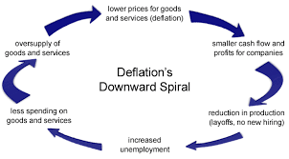

Deflation is a very serious threat in Europe. The problem with deflation is that once it takes root in the minds of consumers, they start to put off their purchases of cars, houses, and other big ticket items. Why buy a car today when it will only be cheaper next year? As borrowers procrastinate, sales fall off for manufacturers. Manufacturers respond by laying off workers, which reduces demand even more, which leads to even more falling sales and layoffs. Deflation has the potential to become a death spiral for an economy.

Deflation is a very serious threat in Europe. The problem with deflation is that once it takes root in the minds of consumers, they start to put off their purchases of cars, houses, and other big ticket items. Why buy a car today when it will only be cheaper next year? As borrowers procrastinate, sales fall off for manufacturers. Manufacturers respond by laying off workers, which reduces demand even more, which leads to even more falling sales and layoffs. Deflation has the potential to become a death spiral for an economy.To combat deflation, the European Central Bank (ECB) has been engaged in quantitative easing, just like our own Federal Reserve Bank. The ECB has been buying up enormous amounts of the sovereign debt issued by European countries, like Germany, France, Italy and Spain. This is a big part of the reason why there is now $10 trillion worth of worldwide sovereign debt (Germany, Japan, Switzerland, Sweden, etc.) that has a negative yield.

Huh? What? I was dozing off. George, did you just say negative yield? No way. You're pulling my leg. I am absolutely serious. If you bought a 1% German bund (10-year German bond) two years ago, so many life insurance companies, pensions trusts, endowment funds, and other trusts are anxious to buy that bund from you that the buyer would pay a premium for it.

A premium occurs when the buyer of a note, bond, or mortgage pays more than the face value. For example, suppose your client just sold an apartment building for $1,000,000. The buyer put down $450,000 in cash, and the seller carried back a first mortgage of $550,000 at 9%. Because that first mortgage note is so safe and because that 9% rate is so high, an investor might be willing to pay $605,000 for that $550,000 mortgage. That extra $55,000 is called a premium.

Why would an investor pay a $55,000 premium for that first mortgage note? Because the investor might only be able to find comparable, bank-quality, commercial first mortgage notes at just 5% elsewhere. Every year the buyer of that mortgage will earn an extra 4% in interest. Over the ten-year term of the note, the buyer earns far more in extra interest than the $55,000 premium he paid.

"Okay, George, let's get back to this 1% German bund. I can see why someone might pay a tiny bit of a premium for a 1% German bund, if 1% was a higher rate than the investor could earn elsewhere (with the safety of a German bund), but you said something earlier about negative yields. Why would any one want to bid up the price of a German bund so high that it produced a negative yield? That's flippin' nuts. Just stick the money in a bank."

The thing about a trust is that the trustee must exactly follow the instructions in the trust agreement. Pension plans and endowment plans (for example, money donated to a school by alumni) are trusts. Most trusts require the trustee to maintain some percentage of the corpus (body of the trust; i.e, the dough) in AAA government bonds. The trustees have no choice. They simply must buy them, regardless of the cost - even if that means that the trust earns a negative yield. Unbelievable, huh?

We took a slight detour. Let's get back to the European Central Bank and its vast purchases of European sovereign bonds. The ECB can't buy up every soverign bond in Europe; otherwise, the trustees of all of the various trusts would have to breach their fiduciary duty. The ECB has to leave some soverign bonds for the public to buy. That's why the ECB is limiting itself to 70% of the sovereign bonds of any one country.

Now remember, the way that the money supply of any country grows is when their banks use their liquidity to make new loans, including commercial loans. Liquidity is just a fancy world for excess dough sitting around unused.

Okay, but what happens when European banks have little appetite to make additional commercial loans? What can the ECB do to inflate the money supply, at least enough to prevent outright deflation? The ECB can't many many more German bonds, for example, if they already own 69% of all of Germany's outstanding bonds. Yikes.

Now we finally get to the astounding news: In order to force new money into the European money supply (to prevent deflation), the ECB has started buying up AAA and AA rated bonds issued by large European corporations, companies like the German industrial giant, Siemens, or the British pharmaceutical company, GlaxoSmithKline. The yields on these highly-rated corporate bonds just went negative this quarter. Siemens can now borrow $50,000,000 for two years, pay no interest at all, and pay back just $49,985,000 two years later.

Wow. May you live in interesting times.

Remember, be on the lookout for the business card or the contact information of just one banker making commercial loans.

When you register on C-Loans, we'll send you a free Commercial Loan Underwriting Manual that we sell for $199.

Is some bank running you around?

Are you a loan officer at a commercial bank or credit union? Sorry guys, only them.

Got a commercial loan request that deserves a loan from a life company, conduit, or bank?

Receive free training in commercial real estate finance. I try to write two training articles about commercial real estate loans every week.

Got a buddy or a co-worker who would benefit from learning commercial commercial real estate finance?