Topics: Coronavirus, Funnies

Posted by George Blackburne on Fri, Mar 13, 2020

No sooner had I written a blog post last week about the attractiveness of CMBS loan rates right now, than I got a message for one of my subscribers informing me that conduits are no longer making hotel loans.

No sooner had I written a blog post last week about the attractiveness of CMBS loan rates right now, than I got a message for one of my subscribers informing me that conduits are no longer making hotel loans.

By the way, CMBS lenders are still making their large permanent loans on the Four Basic Food Groups - multifamily, office, retail, and industrial - at incredibly low interest rates today.

It makes sense why the conduits have stopped making hotel loans. Hotel occupancy rates are getting slammed right now by the Coronavirus Crisis.

Conduits make large, cookie-cutter, commercial real estate loans that are quickly aggregated into large pools and securitized into commercial mortgage-backed securities ("CMBS").

Conduits are not portfolio lenders. They can't just say, "Well, hotels are getting clobbered right now, but the world is not going to stop needing hotels. Since all of our commercial lending competitors are out of the hotel loan market right now, our bank will sneak in there and make a bunch of juicy loans on some of the very nicest hotels in the country."

Because conduits are not portfolio lenders, they can't hold commercial loans on their lines of credit for very long. They need to sell them off quickly. They can't hold these loans for two years, say, until the hotel market recovers.

Conduit is short for commercial real estate mortgage investment conduit, a specialized type of commercial mortgage company that originates loans for the CMBS market.

The thing that is special about conduits is that they get to sell their loans to a special kind of trust, called a pass-through trust, created by Congress, which does not have to pay taxes on its income from these commercial mortgages.

This special pass-through trust assembles a whole bunch (100 to 300) of these large, cookie-cutter, commercial loans into a pool. Then the trust sells pass-through securities, backed by the stream of payments and payoff's coming from the first mortgages in this pool. We call them pass-through securities because only the securities buyer (bond buyer) has to pay taxes on his interest income, not the pass-through trust.

Think of an old-fashioned C-corp. The C-corp pays taxes on its net income, and then the stock owners pay taxes on their dividends. C-Loans is a C-corp. Yikes. It's a form on double-taxation.

Congress created authorized commercial mortgage investment pass-through trusts to avoid this double-taxation. (They had created residential mortgage pass-through trusts a couple of decades earlier.) This move to avoid double-taxation created the commercial Real Estate Mortgage Investment Conduit industry ("REMIC") industry.

By the way, a portfolio lender is a lender that makes its loans using its own dough and intends to hold these loans for the entire term. A bank is an example of a portfolio lender. A family office is another example of a portfolio lender.

A commercial lender using a line of credit from a bank is not a portfolio lender because the bank that is providing the line of credit is probably going to reevaluate that credit facility annually. There is no guarantee that the bank will renew it.

Therefore, a commercial lender using a line of credit will need to sell off the commercial loans in his portfolio on a regular basis. He won't hold them until maturity.

Lastly, I have used the term, "large commercial loan", throughout his article. Conduits seldom make commercial loans of less than $5 million.

Some Thoughts on the Coronavirus Crisis:

You will recall that I made you uncomfortable (and probably bored) a few months ago when I described how the virus would soon become a pandemic and that it would cause another great recession, or possibly even a full-blown depression.

I just wanted to remind you that Chinese small business owners, who employ 60% of the Chinese workforce, have been traumatized. They are not going to want to take on additional debt.

The Chinese Communist Party can order the Chinese banks to lend, but it can't order small business owners to borrow. When banks can't find willing borrowers, yet they keep raking in monthly payments, the multiplier effect kicks into reverse. Any monthly payment that is not recycled into a new loan reduces the Chinese money supply by a factor of twenty.

In other words, if a Chinese bank takes in a $1,000 loan payment and doesn't immediately recycle it into a new loan, a whopping $20,000 gets sucked out of the Chinese money supply. In the parlance of economists, $20,000 is destroyed. During the Great Recession, about $4 trillion were destroyed.

The reason why this is important is because even if a cure, or even an effective treatment, for coronavirus is discovered today, the average Chinese small businessmen has already been traumatized. He is not going to be borrowing even more money from the bank.

China is facing a horrible deflationary vortex, where tight money leads to company failures, which leads to employee layoffs, which leaves fewer workers with money to buy products, which leads to less demand, which leads to more company failures and more layoffs. Its an ugly feed-forward cycle, a deflationary vortex.

If President Xi died and made me Emperor, I would put a moratorium on the loan payments on all bank consumer loans and bank business loans in the country. The Chinese Central Bank ("CCB") can easily replace the dough lost by the country's banks. After all, the dough is just digits in some computer.

Now if you hear the Chinese doing such a thing, there may be hope for us all; but absent that, prepare for a deflationary tidal wave coming out of China. Despite what you might think, we do NOT want China to fall into riots and chaos. They make the industrial parts and the medicines that our manufacturers need. They buy a poop-ton of our industrial and agricultural products. We should not wish them ill.

Topics: CMBS loan, conduit loan, hotel loans

George Smith Partners recently released a tombstone about a commercial loan closing that used a financial term of which I had never heard:

George Smith Partners recently released a tombstone about a commercial loan closing that used a financial term of which I had never heard:

"George Smith Partners arranged $23,750,000 in bridge financing for the refinance of a 229-key, full-service hotel located in Downtown Minneapolis, Minnesota... The Property, built in 1986, underwent a PIP in 2017."

What in heavens is a PIP?

A PIP is a Property Improvement Plan required by a brand or franchise - usually a hotel franchise, like Marriott or Hilton - to maintain or improve standards. Often the property owner needs to obtain a secondary loan or refinance the property.

A property improvement plan (PIP) is required to bring a hotel in compliance with brand standards. According to HVS, an effective PIP should help owners gain market share, increase guest satisfaction, drive revenue performance, and enhance profitability. Elements like lighting, faucets, and fixtures are foundational for brand standards, but now energy-efficient equipment upgrades are entering the equation.

One hotel franchisor recently said that her company is pushing hard to incorporate sustainability measures into the conversion process. There are things that the franchise is recommending in order for the franchisee to run an efficient building.

For instance, if a boiler system has a 30-year life expectancy, but it’s only 20-years-old, the franchisee might consider changing it out early because there is no down time, new systems are 30 percent more energy efficient, and there is a good ROI attached. “We’re looking at mechanical systems, chillers, boilers, and things that are not very sexy,” she says. “It’s really important in looking at how much it’s going to cost to operate that piece of property.”

Property Improvement Plans (PIP's) are not cheap. PIP costs can vary greatly with different brands, hotel sizes, and property locations. One of the most popular PIP's, Holiday Inn's Formula Blue, usually costs between $10,000 and $25,000 per room. Since the average Holiday Inn Express location has around 75 rooms, that adds up to between $750,000 and $1.875 million in total costs. Hampton Inn's Forever Young Initiative is another popular PIP, which experts estimate will cost between $15,000 and $40,000 per room.

Yikes. That's real money. SBA loans are often, but not always, utilized to finance a PIP. It is important to understand the types of improvements a prospective hotel owner can make using SBA funds. Experienced hotel owners often focus on the following areas:

Instead of obtaining secondary financing, many property owners choose instead to refinance the entire property. Because ten-year Treasuries are so low, this is the best time in history to refinance your property with a CMBS loan.

Topics: PIP commercial loans

Conduit loans, also known as CMBS loans, enjoy a fixed rate for a whopping ten years. Unlike a fixed-rate commercial loan from a bank, there is no rate readjustment after five years. The rate is fixed for the entire ten years.

Conduit loans, also known as CMBS loans, enjoy a fixed rate for a whopping ten years. Unlike a fixed-rate commercial loan from a bank, there is no rate readjustment after five years. The rate is fixed for the entire ten years.

And with ten-year Treasuries at just 0.79%, there has never been a better time in history to get ten-year, fixed-rate conduit loan.

This guy clearly has a suicide wish.

Conduit loans are priced at some negotiated spread over the higher of ten-year Treasuries or corresponding interest rate swaps. Here is where you go to find ten-year Treasuries. Here is where you go to find today's interest rate swaps (as known as the swap rate). Here is another site that provides interest rate swaps.

Today (3/8/20), ten-year Treasuries are at 0.79%, and ten-year interest rate swaps are at 0.81%. Therefore we will use the higher of the two indices - interest rate swaps.

Okay, but what is the spread or margin over the index? Conduits are pricing their office, retail, and industrial commercial permanent loans at 140 to 290 basis points over the index.

Therefore, we are talking about conduit commercial loans priced at between 2.21% to 3.71%. Wow! So who gets the 2.21% rate, and who has to pay 3.71%? It depends on the loan size, the risk, the debt yield ratio and the tenancy.

The larger the deal, the smaller the spread. The safer the deal, the lower the spread. For example, if your property is located on Madison Avenue in New York City, you will enjoy a lower spread than a deal located on a nice retail street in Salt Lake City. Madison Avenue is a more proven location.

There are some properties, however, that sell for such incredibly low cap rates - for example, Madison Avenue in New York City - that the debt yield can be too low. This is a bad thing. Sometimes the debt yield ratio on that Salt Lake City property can be more attractive to a CMBS investor.

Do not confuse the debt yield ratio with the debt service coverage ratio. Interest rates are so low that it is easy for most commercial properties to offer a 1.25 or higher debt service coverage ratio today. The ratio is almost irrelevant when it comes to conduit-size deals ($5MM and larger).

The quality of your tenants also determines your spread over the index. Quality refers to strength of your tenants. If you have a shopping center anchored by Target or Krogers, you will enjoy a tighter spread than a shopping center anchored by a mom and pop grocery story.

CMBS loans are made by commercial real estate mortgage investment conduits "REMIC's", known as conduits. There are specialized commercial mortgage companies that originate large, cookie-cutter commercial permanent (long term first mortgage) loans for eventual securitization. In layman's terms, a conduit loan is a very plain-vanilla first mortgage on one of the four basic food groups - multifamily, office, retail, and industrial properties.

Is your deal kinky? Does it need a long story to explain it. If so, its probably not a conduit-quality deal.

But it is important to note that your property does NOT need to be almost brand new and very beautiful. Life company lenders demand such properties, but most conduits would be perfectly happy to make $8 million permanent loans on forty-year-old neighborhood shopping centers or on occupied, downtown, office buildings.

Every commercial lender prefers to make loans on multifamily properties, so the spreads on multifamily deals are about 10 bps. tighter. You will not be shocked to learn that hospitality spreads are fifty basis points higher than standard conduit deals.

What about loan-to-value ratios? You will seldom get a conduit lender to go higher than 65% LTV on a hotel. The loan-to-value ratios on the four basic food groups are typically between 70% to 75%. The higher the LTV and the lower the debt yield, the higher the spread (and eventually the higher the interest rate) that the borrower will pay.

Lastly, conduit lenders do NOT lock in their rates at application. Most of them will, however, lock in their spreads, while the conduit commercial loan is in processing. That being said, there will be a floor of 5 bps. to 10 bps. below the interest rate quoted at application. In other words, if interest rates go up during application, the borrower will have to pay a higher rate. If interest rates fall, the borrower might enjoy a slightly lower rate.

Investors, I know you are all freaked out that you might die from this coronavirus (its out to kill all of us "old-gomers"); but you can apply for a conduit loan from the safely of the virus bubble in your home. Focus. If you can close a conduit commercial loan during this crisis, your cash flow, and that of your heirs, will be fantastic! Git 'er done. Ten-year Treasuries may never be lower.

Topics: CMBS loan, conduit loans

A great many residential lenders make revolving lines of credit (home equity loans) on owner-occupied homes; so it it natural for lots of commercial loan brokers to ask if their investor clients can get a a line of credit, secured by an apartment building or an office building.

A great many residential lenders make revolving lines of credit (home equity loans) on owner-occupied homes; so it it natural for lots of commercial loan brokers to ask if their investor clients can get a a line of credit, secured by an apartment building or an office building.

As a general rule, the answer is, "No." Commercial real estate lenders do not make lines of credit secured by investment real estate estate. At least I have never seen or heard of it done in my 43 years in the commercial loan business.

Therefore, I was quite surprised to receive a newsletter from the fine folks at George Smith Partners - one of the oldest commercial mortgage banking firms in the country - that contained the following tombstone:

"George Smith Partners placed a structured senior and collateralized line of credit revolver in a cash-out execution for a business in Los Angeles. The first loan was structured to be self-liquidating over 15 years with a fixed rate of 3.90%. The $1,000,000 second trust deed is a true revolver that can be used as a check-book and has no limitations on uses."

This courageous border collie only charges $600 to re-wire your house.

"The second loan is priced at 3.75% (Prime minus 1%). Funds may be drawn down, re-paid and re-drawn without additional bank approval. There is no non-utilization fee. As the credit line is collateralized, there is no mandatory clean-up for funds outstanding over 12 months."

A revolver is revolving line of credit that allows the borrower to borrow some dough, pay interest on it a for a few months, pay it off, allow the line of credit to rest for six weeks, borrow some more money, pay half of it back, paying interest on the outstanding balance monthly, and then pay off the remaining balance in full.

This particular revolver had no utilization fee. In other words, the borrower does not pay a fee each time that he draws down on his line of credit.

There was no annual clean-up for funds outstanding over 12 months either. Bank regulators require that unsecured lines of credit to be rested (paid down to zero) for at least thirty days every year.

In this case, because the revolver was well-secured by commercial real estate, the bank did not require an annual clean-up.

So where do you go to get a revolver on commercial real estate? I dunno. Until recently, I would have sworn that such lines of credit, secured by commercial real estate, were never made.

Apparently, however, such revolvers are occasionally being made. But then some people swear there is a Santa Claus, and I have never seen him either. Folks, revolvers are very, very, VERY rare; and they are no doubt reserved for commercial loans of least $5 million, made to borrowers with almost as much dough as Michael Bloomberg, who apparently is $500 million poorer these days. Haha!

I am going to try to slip two cute GIF's into this blog article. They probably won't work. So if you see a strange picture just sitting in this article, with no funny text, it will because my attempt to insert a GIF failed.

Topics: Revolver

Posted by George Blackburne on Mon, Mar 2, 2020

Last week I wrote a blog about how historically aggressive private money commercial bridge lenders are getting. This month George Smith Partners, the big commercial mortgage banking company (the original founder started George Smith & Company decades before I founded Blackburne & Sons forty years ago) released a newsletter, FinFacts, containing the following tombstone:

Last week I wrote a blog about how historically aggressive private money commercial bridge lenders are getting. This month George Smith Partners, the big commercial mortgage banking company (the original founder started George Smith & Company decades before I founded Blackburne & Sons forty years ago) released a newsletter, FinFacts, containing the following tombstone:

"George Smith Partners ("GS P") placed a $10,900,000 non-recourse loan for the refinance of an underperforming stabilized 50-unit multifamily community in Los Angeles. The Sponsor recently acquired the asset at approximately 50% below market from an affiliate party, and GSP was able to facilitate approximately $3,000,000in cash out proceeds at closing."

"A portion of the loan proceeds will be used to renovate units as they become vacant in order to achieve current market rents. GSP identified a non-institutional lender (private money lender) who was comfortable with the cash out proceeds and who understood the history and dynamics of this non-arms-length acquisition. The non-recourse loan is fixed for 1.5 years with a 7.99% interest rate and 4.99% pay rate."

Terms:

Interest Rate: 7.99% with 4.99% pay rate

Term: 18 months

LTV: 70%

Recourse: Carve-Outs Only

Fees: 1.0%

Prepayment: None; no exit fee

The reason I brought this closing to your attention is because the Big Girls (the originator of this commercial loan at GSP was a lady) are arranging large commercial bridge loans with less than interest-only payments.

The Big Boys, the ladies and men who make and arrange the really huge commercial real estate loans, have their own specialized language. You can think of it as advanced commercial mortgage-ese. Today we'll discuss one of their underwriting terms, mark-to-market (MTM) accounting in real estate.

The Big Boys, the ladies and men who make and arrange the really huge commercial real estate loans, have their own specialized language. You can think of it as advanced commercial mortgage-ese. Today we'll discuss one of their underwriting terms, mark-to-market (MTM) accounting in real estate.

Mark-to-market accounting assigns a value to real estate assets based on what the property could command on the market if it were sold today. This often means assigning a value based on the current market rents for the building, as opposed to the actual rent being generated from existing tenants.

Now let's use mark-to-market accounting is some real life deals:

When Boston Properties acquired the General Motors building for a record $2.8 billion in June of 2008, it internally assigned a value based on the current market rents for the building, as opposed to the actual rent being generated from existing tenants. The company noted that the average rent being paid at the GM building was $90 a square foot, which it said was half the current market rent of $180 per square foot. This MTM analysis played a significant part on its decision to buy the property.

Here is another one, which I pulled from a closing tombstone in FinFacts, the bi-monthly newsletter of George Smith Partners, one of the largest commercial mortgage banking firms in the country.

Pop Quiz:

What's the difference the a commercial mortgage banker and a commercial mortgage broker? Commercial mortgage bankers retain the servicing on the commercial real estate loans that they originate for life companies and the Agencies. The Agencies include Fannie Mae, Freddie Mac, HUD, and Ginnie Mae.

And what have I been preaching to you for decades? The real money in commercial real estate finance is in loan servicing fees. A commercial mortgage broker is often a poor person. A commercial mortgage banker is usually a rich person.

Okay, so here is the MTM language from FinFacts:

"George Smith Partners secured a $4,500,000 refinance for a 13,051 SF mixed-use property in West Hollywood. The loan is fixed at a rate of 3.92% for a 5-year term. At close, the Property had four month-to-month leases in place, plus two cell tower leases. This was problematic since some lenders would not include MTM income or cell tower income in their underwritten cash flow. Although several lenders offered a competitive interest rate, they used a high stress rate when applying their debt coverage ratio constraint. As a result, most lenders quoted proceeds of less than 45% LTV."

"The selected lender was able to mitigate the impact of these challenges by using a lower stress rate, giving full credit for MTM leases and including the cell tower income. As a result, they were able to provide proceeds of 50% LTV at a fixed rate under 4%."

Sadly My Predictions of Stock Market Doom Were Accurate:

On Sunday I wrote:

"Even if COVID-19 never gets out of control in the U.S., hundreds of thousands of small businesses in China are in serious trouble, especially with tens of millions of their workers confined to their homes. The owners of most small businesses in China have no more than four months worth of operating expenses in savings, and small businesses employ 60% of China's workers."

"And the thing is, many of these small Chinese companies manufacture parts for American companies. As a result, the worldwide supply chain has been shaken. We can't manufacture our own high-value goods without many essential parts coming from China. Container ships coming in from China are coming back only 25% full."

"...A worldwide pandemic is a virtual certainty. I am writing this article on Sunday afternoon. It will be interesting to see if the U.S. stock market gets hammered on Monday."

Unfortunately, the stock market lost more than 1,000 points on Monday, and it has been getting hammered ever since.

You guys are my buddies, and I am trying to warn you. The consequences of this virus are far, far greater than the precious lives that the world will lose. Small business owners in China have been traumatized. They are NOT going to be borrowing more money from their banks.

Grasp the concept that the multiplier effect, in a world of fractional banking, can work in reverse at the rate of 20:1. If a Chinese bank takes in a $1,000 monthly loan payment, and it does not immediately recycle that payment into a new loan, a whopping $20,000 gets sucked out of the Chinese money supply.

Now get your mind around the shocking reality that Chinese banks rake in on the order of US$4 billion per month in loan payments. If these banks have no willing borrowers to whom to lend, the unfathomable sum of US$1 trillion will disappear every year from the Chinese money supply.

Money is going to be destroyed in China like it is being sucked into a black hole. A tidal wave of deflation is likely to sweep over the world. Your $1 million home might be worth just $550,000 in 20 months, even if the authorities can mass-produce a vaccine before the end of the year.

Borrowers have been traumatized, and traumatized borrowers seldom borrow. The government cannot force companies and people to borrow, so the world's money supply is headed down a giant drain. You will see deflation everywhere because no one will have any money.

Think 'ole George is crazy? Think back to the depths of the Great Recession, when Fed Chairman Ben Bernanke injected a whopping $4 trillion into the U.S. money supply. (Remember all of that talk about the Fed's big balance sheet?) Why didn't we have runaway hyperinflation? Because the Fed was merely replacing the $4 trillion worth of money that was destroyed when banks stopped lending and borrowers stopped borrowing during the Great Recession.

I sold all of my stocks and invested in a short fund eight days ago. As my golf buddies would say, when I occasionally sink a long putt, "Even a blind squirrel finds a nut on occasion." Haha!

Or maybe I am one of a small handful of folks who understand that the multiplier effect can work in reverse. I remember reading a wonderful economics book, by James Dale Davidson, entitled The Great Reckoning, in the mid-1990's. In about the middle of the book, in the middle of some chapter, he briefly mentioned, "that under some circumstances, the multiplier effect can actually work in reverse." I remember the blood suddenly rushing to my head, and tiny pins and needles suddenly sweeping all over my body. "Oh, my God!"

So in 2007, a year before the Great Recession, I wrote the financial novel, The Reverse Multiplier Effect, When Crushing Deflation Destroys America. At the time, the concept of deflation was unfathomable, even to most investment advisors. My book prescient. During the Great Recession, trillions of dollars were destroyed, as banks took in loan payments and did not recycle them. Only the heroism and determination of Helicopter Ben Bernanke and his injection of $4 trillion saved this country.

Deflation is coming.

Posted by George Blackburne on Mon, Feb 24, 2020

No one liked my last blog article, Commercial Loans and the Second Great Recession. Not one person. [Sob] But I understand. No one likes to hear bad news.

No one liked my last blog article, Commercial Loans and the Second Great Recession. Not one person. [Sob] But I understand. No one likes to hear bad news.

Unfortunately, my fears of another Great Recession might be on point. The mainstream business media picked up the same theme on Thursday and Friday, as the Dow lost ground. There will be some severe economic consequences from the coronavirus.

Even if COVID-19 never gets out of control in the U.S., hundreds of thousands of small businesses in China are in serious trouble, especially with tens of millions of their workers confined to their homes. The owners of most small businesses in China have no more than four months worth of operating expenses in savings, and small businesses employ 60% of China's workers.

And the thing is, many of these small Chinese companies manufacture parts for American companies. As a result, the worldwide supply chain has been shaken. We can't manufacture our own high-value goods without many essential parts coming from China. Container ships coming in from China are coming back only 25% full.

Clusters of COVID-19 are now out of control in South Korea (602 cases, 3 deaths), Japan (135 cases, not counting cruise ships), Italy (132 cases), and Iran (43 cases, 8th deaths). A worldwide pandemic is a virtual certainty.

I am writing this article on Sunday afternoon. It will be interesting to see if the U.S. stock market get hammered on Monday.

Now on today's training in commercial real estate finance.

In this week's FinFacts, a superb, free publication of George Smith Partners, one partner, after returning from this year's Mortgage Bankers Association Commercial Real Estate Finance ("CREF") Conference, wrote about the competitiveness of bridge lenders:

"Bridge Lenders: Floating rate bridge loan spreads used to be stratified, ranging from 2% to 6% over LIBOR, depending on the transaction dynamics. That's so 2017 (the old days). Now there's a race to the bottom occurring, with lenders bunched up at 2% to 4% over LIBOR. More and more of them are pushing to the bottom of that range."

"So how do lenders differentiate themselves? Deal structure, credit officers are casting a wider net (One lender even remarked: We will do some funky stuff), source of capital (mortgage REIT vs CLO execution vs leveraged debt fund), flexibility, certainty of execution (we met with senior committee members that stressed their lean and efficient approval process), and borrower costs (exit fees can be waived)."

"Warehouse line rates are compressing for debt funds, contributing to tighter spreads on loans and increased leverage. Lenders are more willing to listen to stories. For example: We will look at heavier risk for strong sponsors."

"Also, more heavy bridge loans (major renovation, unoccupied properties) are being priced almost like light bridge. As one lender remarked: No cash flow, no problem, for the right deal. Geographic: Secondary and tertiary markets are being considered, and the right deals are being priced tightly. Yet many high-yield lenders are still in business, now offering high-leverage, non-recourse construction loans or going very high up the capital stack. The net needs to widen as nearly every lender indicated that their marching orders are to increase production over 2019."

Okay, so what on earth is the difference between a heavy commercial bridge loan and a light commercial bridge loan?

A light bridge loan is where there is only some minor renovation and/or the property is a proven location. You may be able to negotiate a bridge loan at just LIBOR plus 2.0% or LIBOR plus 3.0%.

Examples of Light Bridge Loans:

A heavy bridge loan is one involving substantial construction and/or market risk. If you can even find an interested bridge lender, you may have to pay as much as LIBOR plus 4% or even higher.

P.S. I wonder if the Chinese Communist Party ("CCP") will survive this crisis. The average Chinese citizen despises the tight control of the CCP, but they tolerate it because the CCP has been improving their lives annually.

What happens when the growth rate in China plummets from 6% to 7% annually to a negative number? The largely-peaceful protestors in Hong Kong taught the Chinese people how to bring a government to its knees. Think this is a far-fetched scenario? Everyone was shocked at the speed at which the Russian Communist Party lost power. Could beautiful young Chinese girls soon be sticking flowers into the gun barrels of surrounding Chinese soldiers?

Most of you are too young to remember this, but when Russian soldiers and tanks surrounded the Russian pro-democracy protestors in 1991, led by Boris Yeltsin, some beautiful Russian girl started sticked flowers in to the gun barrels of the Russian soldiers. In less than an hour, the surrounding Russian army brigade changed sides and pointed their guns outwards, protecting the protestors.

Boys are so easy. :-)

Topics: Heavy bridge loan, Light Bridge Loan

Posted by George Blackburne on Tue, Feb 18, 2020

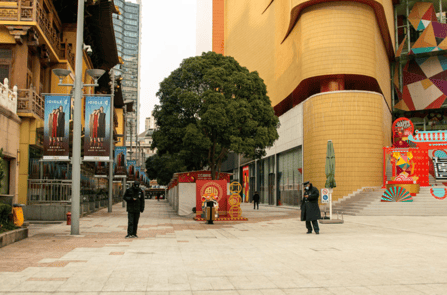

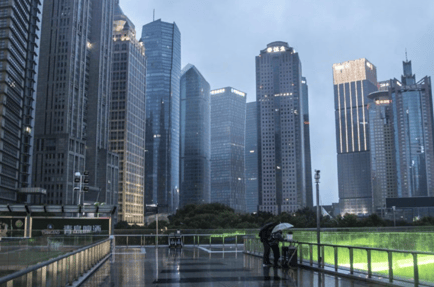

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

Obviously, if the coronavirus gets loose in the United States like its already loose in China, the U.S. economy is going to crumble. A lot of people - especially old 'gomers like me with a bad heart or with bad lungs - will be too afraid to go outside.

Please pay attention!

If your father and mother are over the age of 55, and they have a fairly serious pre-existing health condition, you may have to ground them for three or four months. "Go to your room!" This disease is killing well over 35% (50%?) of these older folks with pre-existing health problems.

This disease starts in the lungs, where it starts killing the cilia - the active little hairs in your lungs that work like oars to stir and to clean out the good mucous that protects your lungs.

In response, the immune system over-reacts (called an Immune System Storm) and floods the lungs with white blood cells. The patient starts to drown from his own immune system response, and breathing becoming increasingly difficult.

In many cases, the coronavirus also attacks the walls of the blood vessels in the lungs, and blood starts to seep out from the arteries and veins into the lungs, further drowning the patient.

In about twenty percent of cases, this evil virus moves on to attack the liver, and it interrupts the blood cleansing process. Not good. Seriously not good. And if the disease moves on to your father's or mother's kidneys, the fatality rate is over 91%.

The good news is that younger adults seem to survive the infection. I read today that in China, doctors are collecting plasma from young adult survivors and giving it to the very sick. It seems to help. Your own children? Don't be reckless, but very few young kids are getting the serious version of this disease. Thank God for that. Thank you, sir. Source for all this medical stuff: Article in the National Geographic.

So, of course, if the coronavirus runs rampant through the United States, the economy is toast; but today I am going to make the argument that even if the coronavirus stays predominantly in China, the U.S. may still suffer another Great Recession.

Pop Quiz:

Q: What's the difference between a Great Recession and an outright economic depression?

A: In a Great Recession, the Fed intervenes and keeps the banks from failing. That was the huge mistake that bank regulators made in the 1930's. We let 9,000 banks fail during the Great Depression - 4,000 in just 1933 alone.

Okay, so why would an economic slowdown in China crush the United States? Once again, it involves the multiplier effect kicking into reverse. You will recall from earlier articles that the multiplier effect is that virtuous cycle whereby a $100 deposit into a bank increases the country's money supply by a whopping $2,000.

In a world of fractional banking, a bank only has to keep a fraction of its deposits on hand in the form of cash, and it is allowed to lend out the rest. Therefore, if Bank A takes in a $100 deposit, it only has to keep $5 in reserve. It can lend out the remaining $95 at a profitable interest rate.

The proceeds of this $95 loan end up eventually as a deposit in Bank B. Bank B keeps $4.75 in reserve (5%), and lends out $90.25. This money eventually ends up in Bank C, which keeps 5% in reserve and lends out the rest. And so on.

The end result is that a whopping $2,000 in new money is created from that single deposit of $100. Twenty-to-one. One divided by the Reserve Ratio demanded by the regulators. 1 / .05 = 20.

Wow. Pretty cool, huh. But here's the problem. The multiplier effect can sometimes work in reverse, thereby destroying vast amounts of a nation's money supply.

Money then becomes tight, businesses fail, workers are laid off, resulting in fewer consumers, reducing demand, lowering prices as companies desperately try to sell their products at some price. Lower prices means lower profits, squeezing the budgets of the surviving companies, resulting in more company failures, more layoff's, and a general circling down the economic drain.

Now let's jump to China. Wong Chiang builds and sells parts for electric scooters. Fearing an economic slowdown due to the coronavirus, Mr. Wong decides not to replace much of his inventory of scooter parts (they might just collect dust on the shelf), so as existing scooter parts sell out, Mr. Wong stops borrowing more money on his inventory line of credit from the bank. In fact, he starts to substantially pay down his line of credit.

Shanghai Bank, his bank, receives a series of loan pay-downs from Mr. Wong totaling $100,000. Since Mr. Wong refuses to borrow more money, Shanghai Bank looks around for some other borrowers to whom it might lend; but it has no takers. Every other business owner in the Shanghai area is equally freaked out about taking on new debt.

Guess what happens? Since the reverse multiplier effect also works at 20:1, Mr. Wong's $100,000 loan pay-down results in the Chinese money supply shrinking by a whopping $2,000,000!

And other Chinese businessmen are also probably paying down their debt right now in anticipation of a recession. The Chinese money supply has to be contracting right now like the tailpipe of a man about to get a prostate exam. Hahahaha! In order to convince older men to get prostate cancer exams, there was once a terrific commercial showing a doctor wearing one rubber glove. "I have performed 2,332 and a half prostate exams." Some poor guy apparently ran out screaming from the exam room. [Oh, my goodness, laughing my tush off.]

With billions of yuan also flowing back to Chinese banks in the form of normal monthly loan payments, the Chinese money supply must be contracting severely right now (20:1). This is extremely deflationary.

Could we see U.S. commercial real estate fall by 45% again? If this epidemic drags on more than a few more months, then the answer is yes.

But wait, why does a contracting Chinese economy mean that the U.S. will soon go into a deflationary recession as well? Think about all of the products that we sell to China. Our exports to China will definitely be declining.

And let's talk about U.S. manufacturing. Parts. Our factories will not be able to get all of the Chinese parts they need to manufacture their own products.

Millions of Chinese are still not back to work after their Chinese New Year vacation. The Chinese Communist Party has closed thousands of factories in order to slow the spread of the virus. Over 50 million Chinese are effectively in quarantine in their own homes. Travel by private car in Wuhan was just banned today.

Is there any hope? The coronavirus does not like heat, humidity, or sunlight. There is some hope that the disease may burn itself out in the Spring; but there is no guarantee.

What can you do? Avoid taking on new debt. Stay liquid, including keeping some extra cash at home. Build up a supply of food. People are starting to go hungry in Wuhan. There were food riots at the supermarkets in Shanghai this week, hundreds and hundreds of miles away from Wuhan. Got a gun? Should you buy another one for your wife, each of your older kids, and your dog? I think so.

Dog and cat food. Some desperate Chinese people have been forced to hurl their sweet dogs and cats from twenty-story buildings because they were competing for the family's dwindling supply of food (and there was unfortunately an erroneous rumor that dogs and cats were acting as a reservoir of the virus).

Toilet paper. I kid you not; there was an armed robbery in China yesterday where the perpetrators stole a huge shipment of toilet paper. "Hey, man, did you get the goods? Yes, we got ten pallets of toilet paper."

But here is some good news. I no longer think the Chinese will be starting a war against us in less than four years. This epidemic must be traumatizing the Chinese people.

The year was 541 A.D. The Western Roman Empire had already fallen to the Visigoths; but the Eastern Roman Empire, headquartered in Constantinople (modern day Turkey), would survive for another 850 years. The Bubonic Plague, carried by fleas, was a pandemic that wiped out much of the population of the Byzantine (Eastern Roman) Empire, as well as that of the Persian Empire.

What I never knew until yesterday was that a horrible economic depression followed the Plague of Justinian (the Roman Emperor in 541). Just sayin'.

We may soon be going through an economic poop storm, and if we do, the banks will quickly exit the market. Please remember that Blackburne & Sons is NOT a mortgage fund. If you are invested in a hard money mortgage fund right now, get the heck out immediately. There is nothing worse than being invested in a hard money fund when the sponsor fails. You'll be lucky to recover 25 cents on the dollar.

Instead, Blackburne & Sons quickly assembles a new and different syndicate to fund every deal. There are always private investors willing to fund a good loan, even when blood is running in the streets. It's simply a matter of interest rate.

Blackburne & Sons was in the market, making commercial loans, every single day of the S&L Crisis, the Dot-Com Meltdown, and the Great Recession.

Commercial lending is all about relationships. Were you smart? When the everything was peachy keen, did you bring your good hard money deals to Blackburne & Sons, or did you foolishly try to establish a relationship with some hard money mortgage fund that will be out of business in the next nine months?

Most hard money mortgage funds are Ponzi Schemes. When new deposits stop flowing into the fund, and the sponsors lack the dough to make new loans and earn new loan fees, hard money mortgage funds fold like a cheap suit. But Blackburne & Sons will still make you a commercial real estate loan - every single day of the Coronavirus Crisis. We are always in the market.

Topics: commercial loans, Coronavirus

Posted by George Blackburne on Mon, Feb 10, 2020

When a bank makes a commercial construction loan, it is certainly not going to take all of the risk. A bank will usually require that the developer cover at least 20% to 30% of the total project cost - land cost, hard costs, soft costs, and a contingency reserve equal to 5% of the hard and soft costs.

When a bank makes a commercial construction loan, it is certainly not going to take all of the risk. A bank will usually require that the developer cover at least 20% to 30% of the total project cost - land cost, hard costs, soft costs, and a contingency reserve equal to 5% of the hard and soft costs.

Usually this takes the form of the developer contributing the land free and clear of any liens, plus having paid much, if not all, of the engineering and architectural fees.

Therefore I was shocked to read a tombstone sent out by my friends at George Smith Partners, one of the oldest commercial mortgage banking companies in the country. You will recall that a tombstone is a closing announcement designed to show the types of commercial loans that a particular lender makes.

The tombstone boasted of the closing of a $4 million non-recourse land loan in Beverly Hills, at 8% interest for one year. This land loan was made at 90% loan-to-cost (LTC)! Ninety percent on a land loan??? I know that Colorado oregano is now legal in California, but 90% LTC on land is an insane amount of leverage. (In this particular case, the cost was the same as the fair market value.)

So I wrote to my buddy, Bryan Schaffer (a very good man), and asked, "Bryan, I don’t understand. What is the exit strategy? Any construction lender is going to expect the developer to contribute the land free and clear, and it might require even more developer’s contribution."

Before I share with you Bryan's answer, I need to explain that, prior to the Great Recession, banks were allowed to give developers credit for the appreciation in the value of their land. For example, suppose a developer purchased some land for $1 million, and three years later, because he bought shrewdly, the land now appraises for $3 million.

Back then, the bank was allowed to value that land at $3 million for equity purposes. Therefore, if the developer only owed $500,000 on this $3 million piece of land, the bank would say that the developer contributed $2.5 million in equity towards the proposed construction loan.

But then the Great Recession hit, and construction lenders took huge losses. To curb what Federal regulators deemed as reckless commercial construction lending, banks were only allowed to value land at the developer's actual cost - in this case, just $1 million. This has greatly restricted commercial construction lending over the past decade.

We are now ready to reveal Bryan's answer to the question, "A land loan of 90% loan-to-value? What the heck have you been smoking?" Haha!

"George, It is very hard to get the full appreciated value of the land. On this deal, if you just did a construction loan, most lenders would only give the developer his basis (actual cost), which was $1.4 million."

"With a $4MM land loan and an appraisal at $4.4 million, the bank will give us at least a $4 million value for land - and most likely the full $4.4 million value. At some banks, if he deposits the $4 million (from the loan proceeds), they will loan him the entire $4 million against it at a very low rate, which he will use to pay off his land loan. He will get the full $4 million to $4.4 million credit (for the value of the land) and will also show $4 million of liquid assets, but it will be in a restricted account."

"So the hard money loan cost him $200K to $300K, but in exchange he does not have to bring in fresh cash of $2-3 million and likely also looks better for future loans because he has the $4 million in a restricted account. It is a little bit of a financial game, and it is only good for someone that does not have the cash. Hope that helps, Bryan."

The hippos imported by Pablo Escobar are breeding like crazy in the wilds of Columbia, and their poop is polluting the local water supplies. Algae blooms.

Did you get lost? It helps to understand that banks only want to lend to developers with lots of cash on hand. Our developer will take this $4 million in land loan proceeds and stick it into the account of the bank which will make the new construction loan. It's a restricted account, so the dough can only be used to construct the proposed 12-unit apartment building.

Because the land has a whopping $4 million loan against it, the bank can't just value the land at the developer's cost of $1.4 million. It makes no sense, so the bank is forced to value it at least at $4 million. And since the bank is already breaking the Fed's rule about valuing the land at the developer's actual cost, they will probably cave in and value the land at its $4.4 million appraised value.

So the land loan costs the developer $200,000 to $300,000 in loan fees and interest - but it reduces by $2 million to $3 million the amount of equity the developer has to contribute to the property.

As Bryan explained, its kind of a shell game (1) to make the developer look liquid and rich; and (2) to get around the Fed's rule that bank construction lenders must value the land at the developer's actual cost. I suspect that there are a lot of parties winking at each other. Haha!

Topics: Land loans

C-Loans.com® is sponsored by C-Loans, Inc. — For more information, contact Tom Blackburne

555 University Ave., Suite 150, Sacramento, CA 95825

Telephone: (916) 338-3232 x 317 * Tom Blackburne in Indiana: (574) 210-6686 * Fax: (916) 338-2328

Real Estate Broker -- California Department of Real Estate -- License Number 01330173

Arizona Dept. of Financial Institutions – License Number 0909472

The Florida Mortgage Brokers License Number: 0708758

Read our many client Success Stories »

© 2025 C-Loans, Inc. All rights reserved.