In my last two blog articles, I have been pounding on the theme that a commercial loan broker must not waste his valuable time working on goofy loans. Instead, he must spend his precious time building and expanding his list of 4,000+ referral sources.

In my last two blog articles, I have been pounding on the theme that a commercial loan broker must not waste his valuable time working on goofy loans. Instead, he must spend his precious time building and expanding his list of 4,000+ referral sources.

What makes a commercial loan goofy? It depends on the type of loan.

Bridge Loans:

A bridge loan is goofy if it is large, and the borrower's net worth is small. Remember, in all of commercial real estate finance ("CREF"), the Net-Worth-to-Loan-Size Ratio says that the net worth of the borrower must be equal to, or larger, than the loan amount requested. In other words -

Net Worth of the Borrower / the Loan Amount > 1.0

Example:

Charlie the Commercial Loan Broker gets a commercial loan request for a $10 million bridge loan to buy and renovate an old commercial building in a pretty good downtown location. Right now the building is leased out to Goodwill Industries at a very low rental rate, and the lease is expiring.

Bill Borrower wants to buy the building, renovate it, and re-lease it at a much higher market rate. Conceptually the idea is good, but Bill Borrower only has a $1.5 million net worth. Should Charlie the Commercial Loan Broker spend a lot of time trying to place the deal?

Probably not. It is true that most bridge loans are made by hard money lenders, and hard money lenders are not locked into a rigid 1.0 Net-Worth-to-Loan-Size Ratio.

However, $10 million is still a lot of dough, and it is impossible to imagine any hard money bridge lender loaning $10 million to a borrower with a net worth of only $1.5 million. What if there are horrible cost overruns, such as a lumber shortage or a lack of skilled workers (rebuilding after the fires in California)? Out of which deep pocket will the borrower be able to come up with an extra $2 million? Do you see the problem?

Charlie the Commercial Loan Broker should therefore tell his borrower to go find some high-net-worth partners before he invests any time in the deal. Even though Bill Borrower's project is well-conceived, until he finds borrowing partners with a combined net worth of, say, $7 million, his $10 million bridge loan request is goofy.

And yes, you can combine the net worth of the borrowers / personal guarantors to satisfy the net-worth-to-loan-size ratio requirement!

In other word, we can add the $2 million net worth of Dennis Dentist to the $3 million net worth of Darlene Doctor to the $3.5 million net worth of Charles CPA to satisfy the $10 million required by the lender.

Land Loans:

Most land loans today are made by hard money lenders, and as I mentioned above, hard money lenders are not locked into a strict 1.0 net-worth-to-loan-size ratio. Nevertheless, the ratio better be at least 0.70. In other words, the combined net worth of the borrowers / personal guarantors should be at least 70% of the land loan amount.

Example:

Lucky Lefty inherited some desert land from his father. The good news is that the land, while producing no income, is in the path of growth of an expanding nearby city; but it will be 15 years before the land is ripe for development. Arguably the land is worth $15 million today.

Lucky Lefty owns a $150,000 tract house, and he makes $70,000 per year working as a scheduler for Amazon. Now he wants to borrow $7.5 million for an unspecified investment.

Is this a goofy land loan request? You betcha. How on EARTH is Lucky Lefty going to make the monthly payments? And what about an exit strategy? An exit strategy is how the borrower will pay off the loan at maturity. Without a rock solid exit strategy, the idea of building in an interest reserve is goofy.

Construction Loans:

The total cost of a project is the sum of the land costs, the hard costs (brick and mortar), the soft costs (interest reserves, report costs, insurance costs, government fees, etc.), and the contingency reserve (5% of hard and soft costs).

Modernly - after the Great Recession - construction lenders (almost always a bank) require that the borrower contribute 30% of the total cost of a construction cost. Now it's true that an aggressive bank will loan 80% of the total project cost to an experienced, filthy rich developer, but this borrower is coming to YOU, a mortgage broker for help getting construction financing. He is almost never the ideal construction loan borrower.

Therefore, in real life, you, as a commercial loan broker, should almost never work on a commercial construction loan.

Invariably, if a developer comes to a commercial loan broker for a commercial construction loan, that developer CANNOT raise the required 30% of the total cost of the project.

For you, the commercial loan broker, commercial construction loans are goofy loans. You should not waste even one minute working on such deals.

Example:

Johnny Lightbulb owns a reasonably successful wire manufacturing business. He has been in business for ten years, and until now he has been leasing his space. He finds a good piece of land and comes to you for a commercial construction loan.

Lightbulb Wiring is making decent money, but Johnny Lightbulb doesn't want to spend too much of his company's precious working capital to build the new building. He certainly doesn't want to invest 30% of the total cost of his new building.

Can you help him?

Yes! Lightbulb Wiring is a perfect candidate for a construction loan / SBA loan combo, where the construction loan is taken out with a SBA 7a permanent loan, which features a 25-year term.

Many banks will make a construction loan of up to 90% of cost, if they get the privilege of making the SBA loan. SBA loans are very profitable for banks.

You should take your owner-user construction loans to a bank because you need a bank to make the construction portion of the deal. Remember, almost all construction loans are made by banks.

Conclusion:

The smart commercial loan broker does not waste his time working on goofy loans. He does not waste his time trying to force a round peg into a square hole. Instead he invests his precious time building his network of 4,000 referral sources.

I got an email today from one of my former students, and he was starving as a commercial loan broker. In order to help him, I sent him a little questionnaire about his struggles as a commercial loan broker. My initial thought was that if I could pinpoint at which step he was struggling, then I could help him. Then I realized, why I don't I help a whole bunch of commercial loan brokers? So here we go.

I got an email today from one of my former students, and he was starving as a commercial loan broker. In order to help him, I sent him a little questionnaire about his struggles as a commercial loan broker. My initial thought was that if I could pinpoint at which step he was struggling, then I could help him. Then I realized, why I don't I help a whole bunch of commercial loan brokers? So here we go.

You really should pay close attention to what I am teaching you here. This is the meat-and-potatoes of commercial real estate finance ("CREF").

You really should pay close attention to what I am teaching you here. This is the meat-and-potatoes of commercial real estate finance ("CREF").

Does the SBA have a minimum credit score? What if I was forced to declare bankruptcy during the Great Recession? Is it still possible for me to get an SBA loan?

Does the SBA have a minimum credit score? What if I was forced to declare bankruptcy during the Great Recession? Is it still possible for me to get an SBA loan?

"China is already challenging the US for technological and geopolitical primacy and flaunting its authoritarian capitalism as an alternative to democracy. Communism couldn’t pose a credible challenge to liberal democracy, but authoritarian capitalism might. In that sense, China’s model represents the first major challenge to liberal democracy since the rise of Nazism.” — Brahma Chellaney,

"China is already challenging the US for technological and geopolitical primacy and flaunting its authoritarian capitalism as an alternative to democracy. Communism couldn’t pose a credible challenge to liberal democracy, but authoritarian capitalism might. In that sense, China’s model represents the first major challenge to liberal democracy since the rise of Nazism.” — Brahma Chellaney,

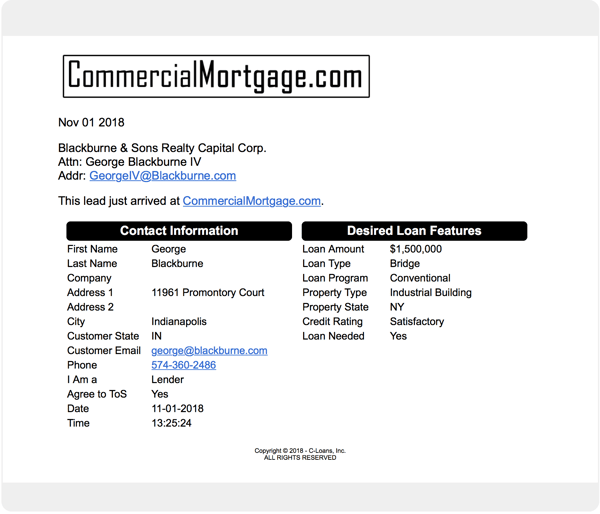

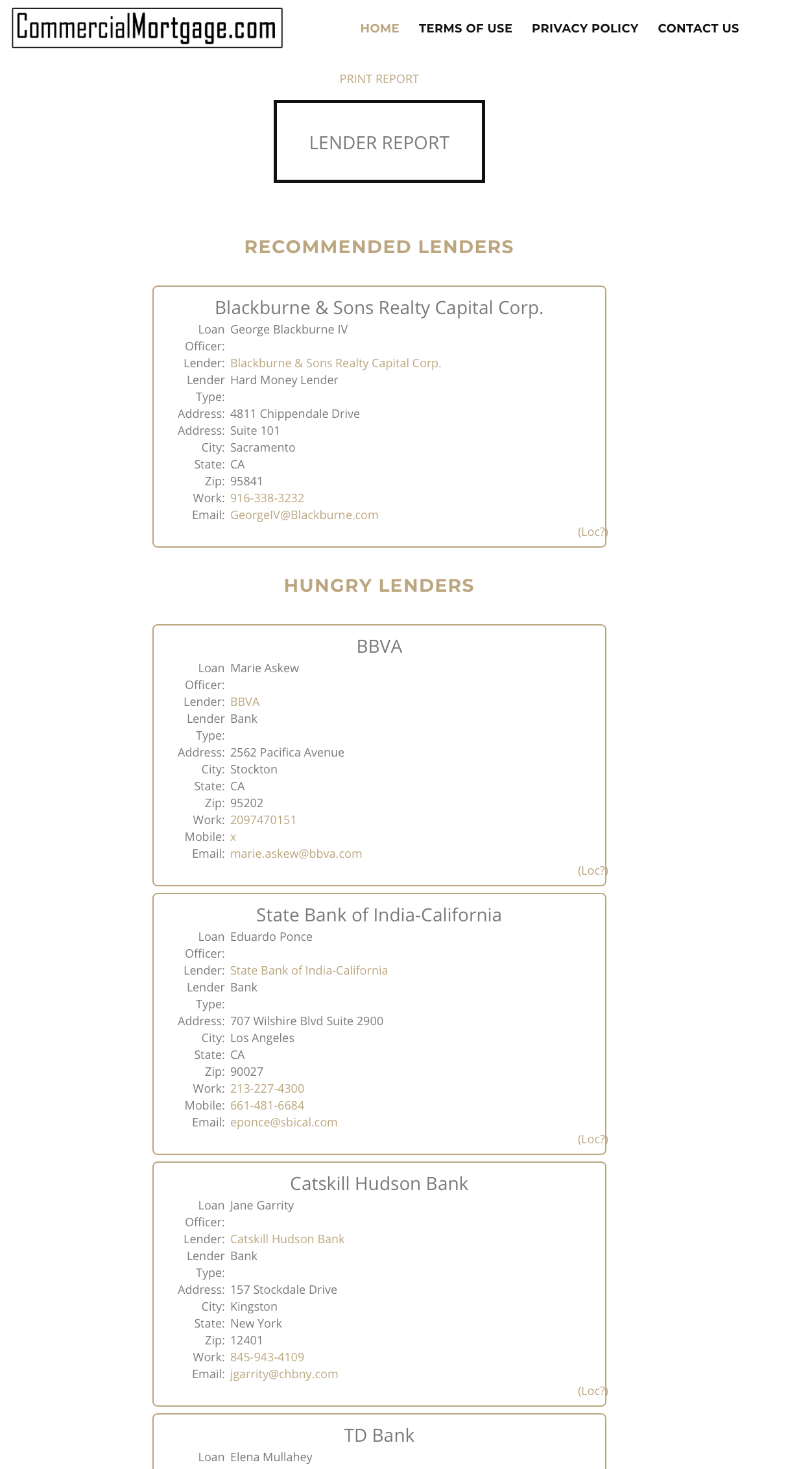

We just completed an extensive upgrade to CommercialMortgage.com ("CMDC") that now allows us to immediately deliver commercial loan leads directly to commercial lenders and commercial mortgage companies by email. The cost to receive these leads is only $1,000 per year.

We just completed an extensive upgrade to CommercialMortgage.com ("CMDC") that now allows us to immediately deliver commercial loan leads directly to commercial lenders and commercial mortgage companies by email. The cost to receive these leads is only $1,000 per year.

As a result, there are very few competing bridge lenders listed on the portal. This lack of competition for bridge loans should be very good news for bridge lenders who are considering an investment of -

As a result, there are very few competing bridge lenders listed on the portal. This lack of competition for bridge loans should be very good news for bridge lenders who are considering an investment of -