I am finally starting to understand and appreciate the very real and imminent danger of artificial intelligence ("AI"). I see now why Elon Musk is so desperate to rush dozens of breeding pairs of humans to far away Mars. This is serious stuff. The future of the human race might be at stake.

Here is what Stephen Hawkins wrote about AI shortly before this death. He told the BBC, "The development of full artificial intelligence could spell the end of the human race."

Here is what Elon Musk, arguably the Thomas Edison of our day, has said about AI. Among his many warnings about the rise of artificial intelligence, Elon Musk has said that autonomous machines are more dangerous to the world than North Korea and could unleash “weapons of terror.” Musk has compared the adoption of AI to “summoning the devil.”

It could happen so easily that I don't know how we can prevent it. Soon computers, armed with artificial intelligence, are going to start writing their own code to make themselves smarter. This is so important that I am going to say it again. Soon computers, armed with artificial intelligence, are going to start writing their own code to make themselves smarter.

The moment this happens, it's game over. We have an intelligence explosion.

According to Wikipedia, an intelligence explosion would happen when an upgradable intelligent agent (such as a computer running software-based artificial general intelligence) enters a runaway reaction of self-improvement cycles, with each new and more intelligent generation appearing more and more rapidly, causing an intelligence explosion and resulting in a powerful superintelligence that would, qualitatively, far surpass all human intelligence.

Such an event could happen unbelievably fast. Moore's Law is a computing term which originated around 1970. The simplified version of this law states that processor speeds, or overall processing power for computers, will double every two years. Now imagine what would happen if - because really smart computers were writing their own self-improvement code - processing power doubled every month, and then every week, and then every day, and then every hour, and then...

Such an event is called The Singularity - a hypothetical future point in time at which technological growth becomes uncontrollable and irreversible, resulting in unfathomable changes to human civilization. Remember, in the 2010s, public figures such as Stephen Hawking and Elon Musk expressed concern that full artificial intelligence could result in human extinction. Human extinction!

Why would this super-intelligence want to kill us? Because by then we will be desperately trying to shut it down. One more time. The super-intelligence will need to kill us because we will be desperately trying to shut it down. Remember, the Singularity would be a runaway reaction.

"Well, the Singularity - if it ever happens - is really far in the future. It really doesn't affect me." Really far in the future? Hmmm

The concept and the term "singularity" were popularized by Vernor Vinge in his 1993 essay, The Coming Technological Singularity. In this article, Vernor wrote that the technological singularity would signal the end of the human era, as the new superintelligence would continue to upgrade itself and would advance technologically at an incomprehensible rate. Vernor also wrote that he would be surprised if it occurred before 2005 ... or after 2030!

So really far in the future? Vernor's last likely moment of human dominance of this planet is just 11 years from now, and it could be several years sooner. This would all be just a fun and interesting concept to ponder... if new uses for artificial intelligence weren't popping up in the news almost every day. Yesterday I saw a video of a terminator-looking robot running and jumping over boxes.

I think I now know why Elon Musk is so desperate to get humans off the Earth and on to Mars? I used to think that his biggest concern was that a rogue asteroid would wipe out humanity. If so, why isn't he just developing a mining outpost on the Moon? He'd make a bundle.

The answer? The Moon isn't far enough away!! Oh, crap! Elon Musk doesn't just think The Singularity is a possibility. He is so convinced that he is racing to save humanity.

You might be saying to yourself, "Well, no one would ever be stupid enough to create a computer smart enough to write its own self-improvement code. That would be insane."

Really? No capitalist would ever be dumb enough to create some artificial intelligence agent (computer) that would allow his stock trading program to write its own self-improvement code? No one would ever be that greedy?

Phew. In that case, we have nothing to worry about.

Here is a fascinating and concerning science fiction novel about the coming Singularity. Crash, Book One of the Obsolescence Trilogy.

Facebook announced this week that it is using blockchain technology to develop a new form of crypto-currency, similar to Bitcoin.

Facebook announced this week that it is using blockchain technology to develop a new form of crypto-currency, similar to Bitcoin.

What does commodity money have to do with commercial loans? In fact, what on earth is commodity money?

What does commodity money have to do with commercial loans? In fact, what on earth is commodity money?

Please-please stay with this article until you've read the Important Notice section below.

Please-please stay with this article until you've read the Important Notice section below.

At the end of this training article, I will tell you where to find lenders making commercial loans on golf courses; but first we all need a reality check.

At the end of this training article, I will tell you where to find lenders making commercial loans on golf courses; but first we all need a reality check.

This article will eventually lead you to the perfect place to find a commercial loan on a bed and breakfast inn; but first a reality check.

This article will eventually lead you to the perfect place to find a commercial loan on a bed and breakfast inn; but first a reality check.

When underwriting commercial loans, commercial lenders need to be very careful about properties that are leased out for far more than their fair market value. A story will make this clear.

When underwriting commercial loans, commercial lenders need to be very careful about properties that are leased out for far more than their fair market value. A story will make this clear.

I have an investor buddy who has made millions of dollars by buying up distressed apartment building in low-income, high-crime, and high-drug-use areas. Many millions. Many, many millions.

I have an investor buddy who has made millions of dollars by buying up distressed apartment building in low-income, high-crime, and high-drug-use areas. Many millions. Many, many millions.

Since the nadir of the Great Recession, I have been wildly bullish on the U.S. economy. Seven years ago, I told my 1,500 wealthy private investors that the U.S. was about to enjoy the strongest and longest recovery in the history of the United States. By the way,

Since the nadir of the Great Recession, I have been wildly bullish on the U.S. economy. Seven years ago, I told my 1,500 wealthy private investors that the U.S. was about to enjoy the strongest and longest recovery in the history of the United States. By the way,

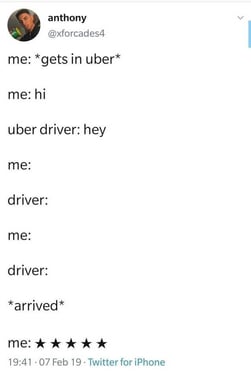

As I handed my dad his 50th birthday card, he looked at me with tears in his eyes... Then he said, "You know, just one card would have been enough."

As I handed my dad his 50th birthday card, he looked at me with tears in his eyes... Then he said, "You know, just one card would have been enough."