Before we get into today's commercial loan training lesson, I have an interesting story for you. Yesterday a newbie commercial loan broker contacted me, and he said, "I desperately need your fee agreement for a deal that is close to closing, but I don't have a banker to trade."

I told him, "Just call your local bank and ask to speak with a commercial real estate loan officer. Every bank has one. Collect his address, phone, and email address, and voila, you're done!" Twenty minutes later, he sent me my commercial loan officer and lived happily ever after.

You can trade a commercial real estate loan officer, working at a bank or a credit union (no other types of commercial lenders please), for your choice of (1) an Income Property Underwriting Manual; (2) a Commercial Mortgage Marketing Course; (3) a Fee Agreement; or (4) a regional copy of The Blackburne List of 750 commercial lenders.

Even if you are not a commercial loan broker, this particular training article has some lessons that you might find very helpful, especially the part about marketing leverage further below.

Before we go any further, it is important to understand that it is illegal to pay a referral fee on a residential one-to-four family dwelling loan, where the purpose of the loan is to either buy the property or to build it. What about residential refinances or business-purpose residential loans? I dunno. Anybody else out there know?

Such referral fees on residential loans are called kickbacks, and the Feds will go absolutely bat-snot crazy if you violate RESPA. They do not want people steering unsophisticated and trusting residential borrowers to higher-cost lenders.

Referral fees on commercial loans, however, are perfectly legal. You do NOT have to be licensed.

If you are not licensed, however, be absolutely sure that you do not try to negotiate loan terms. For example, you cannot say, "The bank will probably charge you 2.75% to 3.5% over five-year Treasuries." Even though this is true, don't say it! It might be considered negotiating terms. Just work on a name and number referral basis, and you will be fine.

The standard referral fee for commercial loan leads is 20% of the lender's loan fee. This is what Blackburne & Sons pays.

Get tons of commercial loans for less than the cost of two cups of coffee.

Marketing Leverage:

I have a business buddy who is spending a fortune advertising his mezzanine loans and preferred equity investments using Google AdWords. Whenever I use Google to look up “supermodels in swimsuits” (haha, just kidding?), my buddy’s advertisement pops up.

First of all, kudos to Google for knowing that I am in the commercial real estate business. Kudos also to Google for showing my buddy’s very relevant advertisement. Pop quiz, Google: "Where do I (old man Blackburne) stand on gun control?” I am sure that Big Brother knows.

But holy cramps, this kind of advertising is incredibly expensive. My buddy was moaning recently about the cost. He needs to start using marketing leverage.

Marketing leverage is the technique of advertising to people who themselves are advertising like crazy. By doing so, your advertising dollar is multiplied or leveraged. These guys who are advertising themselves have lots of leads to refer out.

Example:

Back in the days of snail mail - now called lumpy mail - it cost me over $1 (nowadays $2) to send each lumpy mail piece. I quickly learned that adverting directly to the public for commercial loans was horribly ineffective. But what ended up working like a charm was advertising to mortgage brokers, bankers, commercial brokers (real estate brokers who sell commercial property), and property managers (with whom I had a prior working relationship).

Each of these guys was spending at least $400 per month (today maybe $700) advertising for his own business. I could reach each one for only $1 per month, and if they got a subprime commercial loan request, they would bring it to me. Therefore my $1 was able to reach $400 worth of borrowers. I enjoyed marketing leverage.

Today we can reach referrals sources by email, which is almost cost-free. As you know, advertising to referral sources is still my preferred method, even though TONS of guys are now doing it.

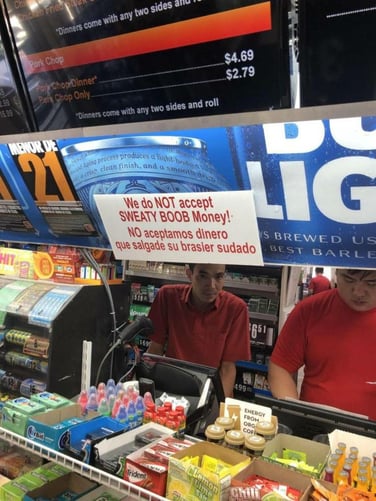

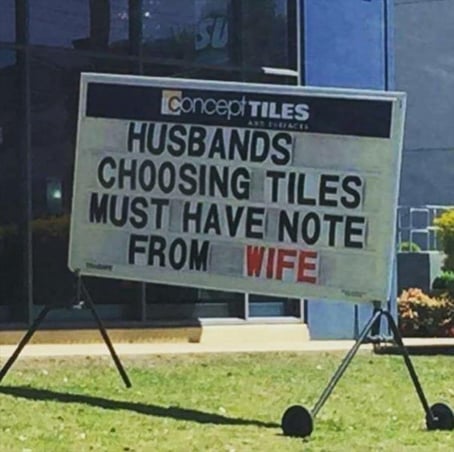

I try to separate myself from the other guys by rewarding my loyal readers with funny pics, jokes, and helpful practice tips. You guys just know, whenever you get a blog article or an email from me, that there will be some kind of reward for opening it.

But if I was my buddy, and I wanted to use expensive Google AdWords, I would build a list of referral sources and submit the list to Google. Did you know that you can do that? You can give Google or Facebook a list, and they will regularly throw up your advertisement to them. In addition to referral sources like mortgage brokers, bankers, commercial real estate brokers and property managers, I would also throw in as many high-net-worth commercial property investors as I knew. This list of actual investors would probably be much smaller.

Then I would only pay for AdWord ads to these special guys, not the general public. Most of them are advertising themselves for commercial real estate clients, and I would achieve marketing leverage.