Even though I have been in the commercial mortgage business for 35 years now, I still learn new commercial real estate finance (CREF) terms every month. Here are some CREF terms that I've learned recently:

Even though I have been in the commercial mortgage business for 35 years now, I still learn new commercial real estate finance (CREF) terms every month. Here are some CREF terms that I've learned recently:

Dequity - Typically the maximum loan-to-value for commercial mortgage loans is 75% (80% LTV for multifamily). Typically the maximum loan-to-cost ratio for commercial construction loans is 80%. If the sponsor / borrower / developer needs more capital than that, he has to raise equity. Equity is typically very expensive - in the range of 12% to 24% annually. Dequity is slightly cheaper equity that is structured as debt. I'll explain this in more detail below.

Equity is the the cash downpayment, prepaid costs (for example, architectural and engineering fees), cash contribution, and/or the equity in the land that the sponsor contributes to satisfy the lender that there is enough of a cushion in the deal to protect the lender from loss. The equity investor is the first guy to lose money if the deal goes South. The equity owner is therefore known as the first-loss piece.

Carried Interest or Promote: In the hedge fund* world, the sponsor is the guy who raises the dough and manages the fund. He typically earns a management fee of 1% to 2% annually, plus a piece (often around 20%) of the investors' profit. This piece of the the profit is known as the carried interest or promote.

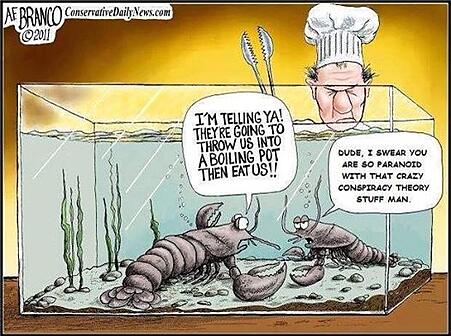

*Hedge Fund - A hedge fund is an investment fund that is exempt from many of the legal requirements and heavy costs of registration with the SEC because ALL of the investors are accredited investors (filthy rich guys). I put an asterik (*) in front of the word, "hedge fund", because the experienced commercial mortgage broker will be very leery about working with any commercial mortgage company that calls itself a hedge fund. A big percentage of the time, they will either be rookie-blowhards or flat-out advance fee scammers. Guys claiming to be merchant bankers are equally suspect. Ignore my warnings at your own peril.

Above I described dequity as equity that is structured as debt. Let me give you an example. Suppose a developer wants to build a speculative or "spec" office building. A construction project is considered speculative or spec if there is no pre-leasing.

The total cost of the project is $10 milllion, and construction lender - almost always a bank - will only go 80% loan-to-cost. The bank will make an $8 million construction loan.

The developer therefore will have to contribute $2 million in equity. He paid $400,000 cash for the land, but he got it rezoned from agricultural to office use (an amazing feat of politics). Everyone agrees that with this zoning change - a real value-added accomplishment - the land is now worth $850,000. The developer paid $50,000 to the structural engineer and $100,000 to the architect (prepaid expenses), so he has $1 million in total equity in the project ($850,000 + $50,000 + $100,000).

But he needs another $1 million in equity, so he approaches a broker-dealer that specializes in raising equity dollars for developers. The broker-dealer agrees to raise the $1 million for him, but the broker-dealer warns the developer that the money will be very costly - around 22% annually.

For legal reasons (less reporting requirements), the broker-dealer structures the deal as a mezzanine loan. You will recall that a mezzanine loan is similar to a second mortgage, except that the security for the loan is not a mortgage on the property, but rather a security interest (think of a security interest like a lien or mortgage on personal property - aka - chattel mortgage) on the membership interests of the LLC that owns the property.

Phew! Lost? Don't give up. A mezzanine loan is simply like a loan against the stock of a corporation that owns a property. If you own the 100% of the stock of the corporation, then you own the building.

Why go through the agony of all these fancy terms and exotic instruments? Because it can take 18 months to foreclose a mortgage on a property in many states. On the other hand, the finance company can repossess your car in a week, if you miss a payment. Why? Because the car is personal property, not real estate. Miss a payment - bam! You pull into a McDonald's. When you come back six minutes later with your burger, your car is gone-girl.

This is why the Big Boys making loans at the top of the capital stack make mezzanine loans. Late on a payment? Bam! Gone, girl.

Remember, we are melting your brain with all of these fancy terms, just to define dequity. Now normally mezzanine loans on standing properties (much less risky deals) only cost around 8% to 10% interest. Here the broker-dealer is charging us on the order of 22% interest. Now the coupon rate (note rate) might only be 8%, but the lender is also charging an 8 point exit fee, plus a profit participation (share of the profits) of 20%. Put them all together, and the lender earns his required 22% internal rate of return (IRR). Ouch.

By the way, an exit fee is merely a "prepayment penalty" that is owed, whether the loan is paid off early, exactly on time, or late. There is no escaping it.

Okay, okay, don't melt. We're finally there. You cursed child. I'm melting.

Dequity is equity money that is structured as incredibly-expensive debt.

If you enjoyed this article, I really do appreciate the re-Tweets, Facebook shares, and LinkedIn and Google+ atta-boys.

Hey, guys, please don't forget that C-Loans also offers business loans - unsecured loans, equipment loans, inventory loans, accounts receivable financing, factoring, leasing, and asset-backed lines of credit.

Our private money commercial mortgage company is tearing it up; but no matter how many loans we offer to our private investors, they keep insisting on more. We need commercial real estate loans!

When I was at the MBA CREF Conference in San Diego, lenders signed up for C-Loans in droves. Get your deals into C-Loans.com.

You think that when I talk about "getting shafted out of $10,000 commission by a client" that I am talking about a deal closing without you getting paid. That seldom happens. What I am talking about is when a borrower runs you ragged for months chasing a commercial loan for him, and then he backs out without any justification. You don't have to take that nonsense.

The most satisfying business deal you will EVER make.

My nine-hour course in How to Broker Commercial Loans includes marketing, underwriting, packaging, placement, and fee collection. And now it also includes my 7-hour audio course on Intermediate Commercial Mortgage Finance.

You have no idea how glorious it is to receive tens of thousands of dollars every month in loan servicing fees, whether you close a new loan or not. You guys think loan servicing is so hard and scary. It's not hard, and its not scary. Right now you start out every month unemployed.

Wish you could afford one of the above training courses? If you convince a banker to sign up with C-Loans.com, you can choose any of our training courses as a gift, AND we'll pay you $250 every time he closes a deal for C-Loans. I would just forward this blog article to your banker buddies and let the article sell itself.

You've seen my commercial real estate finance training courses, and they intrigue you. That Commercial Mortgage Marketing course would really help right now, and my nine-hour course on How to Broker Commercial Loans would fill in a lot of holes in your knowledge of the business. Unfortunately, you just don't have the money right now.

You've seen my commercial real estate finance training courses, and they intrigue you. That Commercial Mortgage Marketing course would really help right now, and my nine-hour course on How to Broker Commercial Loans would fill in a lot of holes in your knowledge of the business. Unfortunately, you just don't have the money right now.

Back in August of 2012, I wrote my most important blog article ever of the subject of commercial loans and commercial loan brokerage. If you read only one commercial real estate finance training article in your lifetime, make sure you read my 2012 blog article entitled,

Back in August of 2012, I wrote my most important blog article ever of the subject of commercial loans and commercial loan brokerage. If you read only one commercial real estate finance training article in your lifetime, make sure you read my 2012 blog article entitled,

Last week I wrote a training article entitled,

Last week I wrote a training article entitled,

I just returned from the Mortgage Bankers Association's 23rd Annual Commercial Real Estate Finance Conference, known as the

I just returned from the Mortgage Bankers Association's 23rd Annual Commercial Real Estate Finance Conference, known as the

Something extraordinary happened this month.

Something extraordinary happened this month.

Okay, so your client buys a vacant office building from a bank that took the property back in foreclosure. In other words, the vacant office building was an

Okay, so your client buys a vacant office building from a bank that took the property back in foreclosure. In other words, the vacant office building was an

As I write this post, the Dow Jones Industrial Average is down 323 points on the day. Oil has fallen to less than $50 a barrel. The European Central Bank is considering a massive intervention in the European bond market - very much like our own Fed's

As I write this post, the Dow Jones Industrial Average is down 323 points on the day. Oil has fallen to less than $50 a barrel. The European Central Bank is considering a massive intervention in the European bond market - very much like our own Fed's

Commercial mortgage rates change daily, and there is no universal source - like Fannie Mae or Freddie Mac - where you can go to see exactly what

Commercial mortgage rates change daily, and there is no universal source - like Fannie Mae or Freddie Mac - where you can go to see exactly what