My friends at George Smith Partners, the old-time commercial mortgage banking firm that services loans for life companies, recently posted the following tombstone:

My friends at George Smith Partners, the old-time commercial mortgage banking firm that services loans for life companies, recently posted the following tombstone:

"George Smith Partners successfully arranged $7,600,000 in permanent financing for a non-traditional anchored shopping center in Northern California. The Big Lots and Dollar Tree anchors had short terms remaining on their primary leases, (but) they both had exceptional health ratios."

What on earth is a (tenant) health ratio?

The Tenant Health Ratio is computed by taking the cost of occupying a space and dividing it by the tenant's total sales at that location. In other words:

Tenant Health Ratio = Occupancy Cost / Total Sales x 100%

Obviously the higher the ratio, the better the tenant is doing at that particular location. The better the tenant is doing at that particular location, the more likely it is that the tenant is going to negotiate an extension of his current lease.

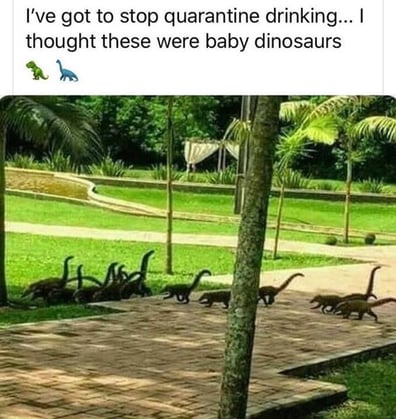

They sure look like baby dinosaurs to me. What are they???

But then I'm drinking right now. Haha!

In the above case, Big Lots and Dollar Tree must have been selling goods like crazy. The health ratio must have been so high that the bank financing this particular shopping center must have felt quite confident that these two tenants would want to renew, when their current short-term leases expired.

What is a high tenant health ratio and what is a low one? I have no idea. If anyone out there knows, kindly write to me at george@blackburne.com, and I will update this blog post.

Craig Cooper traded 20 loan officers for a

Find Your Own Private Investors course this week.

Watch the Price of Gold:

It's always wise to keep an eye on the price of gold. There are a lot of very savvy investors out there, many with a whole network of contacts scattered throughout the world. The price of gold can tell you a lot of things.

First of all, gold will warn you about any disturbing world events. This is particularly important today, with China and the U.S. rushing to build ships and missiles in preparation for the First Taiwanese War.

If you work for a major U.S. missile manufacturer, like Raytheon or General Dynamics, and you discover that gold has just soared $500 per ounce overnight in Asia, you may want to work from home that day. A Chinese submarine, just 1,000 miles off the coast of California, could easily fly a conventional missile right through a particular window of your manufacturing plant. If I were the Chinese, that's how I would open the First Taiwanese War. Take out the U.S. missile manufacturing capability and the brains behind it.

Think 'ole George has gone off the deep end about this coming war with China? My friends and my investors rolled their eyes when I first published my book (available still on Amazon) warning of a deflationary crash in 2007. Deflation? You can't have deflation! That's impossible. Once money is printed, no one is ever going to burn it, right? Uh, huh. Then the Great Recession hit in 2008, and investors leaned what happens when banks stop lending. Trillions of dollars were destroyed.

The price of gold will also warn you when major corporations are going to start defaulting on their debt. Do you know when gold outperforms just about every investment on earth? During hyper-inflation, right? Nope.

Gold performs the best during periods of deflation, when major corporations start defaulting on their bonds. Think about the bonds from Enron, Worldcom, and Lehman Brothers. They're toast. Gold is one of the few assets that is not the debt of another.

Lastly, gold is also a warning about future inflation. I want to make clear that gold is only a so-so investment during periods of inflation. Why? Because gold generates no income. Stocks and real estate are far better investments.

But gold can still be the canary in the coal mine. In the old days, miners would bring canaries into the mines with them. If the poor canary suddenly died, it was a warning to the miners to get the heck out of the mine shaft. The oxygen level in the mine was dangerously low.

Gold is sitting at a lofty level right now - only about 12% off its all-time high. Why so high? Is it because of the coming war with China? I suspect that the coming war is just a small part of today's high gold prices.

Do you what CTL financing is? You would

if you followed our Facebook page.

You can blame today's high gold prices on Andrew Yang. He was the Asian-American presidential candidate who advocated giving every American a basic income of $1,000 per month. From where would the income come? The Treasury would simply issue Treasury bonds, and the Fed would buy them. Presto-chango, there would be no cost. Uh, huh.

This week Congressional negotiators came to an agreement on a $900 billion COVID relief bill. And from where will the money come? The Treasury will simply issue Treasury bonds, and the Fed will buy them. There's no cost! As the hard rock group, Dire Straights, used to sing in 1985, ".. Money for nothin' and your chicks for free."

Gold is not indifferent to inflation... and make no mistake, inflation is definitely coming back. The passage of this COVID Relief Bill may prove to be a paradigm-changing event - the equivalent of Fed Chairman Paul Volker raising the prime rate to 21.5% in 1981. This huge prime rate increase broke the back of inflation, and for the next 40 years we enjoyed disinflation. To you young folks, welcome to 40 years of inflation.