Please keep in mind that (1) the Chinese economy is already starting to crumble; (2) the collapse will likely resemble the collapse of the Japanese economy in 1989, leading to the Lost Decade in Japan; (3) President Xi and the Chinese Communist Party ("CCP") will almost certainly be blamed; (4) President Xi will be at great risk of losing power and quite possibly being quietly shot in some cell in a remote prison; and finally, in desperation (5) President Xi will distract the Chinese populace from the collapsing economy and will unite them by invading Taiwan.

Please keep in mind that (1) the Chinese economy is already starting to crumble; (2) the collapse will likely resemble the collapse of the Japanese economy in 1989, leading to the Lost Decade in Japan; (3) President Xi and the Chinese Communist Party ("CCP") will almost certainly be blamed; (4) President Xi will be at great risk of losing power and quite possibly being quietly shot in some cell in a remote prison; and finally, in desperation (5) President Xi will distract the Chinese populace from the collapsing economy and will unite them by invading Taiwan.

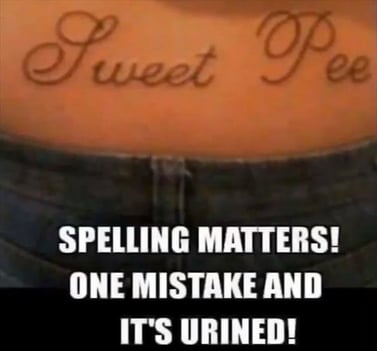

Students of history and wave theory can spot humans making

the same boneheaded decisions every generation.

The invasion of Taiwan will require the destruction of the U.S. air bases on Guam, and likely also those in Japan. Otherwise, the U.S. and its allies will enjoy air superiority. It is interesting to note that the U.S. military required the participation last week of all 3,000 civilians located near its airbases in Japan in an evacuation drill.

Guam is a U.S. territory, and neither Japan nor the United States are likely to tolerate missile attacks on their sovereign territory. These missile attacks will probably start World War III, a conventional (non-nuclear) war fought with missiles, jets, and warships. According the last three war games, the United States and its allies will lose this war.

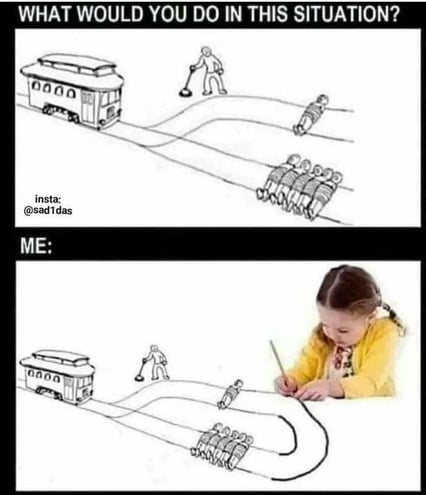

We just can't reach the bastards with our conventional weapons. Our jets can't fly far enough to reach their missile launchers, and the range of their best (and most expensive) missiles is more than twice (three times?) as far. It will be like a bully in the school yard, holding the forehead of the smaller guy, while the little guy swings at the air.

I try to have fun with this blog, but this is serious stuff.

A buddy of mine asked. "Can't we just nuke the bastards?" Between our nuclear triad (intercontinental nuclear missiles, our long-range intercontinental bombers, and our 72 nuclear submarines), we have enough firepower to destroy every town larger than 10,000 people in all of China; but as my Hong Kong buddy recently pointed out, "George, you could kill a billion of us, and we would still have more population than you." Oh.

But we will never use nuclear weapons, just like we will never use our 2,000 canisters of anthrax or our 20,000 poison gas howitzer rounds. China has boomers (submarines with nuclear missiles) too, and they are building a whole desert full of intercontinental missile silos. Almost every human in the United States could die. At least in a Chinese invasion, maybe our younger children might be allowed to survive.

Interesting note: While China tested a hypersonic missile last week that flew around the world and then attacked a test target (missed it by a number of miles), someone in our Defense Department pointed out that hypersonic missiles are incredibly expensive.

Perhaps China has some really cool and dangerous missiles, but maybe they can't afford enough of them. Remember, these are all conventional missiles. Each missile might take out an aircraft carrier or several city blocks, but it might take a whole lot of expensive missiles to take out all of our shipyards and missile factories. Hey, hope springs eternal.

We need to finish developing our mid-air refueling drones to accompany our fighter jets on their 1,000+ mile bombing missions. I read this week that China has the same problem as the U.S. - not enough refueling jets.

It's kind of cool to watch history play out in slow motion right in front of us, but as I have repeatedly told my kids, history does not always happen to the OTHER guy. Just think, you and your family could make some history books someday. Let's just hope you are dipping and kissing some beautiful nurse in a ticker tape parade, rather than...

Remember, I will shortly be sharing with you the exact moment that President Xi will launch his attack. My earlier prediction that the U.S. and China would go to war within three years may have been too generous. With the crash of Evergrande, the war is likely to start a year earlier. Poop!

Every time you hear in the coming weeks about how China's economy is crumbling, keep in mind that this economic crash only accelerates President Xi's plans to invade Taiwan and start World War III. Absolutely don't be doing your happy dance when you read that their real estate has fallen by 25%!

Okay, so when will President Xi start his invasion of Taiwan? Remember, he has to invade in order to distract his people.

Another interesting note: In the past year, President Xi has purged over 1,400 security apparatus officers and policemen. Does that mean he shot them? I dunno. Before World War II, Stalin shot 50,000 officers out of an officer corp of 100,000 - so arguably Xi is just a light weight communist dictator.

Xi would not be purging the secret police if he had no opposition. Remember, he is trying to run for a third term, and not every communist in China can be comfortable with a President who won't step down.

In prior blog articles, I hypothesized that the Chinese people would rise up in mass protests and riots once the economic meltdown got really bad. I read some articles this week that suggest that if Xi is overthrown, it will probably happen from within the Chinese Communist Party.

C'mon, George, you're killing me here. When will China invade Taiwan?

There is a five-month window when the the seas between Taiwan and the Chinese mainland are far too choppy for landing craft. That five-month period starts in October every year and lasts through the end of February. March is the first month when an invasion is even physically possible.

But before the Red Chinese can hope to invade Taiwan, they first have to soften up the island nation. They therefore need to start their super-accurate missile bombardment in October of the preceding year. They need to take out the shore batteries, the air defense missile batteries, the airfields, the fleets of fighter jets, the beach fortifications, etc. This missile barrage will likely take months, so perhaps the window for March of 2022 is close to closing.

Therefore I hypothesize that the missile war will start in October of 2022 and the actual invasion will begin in March of 2023. There is always the chance that the timing will work against Xi. People could start rioting during the no-go months, and by the time the attack window finally opens, Xi will have already been swept from power. Hope springs eternal.

Our generals have told Congress that, "The invasion will not start until 2025. That's the soonest time that China will be ready."

Folks, if we make it to 2025, then Xi will have long since been deposed (and probably shot). Please pray that Xi gets peacefully deposed. But just remember what I constantly remind my children:

"History doesn't always happen to the other guy."

In the United States, we have the very good habit of not executing our former presidents. If the former president of a country fears that he will be executed when he steps down, it tends to discourage him from stepping down.

In the United States, we have the very good habit of not executing our former presidents. If the former president of a country fears that he will be executed when he steps down, it tends to discourage him from stepping down.

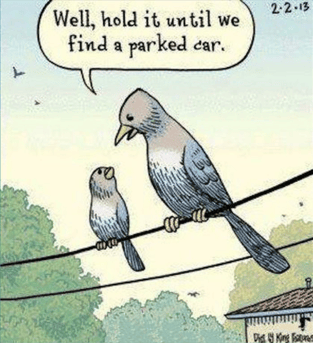

Think back to the beginning of the pandemic. We were all absolute idiots to think that we could contain the pandemic to China. It was like believing that you could have a non-peeing section in a public swimming pool.

Think back to the beginning of the pandemic. We were all absolute idiots to think that we could contain the pandemic to China. It was like believing that you could have a non-peeing section in a public swimming pool.

Let me be very, very clear. Even though China is our largest economic competitor, and even though there is scary chance we may soon go to war against China -

Let me be very, very clear. Even though China is our largest economic competitor, and even though there is scary chance we may soon go to war against China -

My buddy and I were debating whether or not the U.S. will soon go to war against China. His argument - an intellectually sound one - is that China would suffer horribly in such a war.

My buddy and I were debating whether or not the U.S. will soon go to war against China. His argument - an intellectually sound one - is that China would suffer horribly in such a war.

This is a fascinating story of how using a cap rate allowed us to value and sell a foreclosed golf course, and it helped my private investors avoid a loss and actually make a profit.

This is a fascinating story of how using a cap rate allowed us to value and sell a foreclosed golf course, and it helped my private investors avoid a loss and actually make a profit.

This may be the most instructive training article that I have written in several years, so I strongly encourage you to study it. (Note: This is NOT the subject vet clinic.)

This may be the most instructive training article that I have written in several years, so I strongly encourage you to study it. (Note: This is NOT the subject vet clinic.)

This is the perfect time to talk about the "quality" of income. Real estate crashes seem to strike about every ten to fourteen years, and it has been thirteen years since the Great Recession. If we were to have another commercial real estate crash, would you rather own a building leased to Betty's Gift Shop or one leased to Amazon.com?

This is the perfect time to talk about the "quality" of income. Real estate crashes seem to strike about every ten to fourteen years, and it has been thirteen years since the Great Recession. If we were to have another commercial real estate crash, would you rather own a building leased to Betty's Gift Shop or one leased to Amazon.com?

Wow. If you walked into the executive offices of some savings and loan associations in the early 1980's, the wealth and opulence would have amazed you - walls paneled with expensive oak, glistening marble floors imported from Italy, and genuine crystal chandeliers hanging from the ceiling. On the walls you would often find wildly-expensive oil pantings created by the great masters.

Wow. If you walked into the executive offices of some savings and loan associations in the early 1980's, the wealth and opulence would have amazed you - walls paneled with expensive oak, glistening marble floors imported from Italy, and genuine crystal chandeliers hanging from the ceiling. On the walls you would often find wildly-expensive oil pantings created by the great masters.

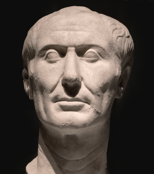

The date was around 50 years before the birth of Christ. The Roman Republic had wonderfully prospered under a truly republican form of government for almost 400 years. At the time, there were no kings, no emperors, no dictators, or no Caesars in Rome. The Senate alone ruled the city-state.

The date was around 50 years before the birth of Christ. The Roman Republic had wonderfully prospered under a truly republican form of government for almost 400 years. At the time, there were no kings, no emperors, no dictators, or no Caesars in Rome. The Senate alone ruled the city-state.