Why do almost all gas stations now have convenience stores? Answer: A convenience store is an extra profit center. The gas pumps pull in the customers, and while they are waiting for their tanks to fill, the convenience store sell them sodas, snacks, lotto tickets, and hot dogs.

Why do almost all gas stations now have convenience stores? Answer: A convenience store is an extra profit center. The gas pumps pull in the customers, and while they are waiting for their tanks to fill, the convenience store sell them sodas, snacks, lotto tickets, and hot dogs.

Right now your real estate web site is like a gas station without a convenience store. You are leaving all kinds of dough on the table. Over the next five to six years, C-Loans.com could pay you enough dough to pay for a year of college for one of your kids.

But what I am asking you to do is a lot of hard work. You might have to spend up to... gasp... two whole minutes on this project. It's exhausting work earning that kind of money. Phew.

Just send an email to your web site guru. "Hey [Steve], please create three new hyperlinks on my home page. Please find a place to put one at the top, one in the middle, and one at the bottom. The top link should say, 'Commercial Loans'. The middle link should say, 'Commercial Real Estate Loans'. The bottom link should say, 'Commercial Financing'. Please point all three links to https://www.c-loans.com."

Just cut and paste the above paragraph and send it to your webmaster. Voila. You're done. You've just added a convenience store to your gas station - a new profit center.

Now here is what happens: C-Loans is programmed to automatically capture the URL of the referring site and print it at the bottom of our loan application. It's automatic. We don't have to think. Bam! Right there at the bottom of our loan application are the words, "This loan was referred by billsmithrealty.com."

When the deal closes, we look up the owner of Bill Smith Realty and send him a check for 12.5 basis points. That's what happened a few years ago with Alan Dunn, the owner of a site named SpyderCube. We ended up closing a $17 million commercial loan for Alan's customer, so we sent Alan a check for a whopping $21,250.

Alan was even asleep when he made that $21,250. The deal came in late at night. Can you imagine the thrill of getting a call, "Hey, Alan, I have some good news for you." Hot snot, I'll bet that we made his whole day.

And here's the thing. That potential borrower is your referral forever. Maybe the first deal falls out, but the borrower comes back and applies for a different loan two years later. You still get paid. He's your guy.

Here is another wonderful thing. C-Loans is not a commercial real estate lender, limited to its own lending programs. C-Loans does not make loans. C-Loans.com is merely a commercial mortgage portal where borrowers can submit their deals to 750 different lenders. We have life companies, conduits, banks, credit unions, savings banks (S&L's), REIT's, hard money lenders, SBA lenders and USDA business and industry specialty lenders.

C-Loans lenders will make permanent loans, construction loans, bridge loans, SBA loans, USDA B&I loans, mezzanine loans, preferred equity investments, SBA construction loans, and USDA construction loans. A link to C-Loans gives you a chance to earn a big referral fee on ANY kind and size of commercial real estate loan, from $100,000 to $500 million. Yes, our conduit lenders have made loans of this size on chains of major hotel franchises or portfolios of office buildings.

Important note: C-Loans usually earns at least 37.5 bps. per closing, so we can afford to pay you 12.5 bps. On deals of greater than $5 million, our best-rate lenders only pay us 25 bps., so your referral fee would be 8.33 bps.

"Gee, George, this all sounds great and everything, but how do I know that you won't cheat me?" For one thing, we didn't cheat Alan Dunn, and there was no way he would have known that we had closed that big deal. I am also an attorney, licensed in both California and Indiana.

Lastly, my hard money commercial lending shop, Blackburne & Sons, has been in business for 40 years now. The average daily balance in our trust accounts is $400,000; and after a loan payoff, there could be several million dollars in that account. If I ever decide to go bad, I am gonna steal the millions in that trust account, not your stinky 'ole referral fee. :-) Fortunately, I have managed to resist the temptation for 40 years. I am proud to say that both of my sons and I are Eagle Scouts. There was a time when that mattered.

But hey, while 100,000 people in this industry may know me, I might be a complete stranger to you. Trust but verify, some would say. So here is my proposition: If you create five or more commercial financing links across your real estate web site, we will create for you a special partner link. With a special partner link, you will get a copy of every deal that comes from your site. Just create the five (or fifteen) commercial loans links on your real estate website, and we will create this special partner link for you. It takes us about 30 minutes to create such as a partner link, so we obviously don't want to have to create the link unless we are getting some really good visibility.

Now back to the good stuff. After awhile, you are going to have several hundred of your loan clients registered on C-Loans as your guys, and you are likely to close two or three deals every year going forward. Every year going forward - think about that. You will have your old referrals and then you will add to that base of potential referral fees even more clients every year.

And if you create at least five links on your website to C-Loans, you can also use your partner link to imbed commercial real estate loan links in your regular newsletters to your clients. Remember, with a partner link, you get a copy of every commercial loan application generated by your site or one of your newsletters.

I could see a time when one of your clients applies for a purchase money loan using C-Loans, and you suddenly realize that he is looking to buy another apartment building. (Please read that last sentence again.)

Important note: We cannot track links inside of newsletters because there is no referring URL. To imbed commercial financing links in your newsletters, you will need for us to prepare a partner link for you. Therefore, please create your five referral links to C-Loans.com right away and then contact Tom Blackburne at 574-210-6686.

Now some real estate brokers only like a little bit of referral income, so they only create one Commercial Loans link to C-Loans.com on their home page. Smarter real estate brokers like to make a TON of referral fee income, so they put three links to C-Loans on every one of their interior web pages.

The way you can easily do this is to have your website guru edit the template of your pages to add these three links. Then, whenever your webmaster creates a new web page for you, the links automatically appear on the new page, without anyone having to think about adding them. The more links to C-Loans, the more chances you have have of earning a $21,250 referral fee.

In conclusion, I urge you to add a convenience store to your gas station. Just cut and paste the following message into an email to your webmaster:

"Hey, [Steve], please create three new hyperlinks on my home page. Please find a place to put a link at the top, one in the middle, and one at the bottom. The top link should say, 'Commercial Loans'. The middle link should say, 'Commercial Real Estate Loans'. The bottom link should say, 'Commercial Financing'. Please point all three links to C-Loans.com."

Now, the really, really smart guys will add the following:

"In addition, [Steve], would you please edit the template you use to create new web pages for our site to add these three links (top, middle, bottom)? This way, the next time you create a new web page for us, the new page will automatically contain these three links."

Voila! You have now added a convenience store to your gas station. I said it would take a whopping two minutes, and you did it in just 97 seconds. :-)

Questions: Call Tom Blackburne at 574-210-6686.

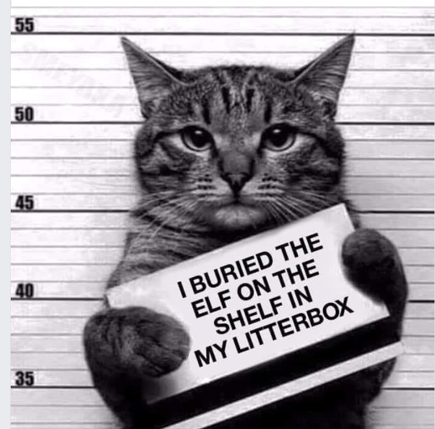

Cute Halloween joke:

Cute Halloween joke:

Anyone who owns a web site that is related to real estate or which provides services to high net worth individuals (accountants, attorneys, insurance salesmen, financial planners, etc.) should pay close attention to this article.

Anyone who owns a web site that is related to real estate or which provides services to high net worth individuals (accountants, attorneys, insurance salesmen, financial planners, etc.) should pay close attention to this article.

This week C-Loans, Inc. paid a referral fee of $1,131.25 to a lady who had merely mentioned

This week C-Loans, Inc. paid a referral fee of $1,131.25 to a lady who had merely mentioned

A few years ago, Alicia, who was running C-Loans at the time, called up a guy named Alan Dunn and said, "Alan, I'm about to make your whole day. Do you remember that hyperlink entitled

A few years ago, Alicia, who was running C-Loans at the time, called up a guy named Alan Dunn and said, "Alan, I'm about to make your whole day. Do you remember that hyperlink entitled

There are lots of tricks and techniques you can use to find more commercial mortgage referrals to send to

There are lots of tricks and techniques you can use to find more commercial mortgage referrals to send to  All you have to do is visit our

All you have to do is visit our