In my early years of brokering commercial loans to savings and loan associations (S&L's) - the most active type of commercial real estate lender 35 years ago - the debt service coverage ratio was the bane of my existence. Arghh! I hated that darned ratio. It killed soooo many of my commercial loan deals.

In my early years of brokering commercial loans to savings and loan associations (S&L's) - the most active type of commercial real estate lender 35 years ago - the debt service coverage ratio was the bane of my existence. Arghh! I hated that darned ratio. It killed soooo many of my commercial loan deals.

Example:

My client was buying a small office building on the San Francisco peninsula in 1988 for $1,000,000. His plan was to put down 25%, and I submitted a $750,000 first mortgage request to Bayview Federal Savings. My loan officer at Bayview went out and drove by the property. Thumbs up.

Then we went to Loan Committee, and these stingy misers came back and said that at a 1.25 debt service coverage ratio, with an 11.5% interest rate and a 25-year amortization, the property would only carry a $625,000 new loan!!! Just 62.5% LTV? On a purchase money loan? Are you kidding me? Sometimes the only solution is a warm bath and a sharp razor.

Quick Review of the Debt Service Coverage Ratio:

You will recall that the debt service coverage ratio (DSCR) is the defined as an income property's net operating income divided by the proposed annual loan payments - known as the debt service. The proper form is:

1.xx

It is customary for the debt service coverage to be expressed as two digits to the right of the decimal point; i.e., out to the hundredths of 1%.

Example:

The Maple Apartments enjoys a net operating income (NOI) of $80,000. The owner has applied for a $900,000 refinance of the property, and First National Bank is offering a 4.875% loan, amortized over 25 years. The debt service (annual payments) on this proposed $900,000 loan is $63,252. Compute the debt service coverage ratio ("DSCR").

DSCR = NOI / Debt Service

DSCR = $80,000 / $63,252 = 1.26

It is important to note that when computing the debt service coverage ratio that you must use annual figures; i.e., the annual NOI and the annual loan payments. You can't do the calculation using 1/12th of the NOI and just the monthly payment on the loan.

This is unfortunate because if you were allowed to compute the debt service coverage ratio on a monthly basis, you could qualify for a slightly larger loan amount; e.g., maybe a loan of $1,023,000 rather than just $1,000,000. Sorry. Nice try. But commercial lenders will make you do the calculation on an annual basis.

The Point of Today's Training Article:

Just so that we do not lose sight of our objective here, you will recall that the title of this article suggests that the debt service coverage ratio is now almost irrelevant.

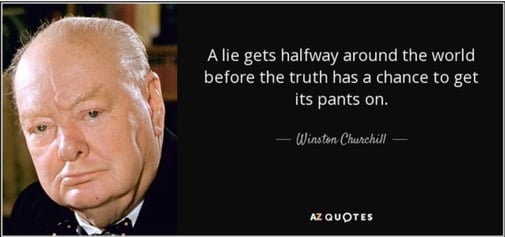

It's arguably true. Last week ten-year Treasuries plunged 50 basis points. A basis point is 1/100th of one percent. Therefore 50 basis points is 50/100th of one percent - or one-half of one percent.

Commercial loans from banks are typically priced at 2.75% to 3.5% over 5-years. Treasuries. Careful: It was the yield on ten-year Treasuries, not five-year Treasuries, that briefly plunged 50 basis last week and set off the whole inverted yield curve panic.

By the way, the reason why our bond yields plunged is because the yield on German bunds went negative this month and sent European bonds buyers rushing over to the U.S. for yield. A bund is a bond issued by the German government.

As to an inverted yield curve - when three-month Treasury bills have a higher yield than ten-year Treasury bonds - don't freak out. Inverted yield curves only correlate to a recession within 18 months if the difference in yields stays at 50 basis points for at least three months.

Okay, We are Finally Here:

With ten-year Treasuries plunging, five-year Treasuries have also declined to just 2.18% as of March 29, 2019. Five-year Treasuries were 2.45% one month ago and 2.58% one year ago.

Since permanent commercial loans from banks are typically priced at 2.75% to 3.5% over five-year Treasuries, we are looking at commercial loans of only 4.93% to 5.68% today. These loans are fixed for the first five years, readjusted once, and then fixed for five more years.

Wow. At today's low commercial loan rates, few commercial loans will be constrained by a 1.25 debt service coverage ratio. Still smarting from the losses they took during the Great Recession, however, commercial banks may still limit their new permanent commercial loans to just 68% to 70% loan-to-value.

Credit unions, on the other hand, are flush with cash. Look for a few credit unions to close some commercial loans this quarter at a full 75% LTV.

Need a small commercial loan of less than $1 million. Sometimes small multifamily, office, retail, and industrial buildings - particularly office and industrial condo's - sell at very low cap rates, and they don't cash flow very well. Blackburne & Sons will gladly lend up to 75% LTV, almost regardless of negative cash flow if your buyer and borrower has good global income. These are NOT bridge loans but rather permanent loans (30/15) with no prepayment penalty.

Someone applied for a $32 million commercial construction loan on

Someone applied for a $32 million commercial construction loan on

One day a lawyer was riding in his limosine when he saw a guy eating grass. He told the driver to stop. He got out and asked him, "Why are you eating grass".

One day a lawyer was riding in his limosine when he saw a guy eating grass. He told the driver to stop. He got out and asked him, "Why are you eating grass".

The LAPD, The FBI, and the CIA are all trying to prove that they are the best at apprehending criminals. The President decides to give them a test. He releases a rabbit into a forest and has each of them try to catch it.

The LAPD, The FBI, and the CIA are all trying to prove that they are the best at apprehending criminals. The President decides to give them a test. He releases a rabbit into a forest and has each of them try to catch it.

Twenty years ago, if you wanted a commercial loan, you might have applied to a savings and loan association, a thrift and loan association, or even a credit company. None of these company types are making many commercial loans today; so I am not even going to bother to describe them. They have gone the way of the buffalo.

Twenty years ago, if you wanted a commercial loan, you might have applied to a savings and loan association, a thrift and loan association, or even a credit company. None of these company types are making many commercial loans today; so I am not even going to bother to describe them. They have gone the way of the buffalo.

Imagine the following fanciful scenario. Beto O’Rourke wins the Democratic nomination, and the presidential campaign for President in 2020 is hard fought and bitter. O’Rourke loses in a close race, and then Trump sets out to ruin O’Rourke’s most important supporters and donors.

Imagine the following fanciful scenario. Beto O’Rourke wins the Democratic nomination, and the presidential campaign for President in 2020 is hard fought and bitter. O’Rourke loses in a close race, and then Trump sets out to ruin O’Rourke’s most important supporters and donors.

Before the Great Recession, there were about 300 hard money mortgage companies making commercial loans across the country. By the end of the Great Recession, fewer than 20 of them survived.

Before the Great Recession, there were about 300 hard money mortgage companies making commercial loans across the country. By the end of the Great Recession, fewer than 20 of them survived.

Before we get into the subject of syndicated commercial construction loans and where to get your large commercial construction project funded, we have an important announcement.

Before we get into the subject of syndicated commercial construction loans and where to get your large commercial construction project funded, we have an important announcement.