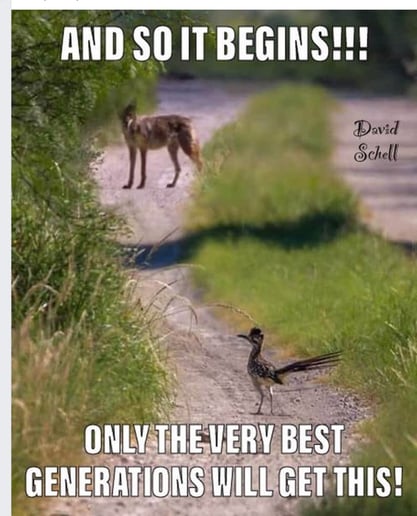

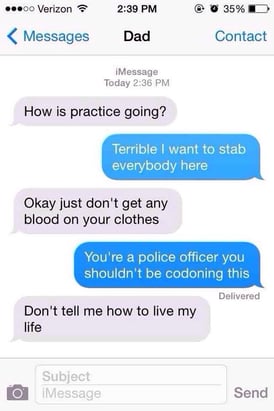

The LAPD, The FBI, and the CIA are all trying to prove that they are the best at apprehending criminals. The President decides to give them a test. He releases a rabbit into a forest and has each of them try to catch it.

The LAPD, The FBI, and the CIA are all trying to prove that they are the best at apprehending criminals. The President decides to give them a test. He releases a rabbit into a forest and has each of them try to catch it.

The CIA goes in. They place animal informants throughout the forest. They question all plant and mineral witnesses. After three months of extensive investigations they conclude that rabbits do not exist.

Then the FBI goes in. After two weeks with no leads they burn the forest, killing everything in it, including the rabbit, and they make no apologies. The rabbit had it coming.

Then the LAPD goes in. They come out two hours later with a badly beaten raccoon. The raccoon is yelling: "Okay! Okay! I'm a rabbit! I'm a rabbit!"

Are you an accredited investor? Interested in earning 26.2%? My wife's cousin, Alex, specializes in hotel construction, and over the past 23 years I have watched him, as a hotel general contractor, build 60 hotels, most of them flagged. On a personal level, Alex is a true gentleman, with a lovely wife and fine children. If you ever met him, you would admire his gentlemanly ways.

Alex is now building for his own portfolio his second flagged hotel, a Marriott Fairfield Inn located on I-5 in Oregon. The equity investors in his first hotel earned well in excess of 25%. I begged him to allow me to help raise equity for him.

Folks, I am an attorney. I am an Eagle Scout (like both of my sons). I have faithfully managed $50 million of my investor's money for 39 years. I am telling you, this is the most promising investment I have ever seen. This equity investment opportunity is sold out on paper, but there is always some shrinkage as we approach the closing. Some of the backups will almost certainly get in on the deal. I urge you to call Angela Vannucci at 916-338-3232 and get on the list of backups.

A few moments ago a guy named Alan made one of the best deals of his life. He traded me a list of 20 bankers making commercial real estate loans. In return, I am sending him our 9-hour video training course, How to Broker Commercial Loans.

This course is absolutely fantastic! We teach our students an entire profession in one, long exhausting day; and those of our students who are natural salespeople will earn incomes rivaling those of a physician.

We sell it elsewhere on C-Loans.com for $549 - not the $250,000 in tuition that some liberal arts colleges charge. Haha! The course teaches you everything from marketing for commercial loans, underwriting commercial loans, packaging the commercial loan, finding the right commercial lender, and lastly, fee collection.

But let's suppose you are a starving commercial mortgage broker. You would love-love-love to own this course, but you don't have $549. I will give you this 9-hour commercial mortgage brokerage training course course for free, if you will compile a list for me of twenty bankers making commercial loans. These are DVD's, so you will have to pay $30 or so for the shipping.

I will please need the name of the loan officer, the bank, the address, the phone number, and his email address. And guys, these commercial real estate loan officers must work at either a FDIC-insured bank or a NCUSIF-insured credit union. I will not accept commercial real estate loan officers working for any other type of commercial lender. I just want bankers.

You will probably want to call the twenty closest banks to your office and ask for a commercial real estate loan officer. Sometimes getting the banker's email address can be tricky. They don't like giving it out. I like to ask, "If I wanted to send you a commercial loan package, to what email address would I send it?"

Please send your list to me by email, george@blackburne.com. Please insert in the subject line, "Trade for 20 Bankers." Don't forget your own own address and phone number. Obviously this is George Blackburne III (the old man). Guys, I get 1,300 emails every single day, so it will be very easy for me to miss your email. Right after emailing me your list of bankers making commercial loans, please send me a text to 574-360-2486, "George, I just sent you a list of 20 bankers."

Guys, I Please Need Your Help

I have a problem. Between C-Loans.com and CommercialMortgage.com, I am generating a half-dozen large ($1 million+) bridge loan requests every single day, and I don't have enough Big-Boy bridge lenders to work them.

Now I have given you free, searchable access to almost 4,000 commercial lenders (mostly banks) on CommercialMortgage.com. Would you kindly please-please-please return the favor by sharing with me some bridge loan lenders that can comfortably handle commercial loans of over $1 million. I am really looking for the proven guys who do deals of $1 million to $10 million or $2 million to $20 million.

Please write to me at george@blackburne.com. So I don't miss it, would you please make the Subject Line, "Bridge Lender(s) For You."

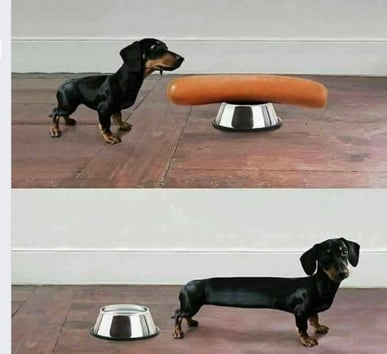

A lady was picking through the frozen turkeys at the grocery store, but couldn't find one big enough for her family. She asked a butcher, "Do these turkeys get any bigger?" The butcher replied, "No, ma'am, they're dead."

Where to Find Bankers

It's easy to find 20 bona fide bankers to trade to C-Loans, Inc. for our wonderful, 9-hour video training course, How to Broker Commercial Loans.

Before I explain how, there is an even more important reason why you want to build your own list of bankers. The single best way to market for commercial loans is to advertise to commercial bankers.

Why? The first place a potential commercial mortgage borrower calls is his own banker, so the typical commercial real estate loan officer, working for a bank, gets two or three such calls per day. He turns down 80% of these commercial loan requests. There is no reason why he can't refer them to you.

Okay, so how do you find these these bankers? I recommend that you start with those banks that are located close to your office. These banks are very easy to find. Simply go to Google Maps and type in the address of your office. Then click the "Nearby" icon and type in, "Banks." Every bank within 50 miles of your office will pop up.

Then call the bank and ask to speak with a commercial real estate loan officer. The typical bank has a single commercial real estate loan officer covering five or six branches, so he will likely work out of a different branch. Then work with the loan officer or receptionist to obtain his phone number (try to get both work and mobile), address, and email address.

The email address is critical, and sometimes bankers are a little freaky-deaky about giving it out. They are worried about being spammed. The best way to ask for a banker's email address is to ask, "If I wanted to send you a commercial loan summary, to which email address should I send it?"

A white-haired old man walked into a jewelry store on a Friday, with a beautiful young lady at his side. "I'm looking for a special ring for my girlfriend," he said. Our jeweler looked through our stock and took out an outstanding ring priced at $5,000. "I don't think you understand. I want something very unique," the man said. At that, our now very excited jeweler went and fetched our special stock from the safe. "Here's one stunning ring at $40,000."

The girls eyes sparkled, and the man said that he would take it. How are you paying?" asked our jeweler. “I'll pay by check; but of course the bank will want to make sure that everything is in order, so I'll write a check and you can phone the bank tomorrow, and then I'll fetch the ring on Monday," replied the old man.

Monday morning, our very disappointed jeweler phoned the man. "You lied, there's no money in that account." "I know - sorry - but can you imagine what a FANTASTIC weekend I had?!"

Twenty years ago, if you wanted a commercial loan, you might have applied to a savings and loan association, a thrift and loan association, or even a credit company. None of these company types are making many commercial loans today; so I am not even going to bother to describe them. They have gone the way of the buffalo.

Twenty years ago, if you wanted a commercial loan, you might have applied to a savings and loan association, a thrift and loan association, or even a credit company. None of these company types are making many commercial loans today; so I am not even going to bother to describe them. They have gone the way of the buffalo.

Imagine the following fanciful scenario. Beto O’Rourke wins the Democratic nomination, and the presidential campaign for President in 2020 is hard fought and bitter. O’Rourke loses in a close race, and then Trump sets out to ruin O’Rourke’s most important supporters and donors.

Imagine the following fanciful scenario. Beto O’Rourke wins the Democratic nomination, and the presidential campaign for President in 2020 is hard fought and bitter. O’Rourke loses in a close race, and then Trump sets out to ruin O’Rourke’s most important supporters and donors.

Before the Great Recession, there were about 300 hard money mortgage companies making commercial loans across the country. By the end of the Great Recession, fewer than 20 of them survived.

Before the Great Recession, there were about 300 hard money mortgage companies making commercial loans across the country. By the end of the Great Recession, fewer than 20 of them survived.

Before we get into the subject of syndicated commercial construction loans and where to get your large commercial construction project funded, we have an important announcement.

Before we get into the subject of syndicated commercial construction loans and where to get your large commercial construction project funded, we have an important announcement.

If a commercial loan broker needs leads, his single best source - by far - is bankers. The first place that a commercial loan applicant calls is his own bank. As a result, the typical commercial real estate loan officer working for a bank receives calls for at least ten commercial loans every week.

If a commercial loan broker needs leads, his single best source - by far - is bankers. The first place that a commercial loan applicant calls is his own bank. As a result, the typical commercial real estate loan officer working for a bank receives calls for at least ten commercial loans every week.

You may recall from an earlier blog article that I am putting together a $2,000,000 syndicate of equity investors to help a developer build a brand new Marriott Fairfield Inn in Roseburg, Oregon. Our investors are projected to earn a 25.4% annual simple interest return. Are you an accredited investor?

You may recall from an earlier blog article that I am putting together a $2,000,000 syndicate of equity investors to help a developer build a brand new Marriott Fairfield Inn in Roseburg, Oregon. Our investors are projected to earn a 25.4% annual simple interest return. Are you an accredited investor?

This month I am syndicating a fantastic deal. Please do not interpret my enthusiasm as any sort of guaranty of success or safety; however, let's face it. Some investment deals are better than others.

This month I am syndicating a fantastic deal. Please do not interpret my enthusiasm as any sort of guaranty of success or safety; however, let's face it. Some investment deals are better than others.

The Commercial Loans Blog now has over 300 training articles on the subject of commercial real estate finance ("CREF"). I have covered so much material in my blog that I often have trouble thinking of new topics to write about regarding the commercial loan business. If my goal was to write down everything that I had learned in my 40 years in the commercial loan business before I died, well, I've largely succeeded.

The Commercial Loans Blog now has over 300 training articles on the subject of commercial real estate finance ("CREF"). I have covered so much material in my blog that I often have trouble thinking of new topics to write about regarding the commercial loan business. If my goal was to write down everything that I had learned in my 40 years in the commercial loan business before I died, well, I've largely succeeded.

Are you building a small apartment building, office building, or flagged hotel? Is the bank demanding that you contribute an insane amount of equity to your deal? We may be able to help.

Are you building a small apartment building, office building, or flagged hotel? Is the bank demanding that you contribute an insane amount of equity to your deal? We may be able to help.