Once upon a time Bill Badluck borrowed $2 million from a non-prime commercial lender on his office building. His lender was not a commercial bank, a credit union, or even a regular conduit making CMBS loans. Instead his lender was one of these new commercial lenders making non-prime commercial loans, the same kind of sub-prime commercial loans that Bayview Financial used to securitize before the Great Recession.

Once upon a time Bill Badluck borrowed $2 million from a non-prime commercial lender on his office building. His lender was not a commercial bank, a credit union, or even a regular conduit making CMBS loans. Instead his lender was one of these new commercial lenders making non-prime commercial loans, the same kind of sub-prime commercial loans that Bayview Financial used to securitize before the Great Recession.

A non-prime commercial loan is a commercial loan offering a long term, a fixed rate higher than a bank but lower than a traditional hard money lender, and an enormous prepayment penalty. These loan requests are less than perfect, perhaps because the property is in a secondary location or because the borrower's credit score is not high enough. Perhaps the tenants in the building are financially weak, like a tanning salon or a nail salon, or perhaps many of the existing leases all mature in the next year or two. If the tenants don't renew their leases, the property could soon be 70% vacant. There is something about the loan that is less than prime.

What's the difference between a non-prime commercial loan and a sub-prime commercial loan? There is really very little difference. Wall Street developed the new name because of the bad press associated with the word, "sub-prime", during the Great Recession. The only real substantive difference is that non-prime commercial loans are fully-documented. The non-prime lender asks for all of the same documents as a bank - financial statements, tax returns, leases, etc.

Okay, now back to Bill Badluck and his bad luck. Unfortunately Bill loses a number of his office tenants, and because he's not bringing in much money from the property, he falls behind in his payments. The non-prime lender starts to foreclose.

Suddenly the U.S. Cavalry arrives and rescues Bill from the... Native American warriors justifiably defending their own homeland from the evil incursions of the European-Americans. The nearby church school wants to expand, and it has offered Bill $600,000 for his excess parking. Bill doesn't even use that extra parking area. He has far more parking spaces than what is legally required by the city.

Bill calls the loan servicing department of his non-prime commercial lender and tells them, "Listen, you guys are about to foreclose on my building and take a huge haircut (loss on a loan or investment). Just allow me to release the extra 1.3 acres, and we can apply that to my loan. With my loan paid down to just $1.4 million, I will easily be able to make your payments."

The condescending little bureacrat in the loan servicing department says, "I'm sorry, sir. That's a business decision. We're not allowed to make business decisions." "Are you crazy?" asks an exasperated Bill. "If you continue to foreclose on this building, I am going to stop making repairs. The tenants will all move out, and once the building is empty, it will be stripped of copper within a week. You guys will inherit an empty shell, and you'll lose $1 million." Surprisingly the little bureaucrat replies, "I believe you, Mr. Badluck. Every time we foreclose on a property, we lose our shirts. I know this sounds ludicrous, but releasing that extra acreage from our mortgage is a business decision, and we are not allowed to make business decisons."

What the fudge? Aghhhh!

Indira Investor is pretty wealthy. Her deceased husband was a renown surgeon, and they invested well. She owns a shopping center on the premier commercial strip in town, and this shopping center has a vacant pad right on this busy thoroughfare. McDonalds has come to her and offered to lease the pad for 30 years at a terrific rate. Indira simply has to build a new restaurant building to company's plans and specifications.

The new building will cost $900,000. Fortunately, that is not a problem because she has the extra cash just sitting around. Unfortunately her attorney has spotted a covenant (fancy word for promise) in the her $5.2 million conduit mortgage documents that forbids her from making any changes to the property. Huh?

Indira calls the loan servicing department for the conduit and explains her situation. The pad is unused, and Indira will be paying for the new building herself. Once completed, McDonald's will be paying an extra $21,000 per month. This will benefit the conduit's security position immensely. Intead of the shopping center being worth $7.3 million, it will now be worth $9 million!

"I'm sorry," says the sympathetic agent in the conduit's loan servicing department. "I understand that granting you permission to build will only improve the conduit's position, but we cannot grant you that permission. Granting you permission to build is a business decision, and we are not allowed to make business decisions."

What the fudge?

Okay, here is what is going on. If your company - probably an LLC - made a ton of money last year, and you didn't suck it all out in salary and bonuses to yourself, your LLC will have to pay income taxes. Corporations, limited liability companies, and irrevocable trusts are all responsible for paying income taxes, just like a natural person.

When a portfolio of commercial real estate loans are securitized, they are put into an irrevocable trust. Bonds, backed by these first mortgages, are then issued by the trust and sold to investors - typically pension plan and insurance company investors looking for a fixed rate yield.

When the loan payments come in to the irrevocable trust, the trust first has to pay income taxes of around 50% to the government. Therefore if the mortgages in the trust were earning 5%, half of those earnings would have to go to the Federal government in taxes. Therefore the trust would only have 2.5% interest to distribute to the bond investors. Then the bond investors have to pay 50% of that interest in their own income taxes, so they would only net ...

What? Huh?

I'm pulling your leg to make a point. In order to excuse the irrevocable trust from having to pay income taxes on its mortgage interest - thereby creating double taxation - Congress created the passthrough trust. As long as the irrevocable trust just passes through all of its net income to the bond investors, it will NOT be subject to income taxes.

But there is a catch. In order for the irrevocable trust to maintain its status as a passthrough trust, the trust must not behave like a for-profit entity. It must NOT make any business decisions, even if by failing to make a business decision the trust loses millions of dollars. If it makes a business decision, the trust loses its tax-free status! All a passthrough trust can do is follow exactly the instructions contained in its Trust Agreement. Passthrough servicing trusts are often forced to make the most absurd of decisions. They have zero flexibility.

Non-prime commercial lenders can offer lower interest rates because these commercial loans are all securitizied and rated.

But remember, if you accept a loan from a conduit or a non-prime commercial lender, you are putting yourself in a straightjacket. You cannot divide your property and sell off a piece. You cannot legally improve your property. You cannot place a second mortgage on the property to get at the equity that has accumulated. You cannot refinance the property for five years because of the lock-out clause (absolute prohibition against prepayment). After five years you still cannot refinance the loan because the prepayment penalty is enormous (almost beyond belief).

You will also find it hard to sell the property. The buyer cannot use a second mortgage or a mezzanine loan. He must put down cash-to-loan. If there are only two years left on the non-prime loan, any buyer will not only have put down an enormous downpayment, but he must avoid getting freaked out by the fact that he will have a huge balloon payment due in just two years. Good luck finding such a buyer.

At first blush, non-prime commercial loans and conduit loans sound great because of their low interest rates. In truth, however, they are horrible loans that you will soon regret. You will be held in a straightjacket for an entire decade. Commercial loans from banks and private money lenders - like Blackburne & Sons - are far better because they have no prepayment penalty.

Keep looking for banks making commercial loans. You can swap the contents of just one banker business card for a directory of two thousand commercial lenders.

Get a free $199 commercial mortgage underwriting manual, just for taking two minutes to register (filling out your name, address, etc.) on C-Loans. We want you in a sprint start to enter your next commercial loan.

This is the best time in history to become a commercial mortgage broker because over $100 billion in commercial loans are ballooning this year.

Have you ever wondered what the difference was between preferred equity and a mezzanine loan?

If you have learned a few things today, and you want to continue to learn more about commercial real estate finance (CREF), subscribe to this blog. It's free.

My old friend, Leonard Rosen, is hosting another one of his enjoyable Pitbull Private Lending Conferences on June 2nd at the The M Resort in Las Vegas. I have been to a number of these conferences, and I always get a lot out of them.

My old friend, Leonard Rosen, is hosting another one of his enjoyable Pitbull Private Lending Conferences on June 2nd at the The M Resort in Las Vegas. I have been to a number of these conferences, and I always get a lot out of them.

C-Loans has just introduced a new program where we will give bankers, hungry to make more SBA loans,

C-Loans has just introduced a new program where we will give bankers, hungry to make more SBA loans,

Repricing

Repricing

Location is far-far more important to commercial real estate lenders than home loan lenders.

Location is far-far more important to commercial real estate lenders than home loan lenders.

During the real estate crash of 2008, there were a ton of broken condo's in Florida. Developers would start new residential condo projects in 2007, and by mid-2008, the residential real estate market had completely collapsed. The developer would build a 100-unit condo project, but he would only sell 35 of them. The rest of them, usually several years later, would eventually be rented out as apartments. Voila! You have a

During the real estate crash of 2008, there were a ton of broken condo's in Florida. Developers would start new residential condo projects in 2007, and by mid-2008, the residential real estate market had completely collapsed. The developer would build a 100-unit condo project, but he would only sell 35 of them. The rest of them, usually several years later, would eventually be rented out as apartments. Voila! You have a

Every year commercial mortgage loan demand plunges by 75% in April. Our office phones stop ringing, and the place feels like a morgue. This happens every year, without fail.

Every year commercial mortgage loan demand plunges by 75% in April. Our office phones stop ringing, and the place feels like a morgue. This happens every year, without fail.

There are 5,309 commercial banks in the United States. There are over 35 conduits. There are 7,165 credit unions. There are 830 life insurance companies. Most of these institutions make commercial real estate loans.

There are 5,309 commercial banks in the United States. There are over 35 conduits. There are 7,165 credit unions. There are 830 life insurance companies. Most of these institutions make commercial real estate loans.

Once upon a time Bill Badluck borrowed $2 million from a non-prime commercial lender on his office building. His lender was not a commercial bank, a credit union, or even a regular conduit making CMBS loans. Instead his lender was one of these new commercial lenders making non-prime commercial loans, the same kind of sub-prime commercial loans that Bayview Financial used to securitize before the Great Recession.

Once upon a time Bill Badluck borrowed $2 million from a non-prime commercial lender on his office building. His lender was not a commercial bank, a credit union, or even a regular conduit making CMBS loans. Instead his lender was one of these new commercial lenders making non-prime commercial loans, the same kind of sub-prime commercial loans that Bayview Financial used to securitize before the Great Recession.

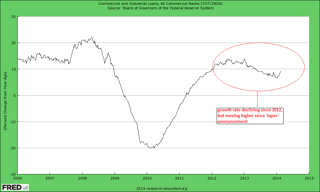

There are two different ways to analyze commercial loan production - the

There are two different ways to analyze commercial loan production - the