Today you will learn a new financial ratio, the New-Money-to-Old-Money Ratio.

Today you will learn a new financial ratio, the New-Money-to-Old-Money Ratio.

Twenty-five years ago the commercial property second mortgage business was huuuuge. Almost 100 private money (hard money) commercial mortgage companies nationwide would glady make you a second mortgage on your apartment building or office building.

Then a commercial real estate depression rolled across the country in the early 1990's. It started with a bust in oil prices, and commercial real estate in Houston, Texas and in Denver, Colorado (the oil business was big business in Denver in those days) collapsed in value. I use the expression, "depression", because commercial real estate in those days collapsed by a whopping 45%. Interesting note: I have survived three commercial real estate depressions in my career, and each time commercial real estate values collapsed by almost exactly 45%. Forty-five percent. Hmmmm. I gotta remember that number.

This was the era of the see-through building. A see-through building was a newly constructed commercial building, with no tenants and hence no tenant improvements. It was just an empty shell, and if you looked through the windows, you could see all the way through to the other side. Hundreds of huge, see-through, office towers could be found in Houston, Denver, and other large cities across the country. Developers couldn't find any tenants for their beautiful new architectural monuments. Commercial construction lenders - typically S&L's (savings and loan associations) - lost billions of dollars during the 1990-1991 recession, leading to the Savings and Loan Crisis, where almost 1,100 out of about 2,300 S&L's went bankrupt.

Anyway, in the early 1990's, everyone thought that the depression would be limited to just the Oil Patch states; but then the Eastern part of the country fell into a severe recession. Everyone in California was sure that the rolling depression would never hit California because Silicon Valley was rocking and millions of people were moving to California. "We are immune," said many Californians. We weren't. In 1991 the rolling commercial real estate depression hit California, and commercial real estate values fell by - you guessed it - 45%.

Now the thing about a second mortgage is that the second mortgage holder has to keep the first mortgage current; otherwise, the second mortgage holder will be wiped out when the first mortgage forecloses. In most cases it doesn't even matter if the borrower has a ton of equity in the property, over and above the first and second mortgages.

The reason why is because no one ever bids at commercial mortgage foreclosure sales. Lots of fix-and-flippers bid at residential foreclosures sales, but no one ever bids at foreclosures of commercial property. Yeah, yeah, I am sure that over the years a few wealthy investors have actually bid at a commercial mortgage foreclosure sale, but such an event is extremely rare. Why? Any bids at a foreclosure sale have to be all-cash, and the numbers are just too big for bidders to show up with $3 million in cashier's checks. The bottom line is that the commercial second mortgage holder absolutely must keep the first mortgage current while he forecloses on his second mortgage.

If a lender is actually going to make a commercial second mortgage, he needs to make sure that the first mortgage payments are not impossibly large. Imagine if you made a $400,000 second mortgage behind a $10,000,000 first mortgage on an $18 million apartment building. At first glance, this looks like a gorgeous deal. It's only 57.8% loan-to-value. Wow.

However, the monthly payments on a $10 million first mortgage, at 5.25% interest and amortized over 25 years, are $59,925. If the second mortgage holder first learns that the borrower is delinquent when the borrower is five months behind on his first mortgage payments and then has to keep the first mortgage current for another 7 months while he foreloses, the second mortgage holder will have to advance almost $720,000 to protect his little $400,000 second mortgage investment. Ouch! In real life, no one has that kind of dough.

Therefore commercial second mortgage lenders developed a financial ratio to warn themselves away from making such a mistake. It is called the New-Money-to-Old-Money Ratio.

The New-Money-to-Old-Money Ratio is defined as the size of the proposed second mortgage divided by the size of the first mortgage, the dividend (result) being multiplied by 100%.

New-Money-to-Old-Money Ratio = (Size of Second Mortgage / the Size of First Mortgage) x 100%

The New-Money-to-Old-Money Ratio should always be larger than 33%.

Let's plug in the numbers from the example above.

New-Money-to-Old-Money Ratio = (Size of Second Mortgage / the Size of First Mortgage) x 100%

New-Money-to-Old-Money Ratio = ($400,000 / $10,000,000) x 100%

New-Money-to-Old-Money Ratio = .04 x 100%

New-Money-to-Old-Money Ratio = 4%

Clearly 4% is way-way less than 33%. It would be reckless to make such a second mortgage, even though the apartment building might be a very nice one and even though the loan-to-value ratio was less than 58%.

Okay, now back to our rolling commercial real estate depression. In the early 1990's, most of the commercial second mortgage lenders were based in California. When the depression finally rolled through California in 1991, commercial real estate fell by 45%. Since most commercial second mortgage lenders were lending up to 65% to 70% LTV in the years leading up to the depression, they found themselves severely upside-down in most deals. Faced with making the first mortgage payments for an uncertain amount of time, on a partially-vacant or vacant commercial building with very little remaining equity, most second mortgage lenders allowed themselves to be wiped out.

Poof! Commercial second mortgage lenders lost billions of dollars and exited the business for good. They have never come back. To this day very few commercial lenders will therefore make second mortgages.

To make matters worse, a change in Federal law (the Garn-St. Germain Act) had recently clarified that the acceleration clause contained in the mortgages of virtually all bank first mortgages was enforceable. An acceleration clause is the section in a mortgage that says if the borrower sells the property or places a second mortgage / mezzanine loan on the property that the bank can immediately demand to be paid in full.

Another huge reason why so few lenders will make commercial second mortgages is because the moment they place their mortgage on the property, the underlying first mortgage lender can accelerate his loan. If that happens, the holder of a $400,000 second mortgage, for example, might suddenly have to come up with $1 million (or $10 million) to pay off an accelerated first mortgage. Yikes.

So is it impossible to get a commercial second mortgage today? No. There is still a handful of rough-and-tumble commercial lenders willing to make a commercial second mortgage. You can find these lenders by entering your deal into C-Loans.com.

"Gee, george, I get it. I'm not going to find many lenders willing to make me a commercial second mortgage; but I don't need to find a lender willing to make me a commercial second mortgage. I just need to find a lender who will allow the seller to carry back a second mortgage. With banks being so conservative today, its hard to find a buyer capable of putting 35% down."

You would think that banks would be happy to have the seller carry back a second mortgage. After all, if the borrower defaults, the seller would be motivated to bring the bank current and foreclose his second mortgage.

In real life, this doesn't happen. Almost invariably the seller lacks the financial resources to keep the first mortgage current. The bank ends up foreclosing and wipes out the seller's second mortgage.

But wait, it gets even worse. When the bank does foreclose, almost invariably it finds that the property has been allowed to fall into a dilapidated condition. How could this happen? The borrower has been using the dough earmarked to keep the property maintained to make the second mortgage payments.

As a result, you will almost never find a commercial bank willing to allow the seller to carry back a second mortgage. Banks always want cash-to-loan; i.e., no second mortgages.

This is one good reason to apply to Blackburne & Sons for your purchase money commercial loans. While we will NOT make a commercial second mortgage, Blackburne & Sons will allow the seller to carry back a second mortgage behind our new first mortgage.

Are you a commercial broker; i.e., do you sell commercial real estate? What I am about to tell you is the most important thing you will ever learn in commercial-investment real estate brokerage! There is no easier way to meet high-net-worth real estate investors than to be a commercial mortgage broker. After all, poor people don't own $5 million office buildings. They are owned by the filthy rich. Every commercial brokerage office needs to have a small commercial loan brokerage operation. It could just be a desk and phone. It doesn't even matter if you EVER close a loan. Your ads for commercial loans will pull in hordes of wealthy investors to whom you can later sell commercial real estate.

Do you need a commercial loan with no prepayment penalty? Is your client's commercial property partially vacant? Do all of your commercial leases run out in the next 18 months? Do you need a lender who will allow a negative cash flow? Do you need a lender who will also look at the borrower's global income - income from salaries, other investments, etc.? Do you need a lender who will allow the seller to carry back a second mortgage? Does your client have a balloon payment coming due on his commercial property? Has your bank offered him a discounted pay-off? Does your borrower have less-than-stellar credit? Is your client's company losing money? Is your borrower a foreign national? Do you need a non-recourse loan?

Do you have a commercial loan that deserves to be financed by a life company, bank, or conduit?

Keep looking for bankers who make commercial loans. You can parlay the contents of a single business card into a free directory of 2,000 commercial real estate lenders.

We here at C-Loans, Inc. have a vested interest in getting you pre-registered on C-Loans.com. Registration is just a fancy way of saying to give us your contact information, so future lenders can reach you. We want you in a sprint start so that the next time you run across a commercial real estate loan, you can quickly enter it into C-Loans.com. To encourage you to pre-register, we are giving away a free Commercial Mortgage Underwriting Manual, a manual we sell separately for $199.

Are you ready to finally learn commercial real estate finance? It's a rare commercial lending conference when one of my former (video course) students doesn't come up to me and thank me for this course.

Did you learn something today? Want to receive two free lessons in commercial real estate finance every week?

Got a buddy or a co-worker who would benefit from free training in commercial real estate finance?

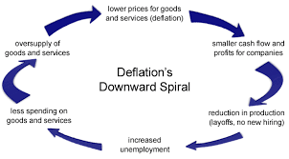

Deflation is a very serious threat in Europe. The problem with deflation is that once it takes root in the minds of consumers, they start to put off their purchases of cars, houses, and other big ticket items. Why buy a car today when it will only be cheaper next year? As borrowers procrastinate, sales fall off for manufacturers. Manufacturers respond by laying off workers, which reduces demand even more, which leads to even more falling sales and layoffs. Deflation has the potential to become a death spiral for an economy.

Deflation is a very serious threat in Europe. The problem with deflation is that once it takes root in the minds of consumers, they start to put off their purchases of cars, houses, and other big ticket items. Why buy a car today when it will only be cheaper next year? As borrowers procrastinate, sales fall off for manufacturers. Manufacturers respond by laying off workers, which reduces demand even more, which leads to even more falling sales and layoffs. Deflation has the potential to become a death spiral for an economy.

I just completed a new training article on how commercial construction loans are underwritten. It was the hardest subject that I have ever attempted because bankers use five different financial ratios when underwriting commercial construction loans. The article took me two weeks to write.

I just completed a new training article on how commercial construction loans are underwritten. It was the hardest subject that I have ever attempted because bankers use five different financial ratios when underwriting commercial construction loans. The article took me two weeks to write.

Today you will learn a new financial ratio, the New-Money-to-Old-Money Ratio.

Today you will learn a new financial ratio, the New-Money-to-Old-Money Ratio. The following article has immensely helpful information for anyone in the commercial real estate business - be she a commercial loan broker, a commercial broker (you sell real estate), or an investor. The article is short, but it hits you with great tool after great tool (all free), bam-bam-bam. Prepare to be wowed:

The following article has immensely helpful information for anyone in the commercial real estate business - be she a commercial loan broker, a commercial broker (you sell real estate), or an investor. The article is short, but it hits you with great tool after great tool (all free), bam-bam-bam. Prepare to be wowed:

I would love to take credit for this wonderful blog article; but it was written by the lovely and smart

I would love to take credit for this wonderful blog article; but it was written by the lovely and smart  This whole subject of mezzanine loans, preferred equity, venture equity, capital stacks, senior stretch financing, A/B Notes, and syndicated loans is called

This whole subject of mezzanine loans, preferred equity, venture equity, capital stacks, senior stretch financing, A/B Notes, and syndicated loans is called

A gorgeous $50+ million commercial construction loan was entered into

A gorgeous $50+ million commercial construction loan was entered into