The United Airline's passenger cabin was being served by an obviously gay flight attendant, who seemed to put everyone into a good mood as he served them food and drinks. As the plane prepared to descend, he came swishing down the aisle and announced to the passengers, "Captain Marvey has asked me to announce that he'll be landing the big scary plane shortly, lovely people, so if you could just put up your trays, that would be super."

On his trip back up the aisle, he noticed that a well-dressed, rather exotic looking woman hadn't moved a muscle. "Perhaps you didn't hear me over those big brute engines. I asked you to raise your trazy-poo so the main man can pitty-pat us on the ground." She calmly turned her head and said, "In my country, I am called a Princess. I take orders from no one."

To which the flight attendant replied, without missing a beat, "Well, sweet-cheeks, in my country, I'm called a Queen, so I outrank you. Now put your tray up, wench."

To which the flight attendant replied, without missing a beat, "Well, sweet-cheeks, in my country, I'm called a Queen, so I outrank you. Now put your tray up, wench."

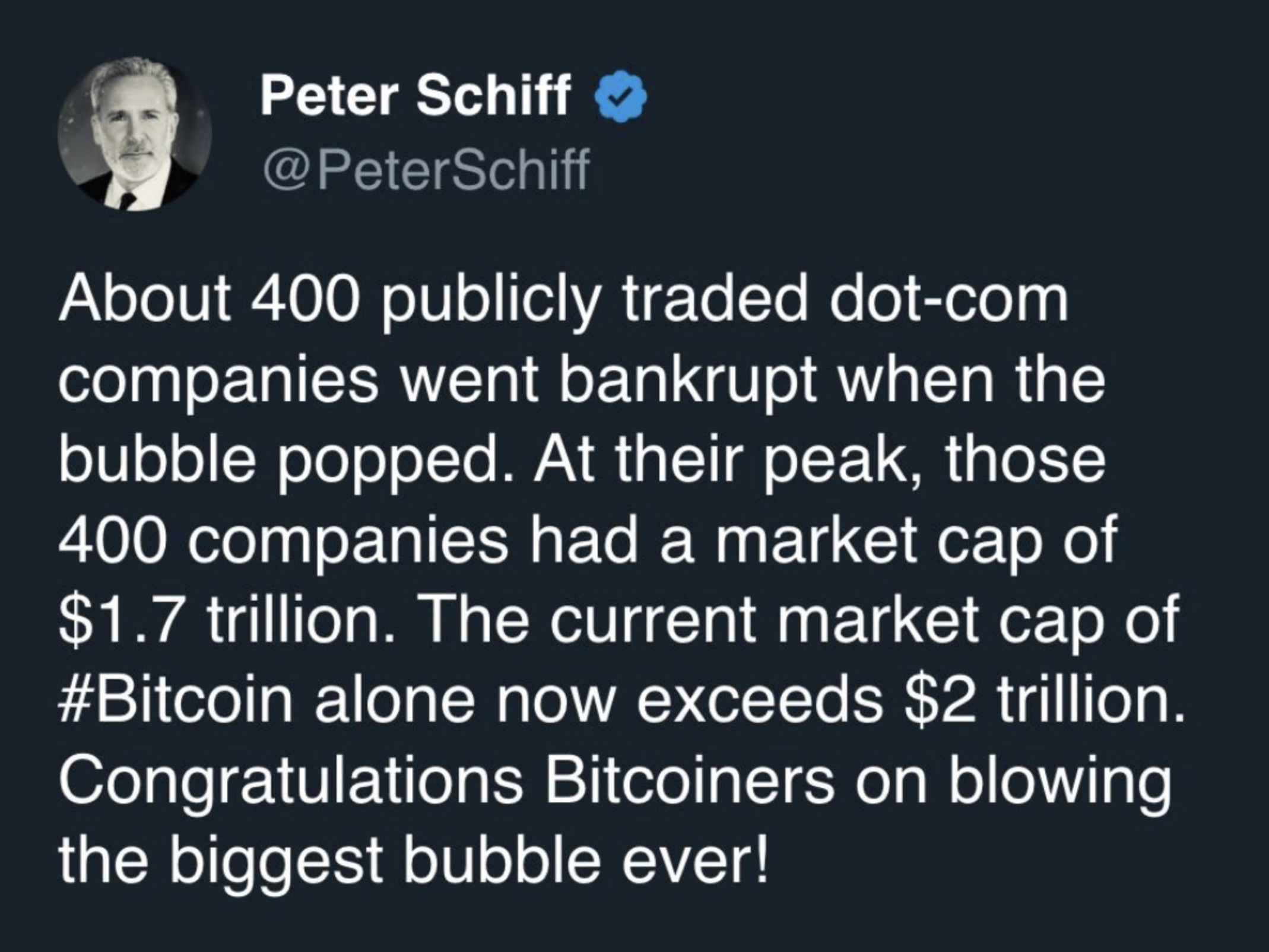

If you are invested in stocks and bitcoin, and you have built up a sizable nest egg for retirement, you may be counting your money while you are still sitting at the table. There may be several more great recessions between now and your retirement.

You need to take at least a little bit of dough off the table. Take a lousy $5,000 or $10,000 and invest it directly into one of our first trust deeds. Discover the pleasure of getting an interest check every month (assuming your borrower pays). When the next, long-overdue, great recession hits, you may wish you had invested more.

Look who wrote the words below.

If you do decide to invest in first trust deeds, make SURE you do not invest in a fund of any sort. I will pay you $50 if your current hard money fund was in business (at least $20MM in assets) in 2007. George, are you nuts? There must be hundreds of hard money funds that survived the Great Recession. Right?

Ha! Every hard money mortgage fund in business before the S&L Crisis failed. Every hard money fund in business before the Dot-Com Meltdown failed. Every hard money fund in business before the Great Recession failed. Hard money funds never survive great recessions.

Curious why hard money funds always fail? Are you an accredited investor? If so, please write to me at george@blackburne.com and ask, "Okay, George, how can you be so certain that the hard money fund in which I am invested will fail?"

Surprisingly, it has little to do with the quality of the subprime loans that your well-intentioned sponsor has assembled in his portfolio. So write to me at george@blackburne.com and pick the brain of the only guy whose hard money shop has survived three different great recessions - where real estate fell by at least 45%. We have been in business since 1980.

Some good news. Xi Jinping of China felt that it was his destiny to attack Taiwan and reunite it with China. He made a huge mistake. He repeatedly announced to the world that China was going to invade Taiwan and thereby start World War III. Now you personally may never have believed it; but the Chinese people certainly did. Chinese consumers stopped spending and started hoarding their money.

Foreign investors certainly believed Xi Jinping, and they have pulled hundred of billions of dollars (more than a trillion?) out of China. Foreign factory owners certainly believed the threats of Xi. They stopped opening factories, and they have looked for suppliers outside of this belligerent Communist country.

It's all about the loan servicing income.

Because of his threats, Xi Jinping has largely destroyed China's position as the Manufacturer For the World. Layoffs are everywhere in China. Shopping malls are empty, and thousands of industrial plants are closing. When these factories do close, they often leave workers with unpaid wages. This is like "living in a powder keg and giving off sparks."

Many experts now believe that the elders of the Chinese Communist Party have placed Xi Jinping under house arrest. Xi is still the figurehead for China, but he has little power left. This make the invasion of Taiwan far less likely. Hooray!

Here is an interesting twist. Putin is deeply reliant on his relationship with Xi Jinping and China. China buys Putin's oil. It supplies his chips.

The CCP party elders, however, do not consider Russia to be a friend. If President Trump demands that China throw Russia under the bus, the new regime in China just might do it. Look for Russia to accept a peace deal within 45 days.