I wrote an opinion piece the other day in which I suggested that Putin should have taken Trump's peace deal. Xi Jinping of China, a personal friend of Putin, has fallen from power. The new leaders of the CCP feel no great love for Russia. They could stop buying Russia's oil and stop sending Russia computer chips.

Pow! Did I ever catch hell from a Russian-American friend of mine? Below is his response, which you'll find very, very interesting.

Tucker Carlson just recently interviewed Jeffrey Sachs. Jeffrey David Sachs is a well-respected American economist and public policy analyst, who is a professor at Columbia University. Professor Sachs says the same thing. Russia unjustly gets a bad rap.

"You took a fine time to leave me, Lucille..."

One of my long-time readers really gave me hell. "You know nothin', John Snow." His chewing out in defense of Russia was so eloquent that I begged him to let me publish it:

Hey, George, sorry to come off at you like this, it was a long day. As a Russian (father) AND Ukrainian (mother), I’m bloody tired of misinformation about this whole thing that affects me and my family. People in this country don’t realize how much lies and propaganda goes every day into this narrative, pretty much 100% of what you hear here is a lie, however, since my family goes back and force to Russia, and I have friends and family inside both Russia and Ukraine who know the true pictures, I can tell you that whatever your conclusions are based on what you hear, it’s mostly wrong!

My friend continued - First off, how can you make an educated opinion about anything that goes on there if the only media coverage you get is from the Ukraine’s side, and ZERO from the other side? Why aren’t any BBC, CNN or Fox journalists going to Russia and cover their side of the story? There are no restrictions, they can go any time, THEY CHOSE NOT TO GO because they have a single-purpose narrative (i.e. propaganda) and they don’t want to go against their orders. It’s worth than what was happening in the USSR when I was growing here, because you would expect media here to be independent and objective, but the reality is quite opposite.

Secondly, what exactly are we defending in Ukraine? Democracy? NONE! Ask yourself, Why EVERY single opposition leader is in hiding in Europe or in jail in Ukraine fearing for their life, while Russian opposition is free to do whatever they want, including the Russian Communist Party? Every opposition media is banned. Russian books and newspapers are banned. If you speak Russian in Ukraine on the street, you can actually get killed, while in Moscow there are at least 4 TV channels in Ukrainian (and about 3 dozen other channels in Armenian, Georgian, Azerbaijani, and other languages), even on the Russian Voice TV show, they have contestants singing songs in Ukrainian!

Ukraine literally conducted a genocide of the Russian speaking population since 2014, and nobody in America gives a damn about it. Have your heard of the Alley of Angels? It’s a cemetery of kids ages from 1 to 15, hundreds of them, who were killed by Ukrainian bombs and artillery in Donbass between 2014 and 2022, WHILE DONBASS WAS STILL PART OF UKRAINE, only because they didn’t want to have anything to do with the Zelensky regime and wanted to continue to speak Russian. How about Russian priests and monks who are in jail only because they are part of the Russian Orthodox church, including the main Patriarch, who had a stroke when he was literally dragged into court, and they still arrested him and put an ancle monitor on this 80-year old guy.

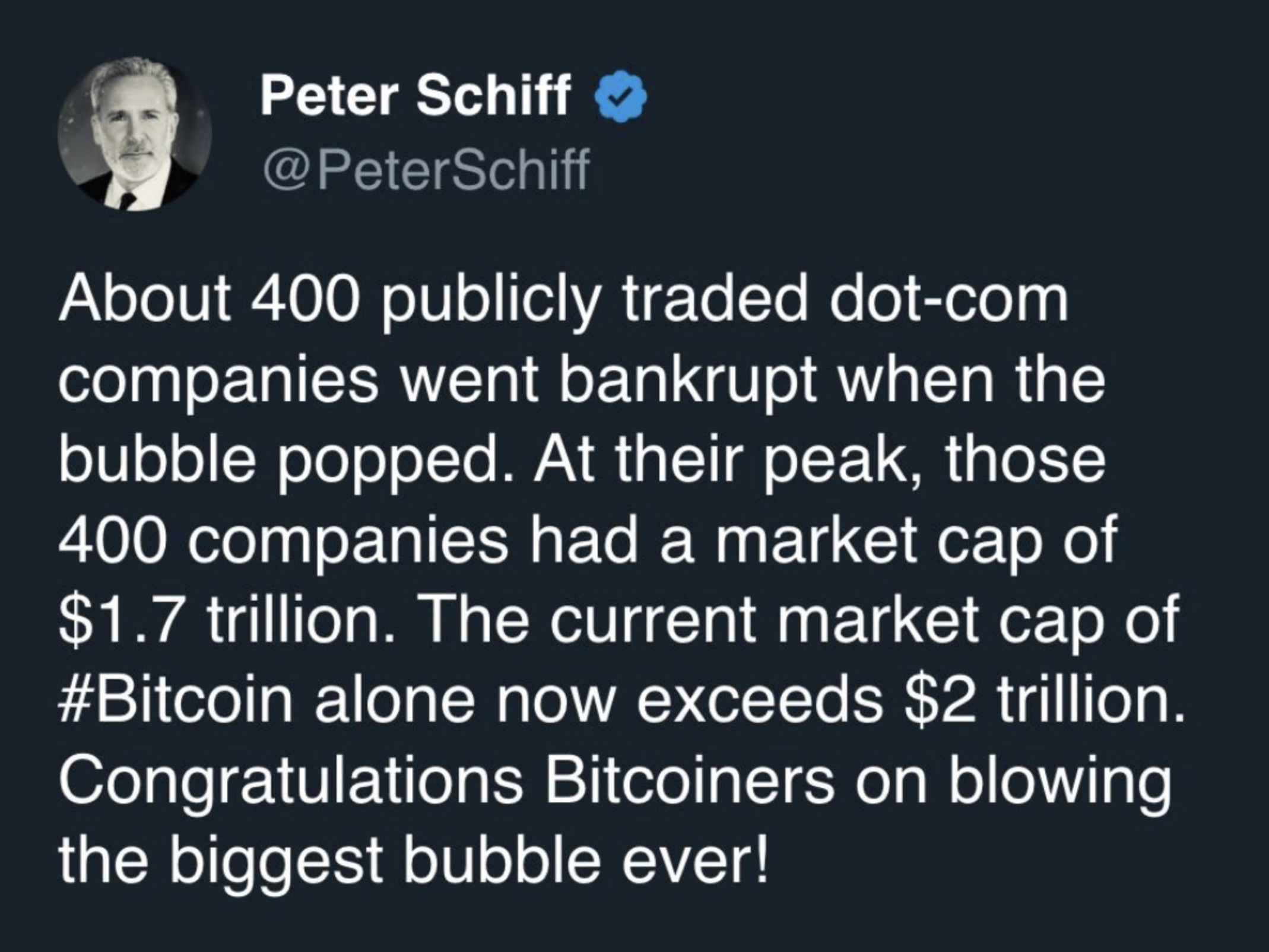

And yet, we dumped over $350 BILLION into this shit hole so that Zelensky and his friends (including Biden family) can launder more than half of it in their crypto accounts. We don’t have money to pay to victims of LA fires, or people in Maui, Florida and North Carolina, but we got billions and billions to give to Ukraine who was NEVER our strategic partner in any of our programs! (Remember, my fiend, the author, is a Russian-American.)

So, when I hear about this PR stunt with attacking Russian nuclear bombers, I laugh because it is not true. Listen to Scott Ritter on youtube, the most Ukraine got was about 7 planes, 3 or 4 of which were out of commission, they were used for parts. Yes, it was sneaky, caught Russian intelligence community off guard, but it didn’t change anything in Ukraine operation, Russian troops continue to advance every day, and Ukraine is losing between 1000 to 1300 people PER DAY DEAD! So, why do something stupid like this (with the help of American military) that can set off World War 3? We should be THANKFUL that Putin is a patient wise man who doesn’t react based on pure emotions like most American leaders.

Another point, I, just like majority of intelligent Russians, have my reservations about Putin, we all know he is corrupt and all, but, and this is something that the US still can’t accept, Putin right now really IS that popular!! His popularity rating REALLY is above 80% right now! Instead, we keep underestimating him as a smart opponent, we keep trying to picture him as a stereotypical KGB hit man, where in reality, he is highly intelligent very well-trained intelligence officer who spent his career in Germany, understands Western mentality very well, fluent in German, and very well equipped to handle crisis situations like this. Only one department at KGB would fit the Hollywood style dealings, the rest of the KGB (and now FSB) consisted of 15 or 20 different departments that employed the best minds in the country and provided the best training that was comparable to Harvard or Cambridge. Imagine all our law enforcement combined into one, including FBI, CIA, Secret Service, NSA, DEA, ATF and a bunch of other agencies with their combined resources and training. When I finished the University, I was offered a job there three times in the analytical department, because I was a specialist in India and I spoke Hindi fluently. I decided not to, but it was a very very good offer!

So, when you are talking about Trump’s deal, the reality is that Trump really doesn’t have anything that he can offer to Putin at this time! Russia is winning, it already took 15% to 20% of the Ukraine’s territory, including the territory where the rare earth metals are that Zelensky has been trying to sell to Trump, Russia’s military production is producing advance weapons at the rate of FOUR times the entire NATO, according to NATO itself! So, Trump really hasn’t offered anything to Putin worth hearing, plus, you really can’t negotiate peace with Russia while you continue supplying weapons and money to Ukraine without interruptions.

By the way, this week was a very interesting event, that nobody in American even knows about. As part of the latest negotiations between Russia and Ukraine, Russia delivered to Ukraine the bodies of almost 7,000 Ukrainian soldiers that were killed and just left by Ukrainians on the field. It was supposed to be an even exchange, however, Ukrainians only had 78 bodies to deliver! Plus, Ukrainians for a week refused to take the bodies, because once they took them, then had to report them to the families and killed in action, and subsequently would have to pay the families of the dead soldiers compensation of about $250K, which is covered by the money from the US and Europe, however, Zelensky already spent this money on something else, so they were trying to find all different reasons not to accept these bodies until yesterday.

Since 1980. When the stuff next hits the fan, you'll

be glad you invested with Blackburne & Sons.

I’ve been an American citizen for over 20 years, and lately our foreign policy scares the shit out of me! It’s run by lunatics and incompetent dilettantes! I voted for Trump because he promised to bring peace, but why are we still involved in all these conflicts? Why are we trying to provoke Russia, China, Iran? Why are we lifting all sanctions from the Syria, and Trump meets personally and shakes hands with the Syrian leader who just a couple of years ago was beheading American citizens, threatening American infidels and earlier this year had a $10 million bounty on his head from our State Department, and in the meantime we have the worst possible sanctions against Russia, WHICH NEVER THREATENED ANY AMERICANS, and Trump still refuses to meet with Putin? I want my kids to grow up in a normal world, not in underground bomb shelters!

Could Russia survive without China? Probably not. But we made Russia-China connection possible because of our stupid foreign policy. We made BRICS possible, we made their search for an alternative global currency possible, we ourselves made America and our dollar less relevant, there is nobody else to blame for it.

Cheers, (A buddy of mine)

Now guys, please don't yell at me. The above opinion is not mine. Putin is deliberately firing into residential areas, which is a war crime. He can rot in hell, as far as I am concerned. But there are two sides to every story, and I thought my buddy scored some legitimate points.