You are going to love me after this training article. It's the best one I have ever written, and whether you are a developer or a commercial loan broker, this training is going to make you a ton of money.

You are going to love me after this training article. It's the best one I have ever written, and whether you are a developer or a commercial loan broker, this training is going to make you a ton of money.

Now is a terrific time to originate or obtain a commercial construction loan. Its particularly easy right now to close deals for the reasons I will outline below.

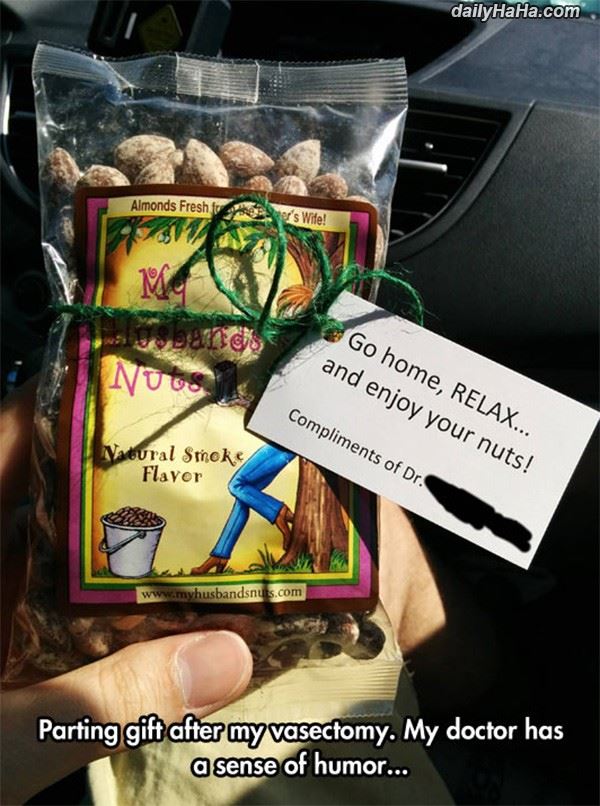

In this blog article I will teach you exactly how to close a commercial construction loan. I have assumed that you are complete rookie. All you have to do is follow the precise steps enumerated below today's funny picture.

But first let me explain why it is so easy to close commercial construction loans right now. First of all, there has been very little commercial construction for the last nine years. The world needs new commercial buildings.

In addition, banks are loaded to the gills with cash right now (almost $3 trillion in excess reserves at the Fed), and commercial construction loans are extremely profitable for the bank. The bank earns its entire loan fee upfront, but it doesn't have to disburse most of it's loan proceeds for many months. This supercharges the bank's yield. Construction loans are also short term. Banks love-love-love short term loans.

Bottom line: In a healthy economic climate like today's, banks prefer construction loans to almost all other loan products.

For commercial loan brokers, commercial construction loans are large, therefore so are the loan fees. And in particular right now, very few commercial loan brokers even know how to originate commercial construction loans. Most of the experienced commercial loan brokers were either driven out of the business or retired during the Great Recession. Commercial mortgage brokers: You have very little competition.

Bottom line: Commercial construction loans are not that hard for a commercial loan broker to originate. Just follow the easy steps outlined below.

But how do you close a commercial construction loan? Its easy. Just follow these steps:

- Start with a local bank. Construction loans require progress inspections, so the lender needs to be located nearby. You can find many hungry commercial construction lenders by using C-Loans.com, and C-Loans is free!

- Choose your local bank by size. Small banks (less than $1 billion in assets) make small commercial loans (less than $2 million). Regional banks ($1B to $10B in assets) make medium-sized loans ($2MM to $8 million). Money center banks (more than $10B in assets) make the commercial construction loans larger $8 million.

- Gather a loan package: Initially you will need the details on the land purchase - purchase price of the land, down payment, balance owing, value of the land today, and if the borrower claims that the land is worth more than the purchase price, a very convincing explanation of why this is so (the developer assembled three contiguous parcels over several years or he got the land re-zoned or Wal-Mart moved right next door). You will need a construction cost breakdown, sales projections if this is a "for sale" property or a pro forma operating statement if this will be a rental property, a curriculum vitae or CV (building experience resume) on the developers, a financial statement on each of the developers, photo's of the land, and ideally an architect's rendering. It's the rare project over $5 million that ever gets financed without an architect's rendering.

- Run the deal by prospective lenders over the phone, keeping the identity of the developer and the exact location of the property close to your vest initially. The first words out of your mouth should be, "Hello, Mr. Banker. My name is John Jones with Jones Mortgage, and I'd like to run a deal by you. Did I catch you at a good time? If not, I'll be happy to call back later."

- Some bankers are aggressive. Some bankers are so"sleepy" as to make it almost a crime for them to collect a salary. If one bank loan officer blows you off the phone, be sure to call back the next day and speak with a different loan officer at the same bank. I have closed scores of loans in my time where Loan Officer A at Bank of the Neighborhood turned me down, but Loan Officer B at Bank of the 'Hood later said yes; but wait a day or two before you call the same bank back.

- Once your borrower has sent you his initial package (the borrower needs to prove he is serious about this loan by putting in some sweat-effort), and once you have an interested lender lined up, its now time to ask your borrower to sign a Non-Circumvention Agreement. Unless the developer intended to find out the name of your lender and then go behind your back, he should have no problem signing a short agreement protecting the mortgage broker.

- Now its time to prepare your loan package. Prepare an Executive Loan Summary, attach your pictures and the short stack of documents described above, and save it as a PDF. Don't know how to create a PDF? If you enter the loan into C-Loans.com and submit the deal to six commercial construction lenders, you can then - right as you leave C-Loans - press the Create a PDF button and save the PDF we create for you to your desktop. One click. Easy-peasy.

- Submit your PDF to your interested lender by email. He will not open it. Whaaat? You'll see. He'll have some BS excuse (the dog ate Hillary's emails), but the truth is that bankers are incredibly... sleepy. How about that for tact?

- Therefore it is essential that you call your banker to confirm receipt of the package. "Hi, Mr. Banker, John Jones here. All I'm doing today is calling to confirm receipt of the package. You did get it, right? Oh, your email was down, but its up again now? Great. You'll read the package tonight? Wonderful. I really wasn't calling to bug you (yeah, right... and I'll love you in the morning). I should call you tomorrow morning? You got it!"

- Don't worry if the banker nit-picks your deal and turns it down. No problemo. He is probably just lazy, or his bank has enough commercial construction loans right now. If a banker really wants to make loans, a few black hairs is NOT going to put him off.

- The secret to successful commercial loan placement is to just keep presenting the deal to different bank loan officers (they can even be at the same bank - see above) until you find one in the mood to lend.

- Once the lender comes back and shows some serious interest, from there on its merely a matter of fetching and shuttling documents.

- At some point in time the banker should issue a term sheet (also known as a conditional commitment letter or loan proposal), which outlines the likely terms of the proposed commercial construction loan and asks for a deposit of $3,000 to $8,000 for third party reports (appraisal, toxic report, title commitment, etc.).

- Although a term sheet is NOT binding on the lender, in real life a term sheet means that you are almost certainly going to get the loan. As long as the third party reports come back okay, you're golden.

- That's it. Easy-peasy.

Do you need a commercial construction loan right now?

Do you need a permanent loan, a takeout loan, a bridge loan, an SBA loan, a mezzanine loan, a nonprime/subprime commercial loan, or a hard money commercial loan?

Do you need a lender who will actually lend at 75% LTV, rather than just boast about it? Do you need a lender who will allow a negative cash flow? Do you need a lender who will also look at the borrower's global income - income from salaries, other investments, etc.? Do you need a lender who will allow the seller to carry back a second mortgage? Does your client have a balloon payment coming due on his commercial property? Has your bank offered him a discounted pay-off? Does your borrower have less-than-stellar credit? Is your client's company losing money? Is your borrower a foreign national? Do you need a non-recourse loan? Do you need a commercial loan with no prepayment penalty? Is your client's commercial property partially vacant? Do all of your commercial leases run out in the next 18 months?

Are you just browsing?

So many borrowers are going to need a commercial loan over the next two years to refinance a balloon payment that at some point bankers and conduit commercial loan officers may refuse to accept new loan applications. It won't be the first time in history.

So many borrowers are going to need a commercial loan over the next two years to refinance a balloon payment that at some point bankers and conduit commercial loan officers may refuse to accept new loan applications. It won't be the first time in history.

For over thirty years, the only commercial real estate lenders making

For over thirty years, the only commercial real estate lenders making

I was recently assisting an elderly woman with a new commercial loan when I made a troubling discovery. She owned a prime piece of commercial real estate, a retail store building leased out to a tenant, on one of the most affluent commercial strips in America. A

I was recently assisting an elderly woman with a new commercial loan when I made a troubling discovery. She owned a prime piece of commercial real estate, a retail store building leased out to a tenant, on one of the most affluent commercial strips in America. A

I have good news and interesting news.

I have good news and interesting news. I received the following email this week that I found extremely interesting and informative:

I received the following email this week that I found extremely interesting and informative:

The sales lesson that is today's blog subject applies to salesmen in just about any industry - be it commercial loan brokerage, commercial-investment property sales, or even car sales. It sounds obvious -

The sales lesson that is today's blog subject applies to salesmen in just about any industry - be it commercial loan brokerage, commercial-investment property sales, or even car sales. It sounds obvious -