This practical marketing tip can be used by widget manufacturers, commercial mortgage brokers looking for commercial loans, and commercial brokers trying to sell a commercial property. I've written around 300 blog articles, mostly about the commercial loan business. This article may be my second most important article ever.

This practical marketing tip can be used by widget manufacturers, commercial mortgage brokers looking for commercial loans, and commercial brokers trying to sell a commercial property. I've written around 300 blog articles, mostly about the commercial loan business. This article may be my second most important article ever.

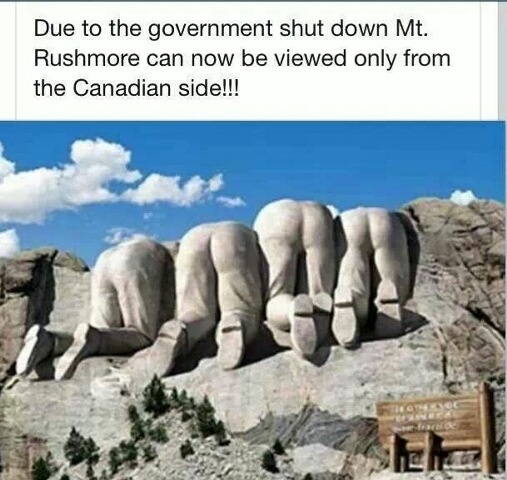

Whenever you market to a select group of recipients again and again, you should share a little bit of your life with them in each of your marketing pieces. I am talking about price sheets (if you are a supplier or a manufacturer), newsletters (if you are a commercial loan broker), rate sheets (if you are a residential mortgage broker), or sales brochures (if you are a commercial broker).

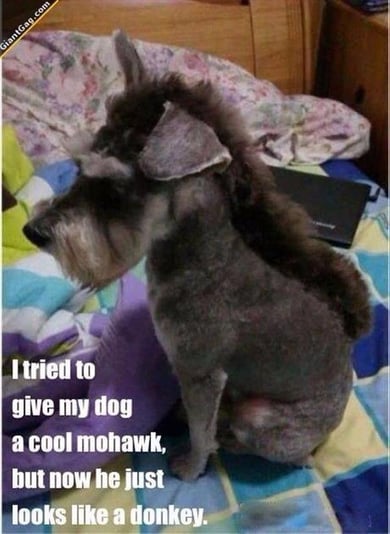

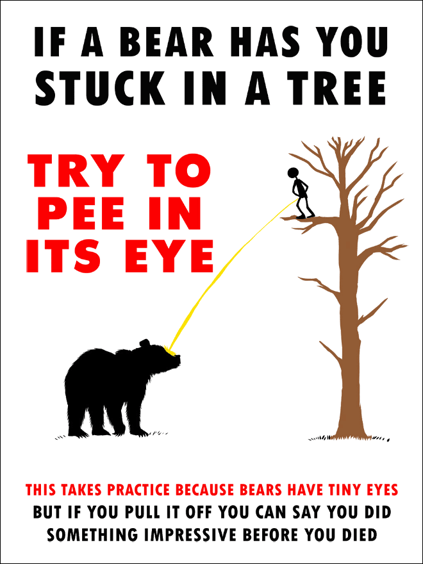

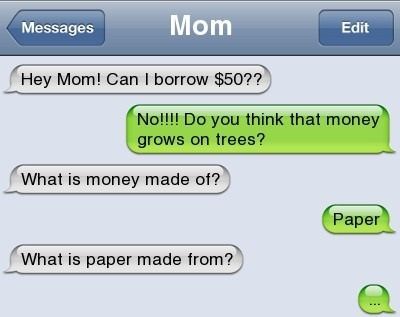

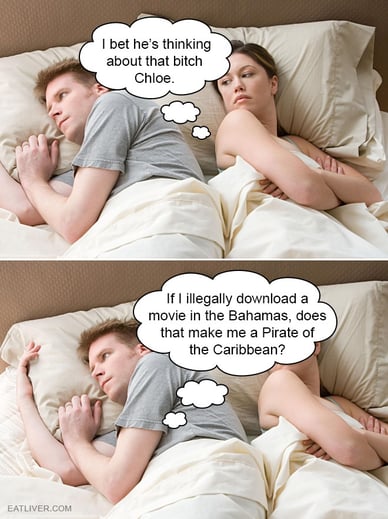

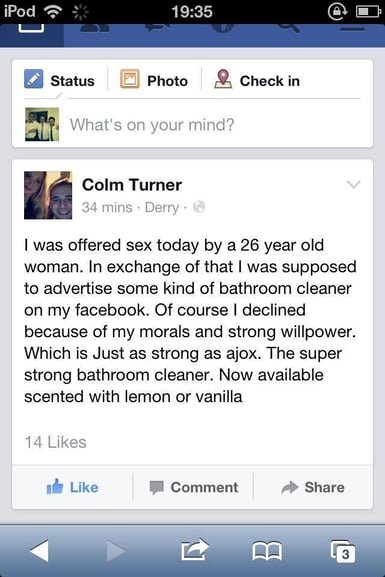

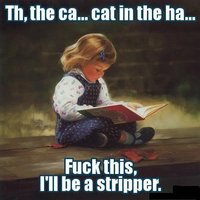

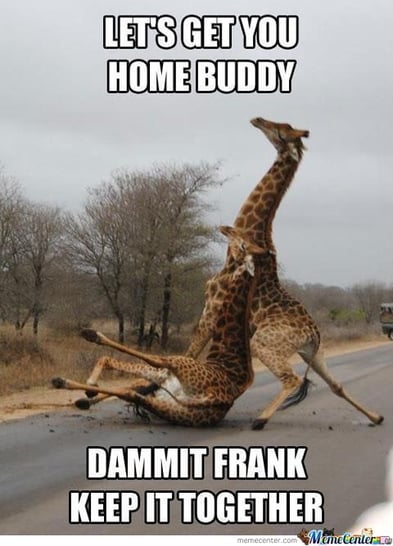

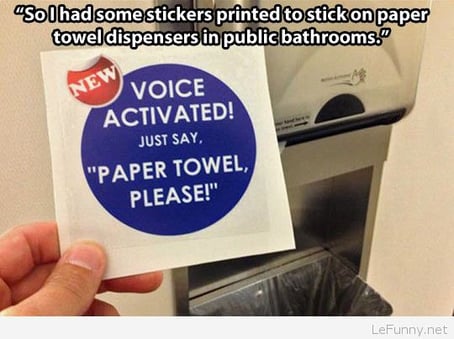

By sharing your life, I mean just a one or two-paragraph story of something funny, entertaining, interesting, or heart-warming that recently happened in your personal life. Here's an example:

-------------------

On a Personal Note...

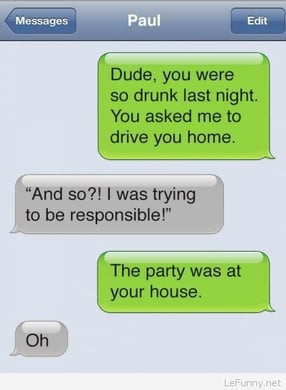

Cisca (my darling bride of 35 years), our granddaughter, and I were on the way to the Indianapolis State Fair last weekend. The turnoff into the parking lot of the Fair was right off a bustling boulevard. Forty cars were stopped in line to make a right-hand turn. We were the second to the last car in line.

Bam! The car behind us smashed into the rear of our car, causing us to be heaved into our seatbelts. Then, out of the corner of my eye, I saw a Jeep flying over the top of our car, like it was in slow motion. This Jeep must have been twelve feet in the air. The trajectory was such that my beautiful wife was about to crushed into mincemeat... Thankfully the Jeep continued its flight and landed on its side, just three feet to the left of my beloved wife.

Have you told your wife, husband, or children recently just how much you love them? Bam - and they could be gone. (This actually happened two years ago. Thank God no one was seriously hurt, including the airborne astronaut.)

Let's suppose that you sell solvents, and every week you send a price sheet by email to your list of 127 local purchasing agents. Three competing companies send a similar price sheet to the same purchasing agents. Your owner would be immensely wise to include a personal paragraph at the top of each price sheet. Suddenly ADR Solvents becomes... Adam Richter, his lovely wife Mary, and cute, little Adam Richter, Jr. (age six), who just got his first hit in a Little League game and who grinned with the greatest of joy when he looked over and saw his father, Big Adam, doing dog-flips in the stands.

What purchasing agent wouldn't be touched by such a story? When the buyer looks at the competing price sheets, and he sees that all four solvent companies are offering about the same prices, which solvent company do you think is going to get the order?

"But George, that is so unprofessional!"

Nonsense. I sell 7% to 12% first mortgage investments for a living to a very distinguished group of accredited investors - doctors, attorneys, CPA's, and the owners of large and successful businesses. We service over $55 million in first mortgage loans and properties for these well-heeled investors.

Nevertheless, I try to share a little bit about my personal life with them in every newsletter. If anyone was going to be put off by my "unprofessional behavior", it would be these wealthy, conservative folks. Let me assure you, the overwhelming majority of my investors seem to really enjoy my little stories. They are why many of them invest with us.

This practice - becoming a pen-pal with your customers - will separate you from the crowd. Those of you who a residential mortgage brokers, you simply MUST start doing this. You sell a fungible product - a conforming loan from Fannie Mae or Freddie Mac - so the only reason why a residential sales broker is going to choose you is because he likes, trusts, and respects you as a person.

By the way, a fungible product is one that is perfectly interchangeable with another. For example, a bushel of corn sold on the Chicago Board of Trade is fungible with any another bushel sold on the Exchange. In plainer words, "There ain't nothing special about it." So back to residential loan agents, they all their loans to the same buyer, Fannie Mae or Freddie Mac. You therefore need to develop a more personal relationship with your residential sales brokers. Don't just send rate sheets. Include a personal paragraph!!!

This leads me to a very important lesson. I call it the Newsletter Effect. If you send a fun, folksy, and personal newsletter every three weeks to the same recipient for nine months, he will swear that he has known you forever. You laugh, but when I used to go to trade shows (I sent a lot of faxes back in the day), mortgage brokers would approach me and tell me that they had been receiving my funny faxes for years. When I would later check my data base, I would find that they had only been on my fax list for nine months.

If you write to someone every three weeks for nine months, he will consider you to be extremely trustworthy. After all, it does takes a certain amount of character to religiously send out a newsletter every three weeks. Or perhaps you are considered extremely trustworthy because you have not been arrested in the "years and years" that he has known you.

If you are a consistent pen-pal, you will discover that your reader considers you a personal friend and the back-up godparent to his kids. And that's a very good thing. We are NOT trying to manipulate people here. We love our friends, and we are darned grateful and humble to to have them. We are just trying to become even richer in friendships.

So today's lesson is to include a personal paragraph or two in every one of your marketing pieces. Those of you who are commercial loan brokers and commercial brokers (experts who sell commercial real estate), you have probably been added to our funny newsletter lists. You may recall that you have been assigned to a particular loan officer at Blackburne & Sons (my commercial hard money shop), and that this loan officer always includes a personal paragraph in his newsletter. My loan officers kick and scream a little when I make them write their little stories, but I have read some very funny and incredibly heart-warming stories from them.

-------------------------

Commercial Loan Brokers Please Continue

IMPORTANT WARNING ABOUT BANKER TRADES:

If you are a regular reader, you know that you can trade one commercial real estate loan officer working at a bank or a credit union for a free copy of my commercial mortgage marketing course, a free copy of my fabulous Income Property Underwriting Manual, a copy of my battle-tested commercial mortgage broker fee agreement, or a copy of a Regional Blackburne List with 750 commercial lenders.

You can also trade ten commercial real estate loan officers for a free copy of my famous 9-hour course, How to Broker Commercial Loans, a free copy of my super-important course, How To Find Your Own Private Mortgage Investors, or my very best course, the Practice of Commercial Mortgage Brokerage, which has over 60 important and practical lessons. Please click here for details.

That's the good news.

The bad news is that so many brokers have taken advantage of this offer that our latest commercial mortgage portal, CommercialMortgage.com is now packed with over 3,000 commercial lenders. We really don't need any more. We have dozens of banks and credit unions for every state (although Alaska is admittedly a little light).

My offer to make any of these trades ends on August 31st. Any list submitted after August 31st will be ignored. Fair warning.

BUT THE FOLLOWING OFFER REMAINS:

If you enter a bona fide commercial loan into C-Loans.com, using the six-step process, and submit that deal to six of our commercial lenders, we'll give you a choice of any TWO of the following prizes:

1. Powerpoint presentation to our Commercial Mortgage Marketing Course.

2. Income Property Underwriting Manual

3. Commercial Loan Broker Fee Agreement

4. Regional Blackburne List of 750 commercial lenders.

When you have submitted your commercial loan to six of our commercial lenders, please contact Tom Blackburne at 574-210-6686 and tell him which two gifts you want. Borrowers and commercial brokers, feel free to take advantage of this offer as well.

Heavens, salaried commercial loan officers working for banks sure can be lazy. This is especially true for salaried guys over the age of 50, and loan officers over 50 constitute over 70% of all bank commercial real estate loan officers.

Heavens, salaried commercial loan officers working for banks sure can be lazy. This is especially true for salaried guys over the age of 50, and loan officers over 50 constitute over 70% of all bank commercial real estate loan officers.

We all know that another great recession is coming eventually, but its anybody's guess as to when it will hit. It could be next year, next decade, or even three decades from now. This week I think I have at least figured out what will be the cause of the next great recession.

We all know that another great recession is coming eventually, but its anybody's guess as to when it will hit. It could be next year, next decade, or even three decades from now. This week I think I have at least figured out what will be the cause of the next great recession.

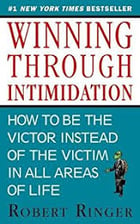

When I grow up, I want to be Robert Ringer. Mr. Ringer was the best-selling author of several business books. I last saw Robert Ringer in Playboy magazine, where he was sitting in a hot tub at a party at the Playboy Mansion with two gorgeous, topless Bunnies. It was lucky that I just happened to notice the picture because normally I only look at Playboy for the articles. Ha-ha!

When I grow up, I want to be Robert Ringer. Mr. Ringer was the best-selling author of several business books. I last saw Robert Ringer in Playboy magazine, where he was sitting in a hot tub at a party at the Playboy Mansion with two gorgeous, topless Bunnies. It was lucky that I just happened to notice the picture because normally I only look at Playboy for the articles. Ha-ha!

Interest rates on commercial permanent loans have increased sharply since the end of the Great Recession in 2009. At one point - about three years ago when the yields on ten-year bonds in Germany and Switzerland went negative - fixed interest rates on commercial loans to prime borrowers reached as low as 3.75%. Today even very good borrowers are likely to pay 5.6% to 6.0% for the same commercial loan from a regional bank. Small town banks are quoting rates as high as 6.25%.

Interest rates on commercial permanent loans have increased sharply since the end of the Great Recession in 2009. At one point - about three years ago when the yields on ten-year bonds in Germany and Switzerland went negative - fixed interest rates on commercial loans to prime borrowers reached as low as 3.75%. Today even very good borrowers are likely to pay 5.6% to 6.0% for the same commercial loan from a regional bank. Small town banks are quoting rates as high as 6.25%.

I often tell the following story to my commercial loan brokerage trainees. Goliath Bank offers a $2 million commercial loan to the borrower at 5.75%, 1 point, 25 years amortized, ten years due, with a rate readjustment at the beginning of year 6. The prepayment penalty is 3% in years one through five. Caution: While the above quote accurately reflects today's market for bank commercial loans, rates are definitely going up.

I often tell the following story to my commercial loan brokerage trainees. Goliath Bank offers a $2 million commercial loan to the borrower at 5.75%, 1 point, 25 years amortized, ten years due, with a rate readjustment at the beginning of year 6. The prepayment penalty is 3% in years one through five. Caution: While the above quote accurately reflects today's market for bank commercial loans, rates are definitely going up.

When a commercial lender underwrites a commercial loan, he will use five financial ratios - (1) the loan-to-value ratio, (2) the debt service coverage ratio, (3) the operating expense ratio, (4) the debt yield ratio, and (5) the debt ratio. We will discuss these five ratios in more detail below.

When a commercial lender underwrites a commercial loan, he will use five financial ratios - (1) the loan-to-value ratio, (2) the debt service coverage ratio, (3) the operating expense ratio, (4) the debt yield ratio, and (5) the debt ratio. We will discuss these five ratios in more detail below.

You're a commercial real estate broker. Your best Idaho client owns a commercial property in Louisiana, and he has a $700,000 balloon payment coming due on it. He wants you - the guy who handles all of his commercial real estate matters - to find a commercial lender willing to make a commercial loan on this Louisiana strip center. Basically he wants you to play mortgage broker.

You're a commercial real estate broker. Your best Idaho client owns a commercial property in Louisiana, and he has a $700,000 balloon payment coming due on it. He wants you - the guy who handles all of his commercial real estate matters - to find a commercial lender willing to make a commercial loan on this Louisiana strip center. Basically he wants you to play mortgage broker.