Today we are going to talk about equity, a concept that may be a little confusing to you. Of course you understand the concept of the equity in your house, but there is far more to the concept of equity.

Today we are going to talk about equity, a concept that may be a little confusing to you. Of course you understand the concept of the equity in your house, but there is far more to the concept of equity.

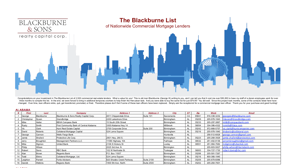

Those of you who have been following Blackburne & Sons Realty Capital Corporation for a long time probably remember when the company used to be called Blackburne & Brown Mortgage Company, Inc. When my sons joined the company, we also changed the second half of the company name to Realty Capital Corporation.

As it pertains to real estate, capital includes debt, equity, and certain hybrids of the two, like mezzanine loans and preferred equity. When we changed the second half of the company name to Realty Capital Corporation, we were sending a signal that we were now providing more than just mortgage loans. We were now also providing equity.

Right now the staff of Blackburne & Sons is mobilizing to raise $2 million in development equity for the developer of a hotel in Oregon. The hotel will cost $15 million, and the construction lender will only go 60% of cost. This means that the developer will have to raise a whopping $6 million in equity - 40% of the total cost. Yikes!

Such is life in the post-Great-Recession era in which we live. Banks got crushed in construction lending during the Great Recession, so they now require developers to put up vast amounts of equity.

Okay, so what is equity? It depends on the context. In everyday life, it means the difference between value of your house and the total amount of the mortgages. "I have $150,000 in equity in my house."

In the context of the capital markets, equities means investments in stocks, as opposed to investments in bonds, gold, or other commodities.

In the context of the development of real estate, equity refers to how much money the developer has contributed to the project. It consists of the actual cost of the land, any legal fees the developer spent in changing the zoning, any property appreciation resulting form that zoning change, any additional value created when the developer successfully assembled several adjoining parcels into a prime building site (called assemblage); any prepaid expenses, like toxic reports, title reports, and surveys; any pre-construction costs, such as clearing the land or demolishing structures; and any cash that the developer is prepared to bring to the construction loan closing.

Equity is often called the developer's skin in the game. It is a measure of how much of the developer's blood will the banker find pooled on the doorstep, if the bank is forced to foreclose.

What about any appreciation in the value of the land? The developer bought the land years ago and since then the land has appreciated by 75%. Nope. Banks will no longer consider that appreciation, unless it has been almost a decade. Bank regulators now forbid it, and banks make 98% of all construction loans. Thank you, Mr. Great Recession.

Here is how we define equity to our own private investors:

"An equity investment is not a loan. There is no promise to pay, there is no interest rate, and there are no monthly payments. Instead, an equity investment is the purchase of a share of the ownership of the business, in this case a very popular hotel franchise called the Fairfield Inn and Suites...

"The reward to the equity investor for the success of this construction venture is a share of the distributed positive cash flow, a share of the principal reduction on the underlying first mortgage, and a share of the net sales proceeds when the property is sold.."

Almost done. In the context of a hotel, what is the difference between rooms and keys? In the days before hotels with suites, it was customary to refer to an 80-room hotel.

But many 80-unit hotels these days have 120 rooms because the suites have a sitting room, where a lady businesswoman might meet a client, and a separate bedroom, where mom and dad might quietly kiss at night, while the kids slept on a fold-out bed in the other room. The unit still only has one entrance, and therefore is has become commonplace to refer to these hotel units as keys.

Development equity historically offers yields to private investors much higher than first mortgage investments. Are you an accredited investor? Please contact Angela Vannucci at 916-338-3232. Blackburne & Sons - Since 1980.

This article is more about economics than than commercial loan training. I hope that you investors will find it interesting.

This article is more about economics than than commercial loan training. I hope that you investors will find it interesting.

Before I get into the subject of placing a commercial loan with a bank, I have two great TV show recommendations.

Before I get into the subject of placing a commercial loan with a bank, I have two great TV show recommendations.

Every two-and-a-half years, I suck it up and write a check for thousands of dollars to my staff to update

Every two-and-a-half years, I suck it up and write a check for thousands of dollars to my staff to update

Any commercial loan broker with more than six-month's worth of experience will tell you, "Daisy chains never close." A

Any commercial loan broker with more than six-month's worth of experience will tell you, "Daisy chains never close." A

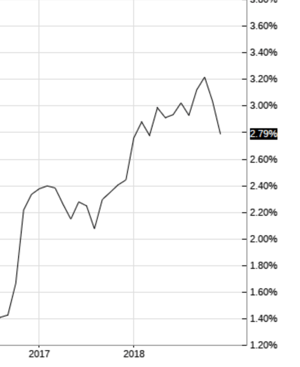

By the end of this training article, you will know what banks are quoting on commercial loans on office buildings, retail buildings, shopping centers, and industrial buildings; i.e., what commercial banks are quoting on permanent loans.

By the end of this training article, you will know what banks are quoting on commercial loans on office buildings, retail buildings, shopping centers, and industrial buildings; i.e., what commercial banks are quoting on permanent loans.

Whenever a commercial mortgage lender offers you or your client an adjustable mortgage loan (AML), it is very important that you compute the implied rate before accepting the loan.

Whenever a commercial mortgage lender offers you or your client an adjustable mortgage loan (AML), it is very important that you compute the implied rate before accepting the loan.

Swap spreads is another popular index in commercial real estate finance.

Swap spreads is another popular index in commercial real estate finance.

I have no lessons about commercial loans today. Instead, let's just have some fun on this relaxing Boxing Day.

I have no lessons about commercial loans today. Instead, let's just have some fun on this relaxing Boxing Day.

So I told you that we have a dog door for our animals to go out, but wild animals can come in using that door. We first realized that we had a problem when we discovered that local raccoons were carefully washing their paws in our water bowl before dining on our dog food. "For these gifts we are about to receive..." Then the HUGE neighborhood tom cat got trapped by our dogs in our house. That darned cat was so big and fierce that he had absolutely no fear of me. I found myself backing up. Buck-buck-buck. Haha!

So I told you that we have a dog door for our animals to go out, but wild animals can come in using that door. We first realized that we had a problem when we discovered that local raccoons were carefully washing their paws in our water bowl before dining on our dog food. "For these gifts we are about to receive..." Then the HUGE neighborhood tom cat got trapped by our dogs in our house. That darned cat was so big and fierce that he had absolutely no fear of me. I found myself backing up. Buck-buck-buck. Haha!

Perhaps you sold a small commercial building, and you carried back a commercial loan; or perhaps you

Perhaps you sold a small commercial building, and you carried back a commercial loan; or perhaps you