Last week a novice commercial loan broker came to me and gave me the complete contact information for twenty commercial real estate loan officers working for banks and credit unions across the country. Each one of these bankers worked for a different bank, and he included no other lender types, like hard money lenders, conduits, ABS lenders, etc.

Here is how he found these bankers.

In trade, I gave him a copy of my famous nine-hour video training course (online now), How to Broker Commercial Loans. I say, "famous", because a decent percentage of all practicing commercial loan brokers have taken my course.

This guy who made the trade will learn how to market for commercial loans, how to underwrite them (five of the nine hours), how to package them, how to find lenders, and how to collect his fee. It also includes my famous fee agreement.

Once you have taken this nine-hour training in commercial real estate finance, your confidence will soar. You will have learned over sixty new terms of art specific to commercial real estate finance.

No longer will commercial brokers (commercial real estate brokers) and commercial lenders intimidate you with their sophisticated language and fancy terms, like cap rates, loan constants, and the debt yield ratio (different from the debt service coverage ratio). In plain English, you will finally know what the heck they are talking about. You will absolutely know this business inside and out, especially if you use my regular blog training articles as a source of continuous updates to this course.

Here is how to get this very valuable training in commercial real estate finance in a trade.

No-Cost Commercial Loan Software

For Newbies and Old Veterans

Every business day about a dozen commercial mortgage brokers come to C-Loans.com and enter a commercial loan into the system. At the very end, they click one button and create for themselves a beautiful PDF of their latest commercial loan package. The PDF includes no reference to C-Loans, and our logo appears nowhere. They then send this PDF to dozens of their own lenders. The entire process takes just four minutes.

Below I will explain how to use C-Loans.com to quickly produce a commercial loan package that you can use to submit your commercial loan to fifty of your own lenders. When you submit your handsomely-prepared commercial loan package to your own lenders, neither your nor your borrower will not owe a fee to C-Loans, Inc.

Of course, if a C-Loans lender sees your deal, makes you an offer, and you or your client accepts it, C-Loans will earn its minuscule software licensing fee. It's only fair. This software took us over 20 years and cost us over $2 million to develop.

When you use our software to create a PDF, here is what your commercial loan package will look like:

Sample Commercial Loan Package

The PDF is small enough to be easily sent by email to your favorite fifty commercial lenders.

Where do you go to get access to this wonderful software? And how much does it cost? You will find this software on C-Loans.com, and the cost is... get ready... it's expensive... ready? It's totally free.

"But, George, I have been to C-Loans.com before, and I don't remember ever seeing it."

When you visited C-Loans.com, you probably got distracted by the enticing blue call-to-action ("CTA") buttons on our home page offering a free commercial loan placement kit or a free list of 200 commercial lenders. (The buttons below are not live.)

Because you probably got distracted by these CTA buttons, you may have never actually entered a commercial loan into the six-step C-Loans System.

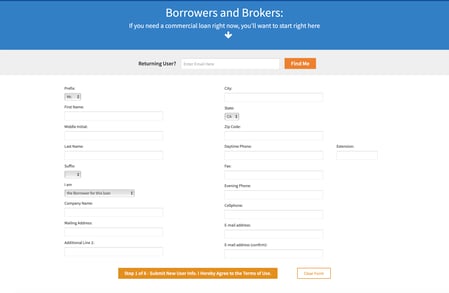

Below is the first step, Step 1 of 6, that you'll find on the home page of C-Loans.com:

:

Had you done so, you could have placed a checkmark next to six lenders and pressed, "Submit". Within minutes, hungry commercial lenders would have been contacting you with offers.

After submitting your commercial loan to six banks, you are given a chance to make your C-Loans app into a PDF:

Voila! It's that simple. Now you have a PDF of your commercial loan package that showcases the property. There was no cost, and perhaps a C-Loans lender will make you an offer that you cannot refuse.