remember, cash only constitutes 8% of the world's money supply. The rest of the world's money supply is digital money, and almost all of that digital money was created by fractional banking. More on fractional banking in a moment.

Here's how it works. The Fed, for example (it works the same way in the EU), buys $1 billion worth of Treasury bonds from Bank A. Suddenly Bank A is flush with cash, and it needs to put that cash to work. It is required to keep $50 million (5%) in reserves, and then it loans out the remaining $950 million to Advanced Missile Devices, Inc.

By the way, I am so convinced that a missile war with China will happen in the next 3.5 years that I just moved 20% of my retirement account into the stock of six U.S. missile manufacturers - Lockheed Martin, Raytheon, Northrup Grumman, Boeing, General Dynamics, and United Technology. As I see it, we don't actually have to go to war for these investments to pan out. America's is now embarking on a crash missile development program.

Did you know that China now has new air-to-air missiles with almost twice the range of our our best air-to-air missiles. They will be able to shoot down our jets long before we even get into range. It's kind of like the English long bow versus the French crossbow. Heavens, I pray that a shooting war doesn't develop with China. They would probably win, even without Russian, North Korean, or Iranian help. We are very, very far behind in missile technology.

Okay, so Advanced Missile Devices spends the $950 million of the $1 billion loan from Bank A, and the proceeds of that loan end up in Bank B. Bank B then makes makes a $902.5 million (95% of $950,000) loan to Blue Cloud Computing Corp. Blue Cloud spends the proceeds, and those proceeds end up in Bank C. Bank C then loans out 95%, and the proceeds up in Bank D; and so on.

By the time it's all done, the money supply of the United States has just increased by a total of $20 billion. That's a 20-fold increase (20:1) of the Fed's injection into the money supply of just $1 billion.

The authority of a bank to loan out money entrusted to its care is known as fractional banking. Banks don't have to keep their deposits just sitting in their vaults, like an old-time goldsmith. They are allowed to lend it out, as long as they keep a fraction (about 5%) in reserve.

This money-creating phenomenon is known as the Multiplier Effect, and it has been going on for hundreds of years. The Multiplier Effect is not some capitalistic evil. By creating new money that needs to be invested somewhere, newly created bank money has helped to finance huge technological advances, like canals, railroads, billion dollar computer chip manufacturing plants, and Elon Musk's new giga-factory for car batteries.

But here's the thing. The multiplier effect works in reverse - and this is where things get really, really scary. If a U.S. bank takes in a loan payment of $1,000 - and it is too nervous to lend it back out - $20,000 gets sucked out of the country's money supply. It's a factor of 20:1. The multiplier effect works in reverse. Grasp this important concept: The multiplier effect works in reverse.

Not scared yet? Banks have outstanding about $6 trillion in loans. If we assume an average annual interest rate of 6%, this means that every year $360 billion flows back to the banks in interest payments.

Now let's suppose the banks get scared, and they only lend back out $160 billion. Wearing helmets and World War I gas masks (see picture above), they hunker down in their financial bunkers, hoarding the remaining $200 billion in loan payments.

Get ready for it... twenty times $200 billion is $4 trillion dollars! This is what happened in 2008. About $4 trillion disappeared from the U.S. money supply in abut one year. Ouch. Not coincidentally, this is about the size of the increase in the Fed's balance sheet during the Great Recession. By buying up trillions of dollars worth of outstanding Treasuries, the Fed was able to re-inflate the U.S.money supply.

Okay, so you now see the danger of a bank slowdown in lending - horrible deflation.

Finally the Point of Today's Article:

An important research paper was just released that showed that negative interest rates reduce bank lending.

Why? Lower interest rates squeeze bank margins, meaning they have less money to build their capital reserves. Capital reserves are the funds the owners of the bank chipped in to create the bank originally and the profits from prior years that the owners left in the bank in order to grow the bank. They are the reserves of the bank to cover future losses.

Banking regulators don't allow banks to grow if their reserves don't grow proportionately. Sometimes banks are legally required to shrink if their reserves fall too low.

How do banks shrink? They stop making new loans and hoard their incoming loan payments. What happens to the money supply when banks stop making new loans? Twenty-to-one, remember? Company failures, mass layoffs, and a deflationary depression..

Negative interest rates reduce bank lending? It's as if gravity just got stronger.

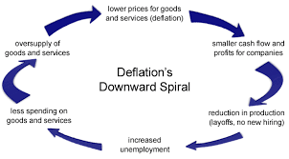

Deflation is a very serious threat in Europe. The problem with deflation is that once it takes root in the minds of consumers, they start to put off their purchases of cars, houses, and other big ticket items. Why buy a car today when it will only be cheaper next year? As borrowers procrastinate, sales fall off for manufacturers. Manufacturers respond by laying off workers, which reduces demand even more, which leads to even more falling sales and layoffs. Deflation has the potential to become a death spiral for an economy.

Deflation is a very serious threat in Europe. The problem with deflation is that once it takes root in the minds of consumers, they start to put off their purchases of cars, houses, and other big ticket items. Why buy a car today when it will only be cheaper next year? As borrowers procrastinate, sales fall off for manufacturers. Manufacturers respond by laying off workers, which reduces demand even more, which leads to even more falling sales and layoffs. Deflation has the potential to become a death spiral for an economy.