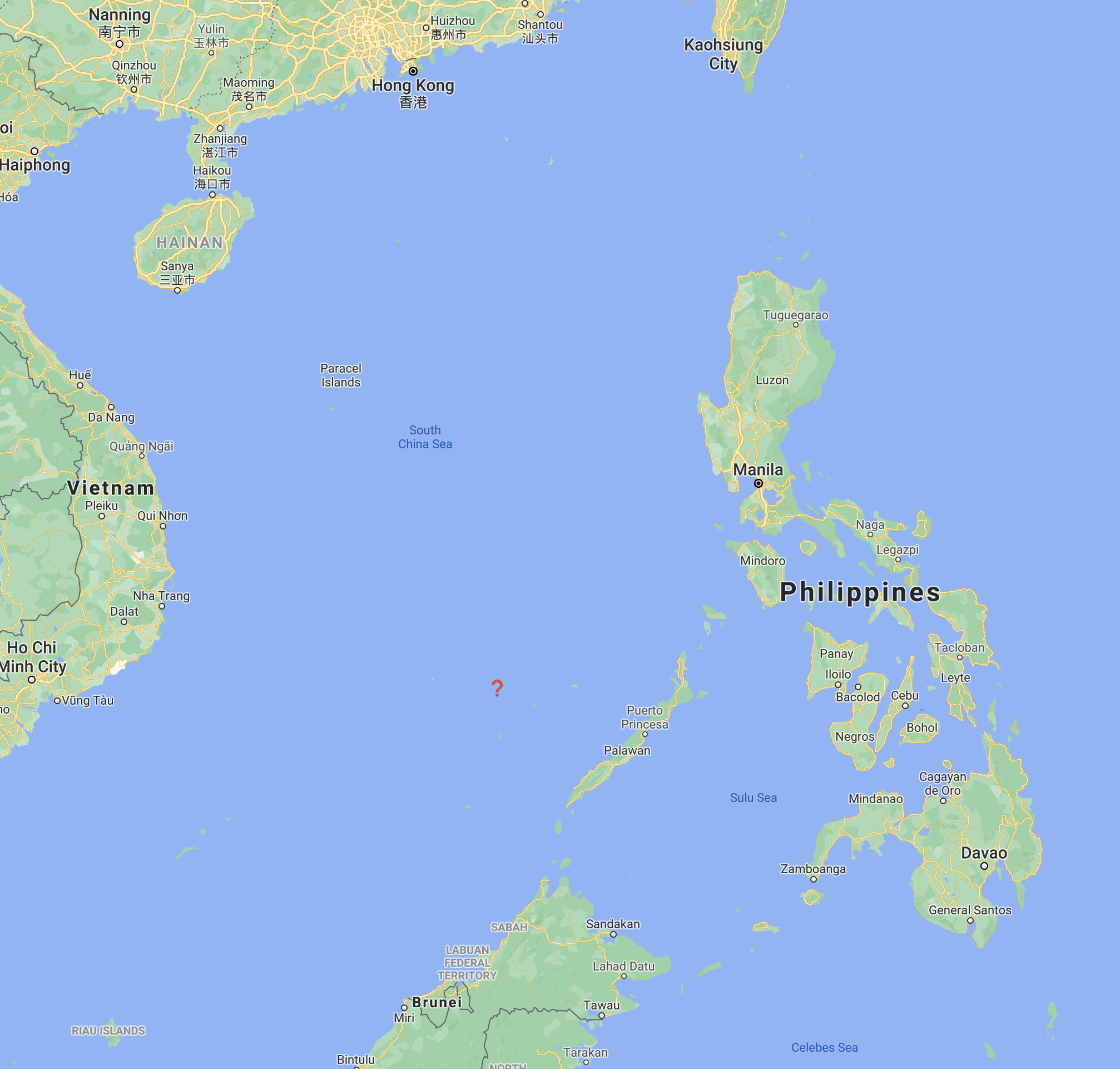

The image above places the disputed Spratly Islands, a location rich in oil and other raw materials.

There is a famous song from the protest days of the 1960's entitled, Eve of Destruction. The chorus goes:

But you tell me over and over and over again my friend

Ah, you don't believe we're on the eve of destruction

The Future Dictator of the World, President Xi of China, continues to poke and challenge the world. His fighters routinely violate Taiwanese airspace, and the size of these incursions (the number the Chinese fighter jets involved) keeps growing.

The latest aerial incursion involved twenty of their most advanced fighter jets. Taiwanese fighter pilots have become so exhausted, and their far inferior air force has become so depleted mechanically, from intercepting them every day for the past six months that Taiwan just gave up this week intercepting them.

The Future World Dictator also sent hordes of "fishing vessels" into the disputed waters off the Spratly Islands in the South China Sea and off the Senkaku Islands in the East China Sea. Then he started filling those "fishing vessels" with Merchant Marine sailors and marines. Now he is sending heavily-armed Merchant Marine ships, many of which are as formidable as a frigate.

In response, the Japanese are rapidly expanding their Navy. The Filipinos are furious too, because they also have a claim to these islands. President Duarte of the Philippines is a wild man. You'll recall that Duarte is the guy who told his Army and Police to just shoot suspected drug dealers. His forces have killed a whopping 7,000 drug dealers in the past six months. Our cop shows go, "Drop your weapons. You have the right to remain silent..." In real life, Filipino cops go, "Bam. Bam-bam-bam." Haha!

President Duarte of the Philippines is just crazy enough to order the Filipino Navy to open fire on these Chinese "fishing boats" off the Spratly Islands.

Ah, you don't believe we're on the eve of destruction

What Really Scares Me:

Everyone is reminded of the old saying, "Power corrupts, and absolute power corrupts absolutely." President Xi of China is the absolute ruler of China for life, much like Hitler was the absolute ruler of Germany. We all know what that absolute power did to Hitler's mind.

By poking India and Japan (along with the weak Philippines and Vietnam) recently, Xi has motivated them to rapidly increase their armed forces. India is starting to produce fifth-generation fighters, under a license from Russia, that can match anything the Chinese can put in the air. Indian air power can be used to help blockade Chinese shipping through the Indian Ocean.

WTFudge are you thinking, President Xi? Why would you want your enemies to re-arm? This next war will be a technological one (advanced missiles, drones, a war to control the satellites in space, etc.) Why would you want to frighten Japan, arguably the best chip manufacturer in the world, into rapidly re-arming?

This irrationality on the part of Xi is causing my "spider senses" to tingle. The guy is already a megalomaniac (obsessed with his own power), and I think mentally he may be headed over the edge. An insane man in charge of the largest Navy, the largest missile force, and the largest Army in the whole world is a very dangerous thing.

I stand by my prediction that we will be at war with China in less than three years. This other crazy guy, Duarte, could easily start that war. Bam. Bam-bam-bam.

Tom Brady has seven rings and Michael Jordan has six.

I know. So mean. Lovely lady.

The outgoing commander of U.S. forces in the Pacific told the Senate Armed Forces Committee last week that China will have the power to take Taiwan by force in less than six years. The incoming commander suggested to the same Senate Committee that the Chinese will have this power in much less than six years.

The Mormons keep an emergency one-year's food supply on hand. If the Chinese start their surprise attack by taking out our GPS and telecommunications satellites, you'll be glad that you kept some emergency food on hand. For example, canned hams last for many years.

I keep telling you, the money in CREF is in loan servicing fees!

Just hire a sub-servicer.

Some Thoughts on the Economy:

There is an old Chinese saying:

First Generation - Peasant

Second Generation - Buys land

Third Generation - Mortgages land

Fourth Generation - Peasant

The cycle starts with a family of peasants working in the fields. In the second generation, a hard-working mom and dad make painful sacrifices and save money. They buy land - say, a family farm. They pay off the property over a lifetime of hard work, which provides the family with an income in their retirement. Their children, raised in comfort, tend not to be as hard-working as their parents. Too often they become spendthrifts (irresponsible with money). To pay their debts, they eventually have to mortgage the land. Unable to pay their mortgage, they eventually lose the land in foreclosure. Their children grow up as poor peasants.

As I look at what's happening with the profligate spending by the Federal government, I worry that we have become that third generation. It started with Trump's big tax cut. That big tax cut plan had a lot of good and necessary features in it that encouraged American companies to move more of their operations back to the United States; but that corporate tax cut was just too large. The Treasury lost too much revenue.

Now Biden and the Democrats, with their $1.9 trillion pandemic relief bill, have ballooned the deficit and the national debt to even more absurd levels. Last month I mentioned that the Federal government will probably get away with creating $1.9 trillion in new money. Much of this new debt will be used to make the payments on our existing debt, thereby absorbing much of it, like a giant sponge; but there has to be an end to this irresponsible belief that deficits no longer matter.

On the other hand, the good credit of the United States is like keeping a credit card free of any outstanding balance. This available credit can be used in an emergency. Certainly the pandemic qualifies as a bona fide crisis. It makes no sense to keep reserves for a rainy day and then fail to use this rainy day fund when it is pouring outside.

Therefore, I don't hate Biden's pandemic relief plan, just its size. I worry.

A parrot sweetly pets a puppy.

We have all heard the old saying, "The harder I work, the luckier I get." This is especially true during tax time in the commercial loan business, from mid-March to late April. Commercial loan demand is almost non-existent.

We have all heard the old saying, "The harder I work, the luckier I get." This is especially true during tax time in the commercial loan business, from mid-March to late April. Commercial loan demand is almost non-existent.

Commercial loan demand in late March and April is typically very, very weak. Commercial real estate investors don't want to mess around with paperwork, especially when they have just finished the painstaking task of preparing their tax returns. In most cases, their complicated tax returns are not even done yet for 2020, so they have little choice but to put off shopping for a commercial loan until their tax returns are done in the mid-part of April.

Commercial loan demand in late March and April is typically very, very weak. Commercial real estate investors don't want to mess around with paperwork, especially when they have just finished the painstaking task of preparing their tax returns. In most cases, their complicated tax returns are not even done yet for 2020, so they have little choice but to put off shopping for a commercial loan until their tax returns are done in the mid-part of April.

There is a difference between a bank and a Federal savings bank. It has to do with their history.

There is a difference between a bank and a Federal savings bank. It has to do with their history.

"May you live in interesting times," is an English expression that is claimed to be a translation of a traditional Chinese curse. While seemingly a blessing, the expression is normally used ironically. Life is better in "uninteresting times" of peace and tranquility than in "interesting" ones, which are usually times of trouble. Wikipedia.

"May you live in interesting times," is an English expression that is claimed to be a translation of a traditional Chinese curse. While seemingly a blessing, the expression is normally used ironically. Life is better in "uninteresting times" of peace and tranquility than in "interesting" ones, which are usually times of trouble. Wikipedia.

Even if you are not in the commercial loan business, you may still want to quickly scan this article. Marketing is marketing, and some concepts are universal.

Even if you are not in the commercial loan business, you may still want to quickly scan this article. Marketing is marketing, and some concepts are universal.

Here are some tips on how to succeed as a commercial loans broker:

Here are some tips on how to succeed as a commercial loans broker:

If you have been reading my articles about the coming war with China, you know that I am super-freaked-out about accuracy of modern missile warfare. The woeful Indians successfully launched a ship-to-ship missile that hit a steaming frigate that was 130 miles away four months ago.

If you have been reading my articles about the coming war with China, you know that I am super-freaked-out about accuracy of modern missile warfare. The woeful Indians successfully launched a ship-to-ship missile that hit a steaming frigate that was 130 miles away four months ago.

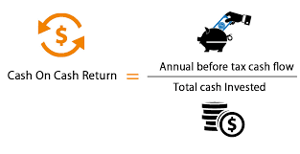

C'mon, guys. This is fifth-grade math today. Don't tune out simply because you see a handful of easy algebraic expressions. Your math teach told you that you would need this stuff some day. Haha!

C'mon, guys. This is fifth-grade math today. Don't tune out simply because you see a handful of easy algebraic expressions. Your math teach told you that you would need this stuff some day. Haha!