Question: What is in-line retail space?

Question: What is in-line retail space?

Answer: Think of a neighborhood shopping center, without the grocery store anchor tenant. In-line retail space is just two to six (or more) retail spaces, arranged in a line.

"But George, what's the difference between in-line retail space and a garden variety strip center or a mini-mall (the term used in Southern California)."

In-line retail space does not have to be on a busy commercial strip (thoroughfare). In-line retail space can be set back from, or even perpendicular to, the nearest busy strip. In-line retail is often shadow-anchored by some big-box retailer, like a Wal-Mart or a large grocery store. Shadow-anchored means that a major retailer is located nearby, which draws the customers, but the small retail space in question is not located on the same parcel as the major retailer.

--------------------------------------------------------

Question: What is senior stretch financing?

Answer: Instead of a first mortgage and a mezzanine loan "behind it", the lender makes just one loan, priced similarly to the blended rate of the first mortgage and the mezzanine loan. (My thanks to Michael Hoffenberg, Founder & Managing Principal, of Trevian Capital for this good explanation.)

--------------------------------------------------------

Here's a good marketing tip: Lender turndowns are a great source of referrals. "I'm sorry, sir, but Bank of Montana can't do this deal; but you might try Bob Smith over at Rocky Mountain Funding. His number is..."

To be even more effective - and this is the point of this mini-lesson, you should market to the companies that are spending a lot of dough on marketing. After all, they're the ones who are getting all of the leads, due to their marketing.

So if you see that a bank, credit union, or hard money lender nearby that is advertising for commercial loans, be sure to call them or visit them and solicit them for their turndowns. Because of their heavy marketing, they will have lots and lots of turndowns for you.

Then be sure to follow up. If I were a one-man commercial mortgage shop in Billings, Montana, I would make it a point to send by snail mail a funny joke or cartoon to the banker at Bank of Montana every week, along with two of my business cards. "But George, I sent him two cards last week," you say with a slight weenie-whine in your voice. "Well, then send him two more... and then two more." The banker opens your envelope. Inside he finds a hilarious political cartoon or a cute, clean joke printed out on plain copier paper, along with two of your business cards. He knows what you want.

And it goes without saying that the expression, "Commercial Mortgages", shows up on your business card, right? Right? Helloooo? You better fix that fix that right away.

Suppose your client has a balloon payment coming due, and the banker swears that he is going to start foreclosure on March 10th if the loan isn't paid off by then. In real life, if you show him a Loan Approval Letter from Blackburne & Sons, 99% of the time he will back off long enough for us to close the loan.

We charge nothing to prepare a Loan Approval Letter because we are happy to serve as a backstop to the bank that has been dragging you out for months. Why? Because we know that at least 40% of the time the bank will leave you standing at the altar looking stupid.

Question: Who out there remembers what a mezzanine loan is?

Answer: A mezzanine loan is a loan secured by 100% of the membership interests (think of them like stock certificates) in the LLC (think of a LLC like it was a corporation) that owns the property. If you own 100% of the membership interests (100% of the stock) of the LLC (corporation), then you own the building.

Why would a commercial lender bother to make a mezzanine loan rather than a second mortgage? Because membership interests (think stock certificates) are personal property, not real estate. You can attach (foreclose on) personal property in a matter of days. If you are 10-days late making your car payment, you could walk into McDonalds and find your car has been towed away just five minutes later.

By the way, my first job was as a credit manager for a finance company, and I got to ride along with the repo man when we popped cars. What a rush of excitement because it was dangerous!

------------------------------------------------

Question: How large are mezzanine loans?

Answer: Mezzanine loans are usually larger than $5 million, and they are usually behind either conduit first mortgages or life company first mortgages of at least $10 million. Mezzanine loans are the province of the Big Boys doing very, very large deals.

------------------------------------------------

Question: Do mezzanine lenders ever make construction loans?

Answer: Mezzanine lenders do not actually make construction loans, but they will make mezzanine loans behind big commercial construction loans. In fact, whenever you see some skyscaper being built these days, you can bet that some mezzanine lender probably made a mezzanine loan behind that construction loan.

The reason why is because commercial construcion lenders really got clobbered in 2008. While commercial construction lenders - almost always banks or syndicates of banks - will, in theory, lend up to 80% loan-to-cost, bankers today are still traumatized by the losses they suffered in construction lending during the Great Recession. On the really large construction projects, the ones larger than $40 million, the bank will normally not exceed 70% of cost.

Very few developers have the cash to contribute $12 million (30% of the cost) of a $40 million project. Therefore, the developer goes to a construction mezzanine lender and has him contribute 20% of the total cost ($8 million). The construction lender contributes 70% of the cost ($28 million), the developer contributes 10% of the cost ($4 million), and now you have the required 100% of the cost ($40 million).

Learn anything today? If so, I am very grateful for each re-Tweet, each Facebook share, and each LinkedIn and Google+ atta-boy.

If you are new to this blog, and you like the idea of getting three or four training lessons in commercial real estate finance every week, please fill in your email address, below my rump-ugly picture, on the right.

Please don't forget that C-Loans also places business loans not secured by real estate. This includes unsecured business loans, equipment loans, leases, accounts receivable financing, factoring, inventory financing, and asset-backed lines of credit. The reason why you want to start brokering business loans is because they close in less than 12 days.

Surely you have met at least one banker who makes commercial real estate loans. I'm offering to trade you over 2,000 bankers for the contact information on just one more. 2,000 for 1? Hellooooo?

When I go to trade shows, it is rare when several practicing commercial mortgage brokers don't walk up to me and thank me for my 9-hour video training course, How to Broker Commercial Mortgage Loans. This course covers marketing, underwriting (lots of ratios), packaging, placement, and fee collection - all for a lousy $549. It also now includes my 7-hour audio course, Intermediate Commercial Mortgage Finance.

Something has happened recently. Years ago I couldn't get the hoity-toity loan officers working at the lenders who made the really large commercial loans to join C-Loans. Now, after 1,000+ closings, they are becoming believers. C-Loans is no longer just a portal for small (less than $5 million) commercial loans. It can now truly handle commercial loan requests of $20 million to $200 million.

One more thing thing: Every time you use C-Loans, you will be be shown a different set of suitable lenders. Some loan officers will be aggressive and competent. Others will be lazy and worthless. You will be able to tell them apart by their lender score. Pay attention to their lender scores!!!

If you have a real estate web site, and if you don't have a link to C-Loans on it, wake up. No. Don't wake up. Go to sleep. We once paid a referral fee of $21,250 to Alan Dunn of Spydercube, and he was asleep when the borrower clicked on his link. Imagine making a $21,250 referral fee in your sleep.

About 18 months ago I wrote an excellent online course about marketing for commercial mortgage loans. Just $199.

Nobody listens to me. For the 212th time, "The real money in the commercial mortgage business is in loan servicing fees." We have so many private investors clamoring for our mortgage investments that we recently increased our loan servicing fee from 1.9% annually to 2.9% annually. In other words, we earn $29,000 per year for collecting 12 monthly payments on a single loan of $1 million. You could close four loans per year and play golf the rest of the time.

How about if I pay you money? I'll give you the free training course of your choice and pay you $250 every time your banker closes a loan for C-Loans.

What is a gateway city? The term is all the rage in commercial real estate lending. The largest banks only want to make commercial loans in these gateway cities.

What is a gateway city? The term is all the rage in commercial real estate lending. The largest banks only want to make commercial loans in these gateway cities.

The world doesn't realize it yet, but three years ago Congress passed the most important piece of economic legislation since the Great Depression of the 1930's. It's called the JOBS Act. Both commercial brokers and commercial mortgage brokers can now use this new legislation to cheaply and easily raise money for their ventures.

The world doesn't realize it yet, but three years ago Congress passed the most important piece of economic legislation since the Great Depression of the 1930's. It's called the JOBS Act. Both commercial brokers and commercial mortgage brokers can now use this new legislation to cheaply and easily raise money for their ventures.

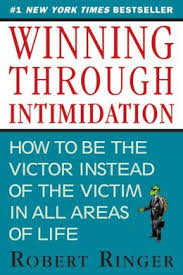

The most helpful business book that I have ever read is Robert Ringer's 1973 New York Times #1 Best-Seller,

The most helpful business book that I have ever read is Robert Ringer's 1973 New York Times #1 Best-Seller,

The other day I received an email flyer from a commercial broker trying to sell an apartment building. The commercial broker boasted that this potential investment offered a whopping cap rate of 14%. The first thought that passed through my head was that this property was almost certainly in a war zone.

The other day I received an email flyer from a commercial broker trying to sell an apartment building. The commercial broker boasted that this potential investment offered a whopping cap rate of 14%. The first thought that passed through my head was that this property was almost certainly in a war zone.

Commercial loan demand is both seasonal and predictable.

Commercial loan demand is both seasonal and predictable.

I'm sure that you already know a great deal about commercial bridge loans, but I hope to add even more to that knowledge today. If you are a commercial broker - a commercial real estate broker or salesman - today's training article will be particularly helpful. By the way, it is the custom and practice in the industry to call commercial real estate salesmen

I'm sure that you already know a great deal about commercial bridge loans, but I hope to add even more to that knowledge today. If you are a commercial broker - a commercial real estate broker or salesman - today's training article will be particularly helpful. By the way, it is the custom and practice in the industry to call commercial real estate salesmen

Seventy-five percent of the time when a developer calls a commercial mortgage broker to help him place a commercial construction loan - that deal is NOT do-able. Why? Because the developer doesn't have enough equity in the deal. He doesn't have enough

Seventy-five percent of the time when a developer calls a commercial mortgage broker to help him place a commercial construction loan - that deal is NOT do-able. Why? Because the developer doesn't have enough equity in the deal. He doesn't have enough

A handful of well-trained commercial mortgage brokers are about to make a fortune originating commercial construction loans over the next few years. There are three reasons why this is true.

A handful of well-trained commercial mortgage brokers are about to make a fortune originating commercial construction loans over the next few years. There are three reasons why this is true.

Question: What is

Question: What is