By the end of this training article, you will know what banks are quoting on commercial loans on office buildings, retail buildings, shopping centers, and industrial buildings; i.e., what commercial banks are quoting on permanent loans.

By the end of this training article, you will know what banks are quoting on commercial loans on office buildings, retail buildings, shopping centers, and industrial buildings; i.e., what commercial banks are quoting on permanent loans.

You will know these commercial loan rates exactly, and you will know these commercial loan rates without the need to call anyone. As a silly character in the 1950's-era sitcom, Dobie Gillis, used to say, "Good stuff, Maynard."

But first I have a reminder: Commercial banks across the country quote almost the exact same commercial loan, whether the bank is located in Bangor, Maine or in San Diego, California. (Please read that last sentence again and embrace it!)

That loan will be the current commercial loan rate for banks, fixed for the first five years, readjusted once at the beginning of year six to 2.75% to 3.50% over five-year Treasuries, 1 point, 25-years amortized, ten years due, and a declining prepayment penalty, commonly 5-4-3-2-1-open- 5-4-3-2-1. Open means no prepayment penalty. If the property is older than 40 years, most banks will cut the amortization down to 20 years.

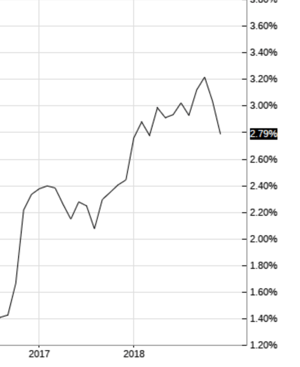

Okay, so what is the current commercial loan rate? You compute it first looking up 5-year Treasuries. Just go to Google and type, "5-year Treasuries." Presto-chango! You have your answer. As of December 27, 2018, five-year (constant maturity) Treasuries are 2.60%.

And now for the magician's trick. Drum roll please, Maestro. Just add 2.75% to 3.50% to five-year Treasuries to get your answer: And of December 27, 2018, banks across the country are quoting 5.35% to 6.10% for commercial permanent loans.

So when do you get 5.35% and when do you get 6.10%? Its depends on the beauty of the property, the location of the property, the loan-to-value ratio, the liquidity of the borrower (banks love-love-love liquidity), and the net worth and credit of the borrower.

Basically, Ginger gets 5.35%. Mary Ann gets 6.10%. It's really this simple.

What about apartments? Typically apartment loans, which are always the most coveted kind of income property loan, are 20 to 30 basis points cheaper. You will recall that a basis point is just 1/100th of one percent. Twenty-five basis points is one-quarter of one percent. Therefore, apartment loans are around one-quarter of one percent cheaper than commercial loans.

I had to look it up too. Euripides wrote scores of tragedies in the days of ancient Athens.

Whenever a commercial mortgage lender offers you or your client an adjustable mortgage loan (AML), it is very important that you compute the implied rate before accepting the loan.

Whenever a commercial mortgage lender offers you or your client an adjustable mortgage loan (AML), it is very important that you compute the implied rate before accepting the loan.

Swap spreads is another popular index in commercial real estate finance.

Swap spreads is another popular index in commercial real estate finance.

I have no lessons about commercial loans today. Instead, let's just have some fun on this relaxing Boxing Day.

I have no lessons about commercial loans today. Instead, let's just have some fun on this relaxing Boxing Day.

So I told you that we have a dog door for our animals to go out, but wild animals can come in using that door. We first realized that we had a problem when we discovered that local raccoons were carefully washing their paws in our water bowl before dining on our dog food. "For these gifts we are about to receive..." Then the HUGE neighborhood tom cat got trapped by our dogs in our house. That darned cat was so big and fierce that he had absolutely no fear of me. I found myself backing up. Buck-buck-buck. Haha!

So I told you that we have a dog door for our animals to go out, but wild animals can come in using that door. We first realized that we had a problem when we discovered that local raccoons were carefully washing their paws in our water bowl before dining on our dog food. "For these gifts we are about to receive..." Then the HUGE neighborhood tom cat got trapped by our dogs in our house. That darned cat was so big and fierce that he had absolutely no fear of me. I found myself backing up. Buck-buck-buck. Haha!

Perhaps you sold a small commercial building, and you carried back a commercial loan; or perhaps you

Perhaps you sold a small commercial building, and you carried back a commercial loan; or perhaps you

Contracts of sale come up modernly when fix-and-flippers sell their recently renovated houses to buyers who lost their prior home during the Great Recession. These receivables are a terrific source of cash flow and wealth, and in my next blog article we are going to talk about how to value them, how to sell them, and how to borrow against them.

Contracts of sale come up modernly when fix-and-flippers sell their recently renovated houses to buyers who lost their prior home during the Great Recession. These receivables are a terrific source of cash flow and wealth, and in my next blog article we are going to talk about how to value them, how to sell them, and how to borrow against them.

The Huns were not the same race of people as the Mongols. Genghis Khan led his hordes into China, across Russia, and into Europe in the 13th Century (1210-1260). The Huns were from a much earlier time. The Huns were a nomadic people who lived in Central Asia, the Caucasus, and Eastern Europe, between the 4th and 6th century AD.

The Huns were not the same race of people as the Mongols. Genghis Khan led his hordes into China, across Russia, and into Europe in the 13th Century (1210-1260). The Huns were from a much earlier time. The Huns were a nomadic people who lived in Central Asia, the Caucasus, and Eastern Europe, between the 4th and 6th century AD.