Lets suppose you're working on a commercial loan, and the lender has used a term with which you are unfamiliar or confused. You can now ask me a question about commercial real estate finance, and I'll try to answer it that same night in a blog article.

Lets suppose you're working on a commercial loan, and the lender has used a term with which you are unfamiliar or confused. You can now ask me a question about commercial real estate finance, and I'll try to answer it that same night in a blog article.

Here are some examples of questions you might ask:

- What is a flagged hotel?

- What does CMBS mean? Who are these lenders? What kind of commercial loans do they make?

- What is this new CREF term, "Debt Yield Ratio?" Is it the same as the Debt Service Coverage Ratio?

- Why is the net worth of the borrower so important to a commercial lender?

- What is the highest loan-to-value ratio that I can get on a commercial real estate loan?

Let's suppose you're just surfing the web, and you don't need a commercial loan at this exact moment.

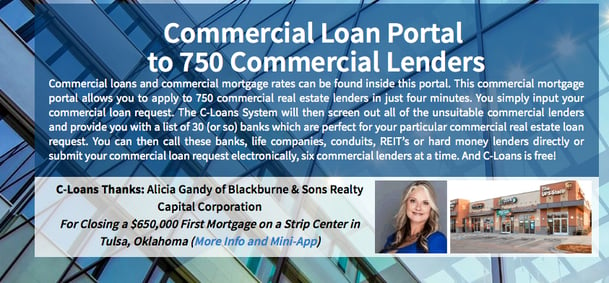

Every time you enter a different commercial loan into C-Loans.com, you will see a different set of lenders. Let's suppose you once asked C-Loans.com for a $7 million construction loan on a dog kennel in Nome, Alaska, and you were disappointed with the small selection of potential commercial lenders. Just remember, every commercial loan request will produce a different list of suggested commercial lenders. The truth is that very few commercial lenders today are looking for huge loans on dog kennels in Alaska.

Do you need even more potential commercial lenders for your deal? Be sure to try out our newest commercial mortgage portal, CommercialMortgage.com.

Do you have a real estate web page? How would you like to earn huge referral fees in your sleep?

We here at C-Loans, Inc. are always interested in meeting new commercial lenders. If you meet a banker who is making commercial loans, we'll trade you the contents of one business card for a free directory of 2,000 commercial real estate lenders.

Are you ready to finally learn commercial real estate finance. In one weekend (on video) I can teach you the entire practice of commercial mortgage finance. There are a number of graduates of my 9-hour video training course who are now making more than their buddies who graduated from top colleges.

Do you need a commercial lender who will actually make a commercial loan of 75% loan-to-value, and not just boast of it? Do you need a lender who will also look at the borrower's global income - income from salaries, other investments, etc.? Do you need a lender who will allow the seller to carry back a second mortgage? Does your client have a balloon payment coming due on his commercial property? Has your bank offered him a discounted pay-off? Does your borrower have less-than-stellar credit? Is your client's company losing money? Is your borrower a foreign national? Do you need a non-recourse loan? Do you need a commercial loan with no prepayment penalty? Is your client's commercial property partially vacant? Do all of your commercial leases run out in the next 18 months? Do you need a lender who will allow a negative cash flow?

Are you already a practicing commercial loan broker? How many large commercial loan fees have you lost because your current fee agreement stinks?

To understand our new feature, you need to understand tombstones. A

To understand our new feature, you need to understand tombstones. A

TILA and RESPA are Federal laws designed to give borrowers advance disclosure of the costs of the loans for which they are applying. Under the new Dodd-Frank regulations, t

TILA and RESPA are Federal laws designed to give borrowers advance disclosure of the costs of the loans for which they are applying. Under the new Dodd-Frank regulations, t

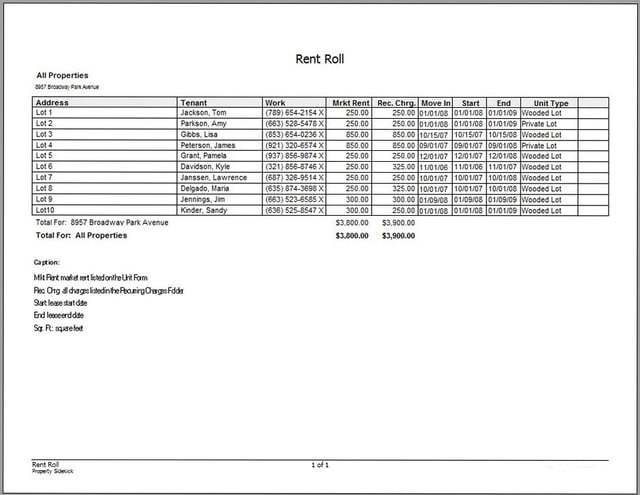

This is going to be a very short training article because the Chinese were right. A picture is worth a thousand words. Today a mortgage broker submitted the attached picture on his

This is going to be a very short training article because the Chinese were right. A picture is worth a thousand words. Today a mortgage broker submitted the attached picture on his

Interest rates on commercial real estate loans are definitely going up. A reasonable commercial mortgage borrower might want to apply now, rather than wait, especially if he has a balloon payment coming due.

Interest rates on commercial real estate loans are definitely going up. A reasonable commercial mortgage borrower might want to apply now, rather than wait, especially if he has a balloon payment coming due.

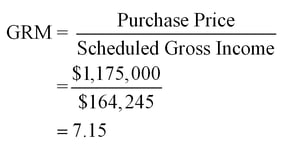

Many investors, when valuing similar apartment buildings in a similar area, use the Gross Rent Multiplier. The

Many investors, when valuing similar apartment buildings in a similar area, use the Gross Rent Multiplier. The

For those of you just getting started in commercial mortgage brokerage, this is a particularly important training article; however, even those of you who are very experienced in brokering commercial loans may find some useful nuggets.

For those of you just getting started in commercial mortgage brokerage, this is a particularly important training article; however, even those of you who are very experienced in brokering commercial loans may find some useful nuggets.

This is the second most important training article about commercial real estate finance ("CREF") that I have ever written. My most important CREF training blog article can be

This is the second most important training article about commercial real estate finance ("CREF") that I have ever written. My most important CREF training blog article can be