The USDA Business and Industry Loan Program is quite similar to the SBA 7a Loan Program. When would a borrower apply for a USDA B&I loan, rather than an SBA 7a loan? What's the difference?

The USDA Business and Industry Loan Program is quite similar to the SBA 7a Loan Program. When would a borrower apply for a USDA B&I loan, rather than an SBA 7a loan? What's the difference?

Some of the lowest wage rates and the highest unemployment rates in America can be found in rural areas. USDA Business and Industry Loan program was therefore developed to help foster employment in rural areas, defined as communities of less than 50,000 people. The Federal government is therefore trying to encourage companies to build factories in these underdeveloped small towns and rural areas.

"Okay, but the SBA 7a loan program should work as well as the USDA Business and Industry loan program in rural areas. Why a different program?"

There are, in fact, some material differences. For example, a company does NOT have to be a small business in order to qualify for a USDA B&I loan. The company could have 10,000 employees and still qualify.

Secondly, the property does not have to 51% owner-occupied in order to to qualify for a USDA loan. Suppose a company wanted to move into a large, vacant industrial building; but they only intended to occupy 25% of the space. They would still qualify for a USDA B&I loan.

In fact, investors can even qualify for a USDA B&I loan, even if they intend to lease out 100% of the space to others!

Example:

Charlie Charger, a former football star for the Smalltown Seminoles, has just developed a coating that increases the efficiency of solar panels. Still madly in love with his wife (a former Seminole cheerleader) and the proud father of three children, Charlie wants to develop a chemical plant right in Smalltown. He wants to give good jobs to his friends and neighbors.

Charlie goes to Isaac Investor, the richest man in town, seeking financial help. Isaac declines to provide venture capital, but he agrees to build an industrial plant for Charger Coatings, LLC, and then lease it to the new chemical venture at a less-than-market rate for the first three years. Isaac could qualify for a $10 million USDA Business and Industry loan to build the plant, even though he is just an investor and even though Isaac intends to initially lease 75% of the space to outside tenants.

Non-profit organizations do not qualify for an SBA loan. In contrast, the USDA will guarantee commercial loans to non-profit organizations.

While an SBA 7a commercial loan can be used to refinance existing debt, there must be a 20% reduction in the debt service. In plain English, this means that the new SBA 7a loan has to reduce the borrower's loan payments by 20%. In contrast, USDA Business and Industry Loans can also be used to refinance existing debt, but there is no requirement of a 20% reduction in debt service.

Lastly, the USDA will regularly guarantee commercial loans up to $10 million, as opposed to just $5 million for the SBA 7a loan program. On a case-by-case basis, the USDA will guarantee commercial loans as large as $25 million.

There is something very important to appreciate when seeking either an SBA loan or a USDA loan. Neither the Small Business Administration nor the U.S. Department of Agriculture actually makes commercial loans. Instead, they merely guarantee a portion of the loans. Please note the emphasis on the word, "portion".

This means that there is a portion of these commercial loans that is not guaranteed. Some bank has its tail flapping in the breeze, ready to get shot it off, if the loan goes bad. Therefore some banks may be willing to take the risk, but others will not. This is a HUGE point.

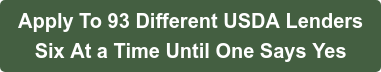

This means that seven SBA lenders could turn your deal down, only to have the eighth SBA lender (or USDA lender) approve your deal. C-Loans.com is therefore perfect for applying for either an SBA or USDA loan. You enter the deal once into C-Loans (about four minutes worth of work), and then you submit it to SBA lender (or USDA lender) after SBA lender until you find a lender willing to do the deal.