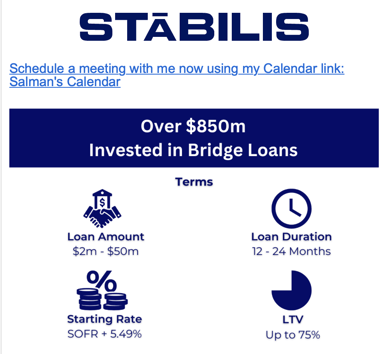

I saw an advertisement on LinkedIn this week where a lender was tying his interest rate to SOFR. Look in the lower left-hand quadrant of the Stabilis ad below. Do you see where it says, "Starting Rate SOFR + 5.49%?"

What on Earth is SOFR?

SOFR stands for the Secured Overnight Financing Rate. It may sound like a complex financial term, but it is actually a significant development in the world of interest rates. In simple terms, SOFR is a benchmark rate that is used to determine the cost of borrowing cash overnight, collateralized by Treasury securities.

Unlike the traditional benchmark rate, LIBOR (the London Interbank Offered Rate), which relies on the expert judgment of panel banks, SOFR is based on data from actual transactions in the marketplace. This shift from subjective judgment to objective data is aimed at increasing transparency and reducing the risk of manipulation.

SOFR is replacing LIBOR because LIBOR broke down about ten years ago. During the global financial crisis in 2008, European banks became so worried about their own and each other's solvency that they refused to lend to each other, even on an overnight basis.

What Went Wrong With LIBOR?

The London Interbank Offered Rate, or LIBOR, had been the go-to benchmark rate for commercial real estate lenders for decades. However, the global financial crisis in 2008 led to a breakdown in trust and a severe lack of liquidity in the interbank lending market.

This lack of lending activity caused a significant problem for LIBOR, which is calculated based on the borrowing rates submitted by a panel of banks. With banks being hesitant to lend, the data used to determine LIBOR became unreliable and subjective.

The crisis revealed that LIBOR was vulnerable to manipulation and lacked transparency. The rates submitted by the panel banks were based on their own judgment and could be influenced by various factors, including their own financial health or even market pressures.

In response to the crisis, regulators and financial institutions recognized the need for a more robust and objective benchmark rate. This led to the development of the Secured Overnight Financing Rate (SOFR), which is based on actual transactions in the marketplace.

Unlike LIBOR, which relied on the subjective judgment of panel banks, SOFR is calculated using data from observable transactions in the repo market. These transactions involve borrowing cash overnight and using Treasury securities as collateral. By using real transaction data, SOFR provides a more accurate reflection of the cost of borrowing cash overnight.

Note: The data doesn't come primarily from interbank lending, so if the banks freeze up and interbank lending dries up, the regulators can still compute SOFR.

When To Use Blackburne & Sons:

Blackburne & Sons Realty Capital Corporation is a 44-year-old commercial hard money lender based out of Sacramento, California. Unlike other hard money shops, which only make bridge loans, we make 15-year loans with a 30-year amortization. There is no prepayment penalty, so our loans are perfect for your bridge loan needs; But... your client will never have a balloon come due during a bad recession.

Our specialty is making small hard money loans on junky little commercial properties in the Boonies.

We will also finance politically-incorrect properties, such as cannabis properties and gentlemen's clubs. We once financed the World's Largest Female Mudwrestling Palace in Los Angeles. The loan paid like clockwork. This month we are working on a drag show bar.

The next great regression is well past due. Maybe a bitcoin blowoff? Look around. All of those hard money mortgage funds with whom you work? Over 90% of them will be out of business within months of the next crash because they charge their investors only 1% for loan servicing. It will take a management fee or servicing fee of 3% to 4% for them to survive.

The S&L Crisis wiped out 90% (100%?) of all hard money funds. A new generation of funds arose, but the Dot-Com Meltdown wiped out 90% (100%?) of them. Another generation of hard money funds arose, but the Great Recession wiped out 90% (100%?) of them.

In contrast, Blackburne & Sons instantly puts together a new syndicate of private investors to fund each deal, so we are not reliant on the health of some fund. Blackburne & Sons is the only hard money shop that can boast that it was in the market every day of all three great recessions.

You need to develop a relationship with Alicia Gandy, our Loan Goddess, or with George IV, my oldest son. Success in commercial mortgage brokerage is all about relationships.

Get one short lesson or joke every day.

Ancient Egyptian texts talk about the Sea Peoples. “They came from the sea in their war ships, and none could stand against them.

Ancient Egyptian texts talk about the Sea Peoples. “They came from the sea in their war ships, and none could stand against them.

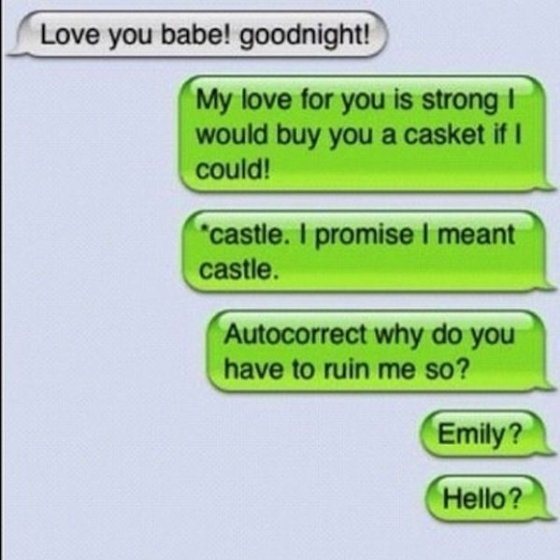

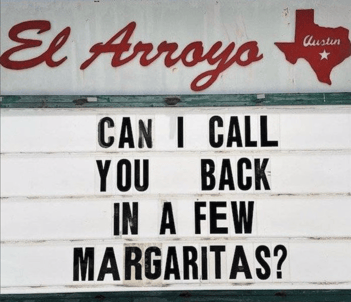

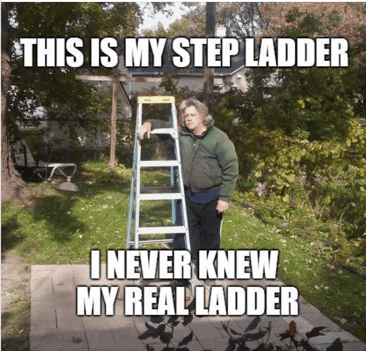

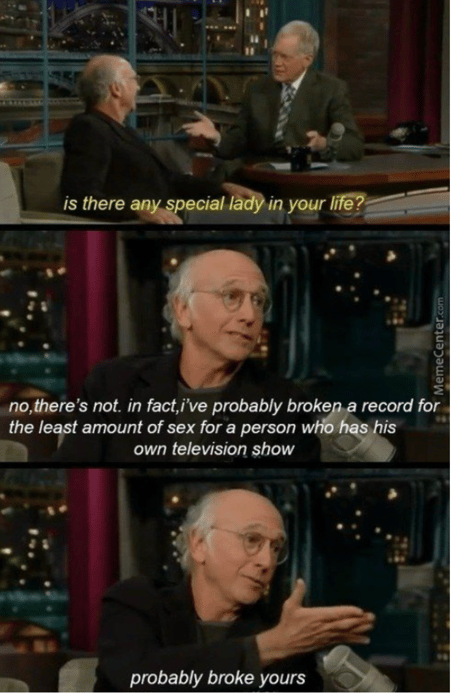

Joke Du Jour:

Joke Du Jour:

I've got some superb commercial loan training for you today, but first a slightly racy joke.

I've got some superb commercial loan training for you today, but first a slightly racy joke.

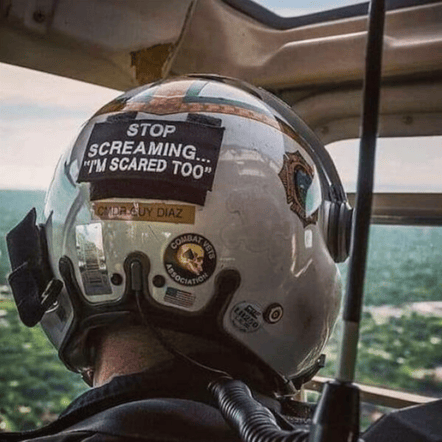

Joke Du Jour:

Joke Du Jour: