To understand our new feature, you need to understand tombstones. A tombstone is an annoucement of the successful closing of some financial deal, like taking a company public or closing some large loan or bond issue. Historically tombstones were placed in financial publications, like the Wall Street Journal, the Financial Times, or the New York Times.

To understand our new feature, you need to understand tombstones. A tombstone is an annoucement of the successful closing of some financial deal, like taking a company public or closing some large loan or bond issue. Historically tombstones were placed in financial publications, like the Wall Street Journal, the Financial Times, or the New York Times.

The announcements were rectangonal in shape and oriented in a portrait mode. They literally looked liked tombstones. The content was always very dry. "Goldman Sachs is pleased to announce the secondary offering sale of 2,000,000 shares of Chrysler Motors at $100 per share for a total equity raise of $200,000,000. Morgan Stanley and Credit Suisse participated in the offering."

The Securities Exchange Commission ("SEC") for many years forbade the public advertisement of securities offerings. Therefore tombstones were therefore always backwards-looking. They announced the closing of some securities offerings. Since the deal was already closed, and any reader of the tombstone could no longer buy a piece of the offering, a tombstone was not considered an advertisement.

So why would an investment banker, like Goldman Sachs in my example above, pay the Wall Street Journal $10,000 or more to publish a tombstone for a deal that was already closed? The advertisment was not going to bring in new investors for the offering because the offering had already closed. The offering was already fully-subscribed; i.e., sold out. Answer: The tombstone told other motor companies, like GM and Ford, that Goldman Sachs stood ready to raise a secondary offering for them as well. It also told other investors to call Goldman Sachs if they had investment dough burning a hole in their pockets.

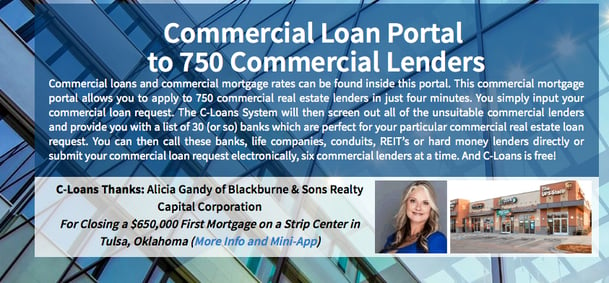

Modernly commercial real estate lenders publish their tombstones online on their home pages, in their newsletters to their clients and brokers, and in the online version of trade magazines, like the National Real Estate Investor or Globe Street. It is always smart to study every commercial loan tombstone that you can find because by studying what commercial loans a lender has already closed, you will know what kind of new commercial loans that the lender is seeking. In other words, be sure to read tombstones! :-)

C-Loans.com has just added a new tombstone feature on our home page. Ten seconds after arriving on our home page, a series of rotating tombstones will appear. The one you will see today is for a commercial loan closed by Alicia Gandy, our top producer who we call our Loan Goddess. You will notice that the tombstone brags about a $650,000 closing of a permanent loan on a strip center in Tulsa, Oklahoma.

If you click on the link that reads, "More Info and a Mini-App", you will be taken to a page that tells you more about this particular lender, in this case Blackburne & Sons Realty Capital Corporation. You'll see the lender's preferences in terms of loan sizes, loan types, property types, and lending area. You can also apply directly to this hungry commercial lender by filling out the mini-app.

Are you a commercial mortgage broker? If so, you will be cheated out of countless loan fees. When you have suffered enough...

Do you have an "A quality" deal that deserves to be funded by a bank, life company, or conduit?

Are you finally ready to learn commercial real estate finance (CREF)? You can learn this entire profession in one long weeked, and most states have no licensing requirement to broker commercial loans.

Have you checked out our latst commercial mortgage portal? CommercialMortgage.com is far easier than C-Loans.com, and it enjoys four times as many lenders.

Be on the lookout for bankers making commercial loans. We'll trade you contents of one business card for a free directory of 2,000 commercial real estate lenders.

Do you need a business loan secured by something other than commercial real estate?

Want to learn commercial real estate finance for free?

Got a buddy or a co-worker who would benefit from learning commercial real estate finance?

TILA and RESPA are Federal laws designed to give borrowers advance disclosure of the costs of the loans for which they are applying. Under the new Dodd-Frank regulations, t

TILA and RESPA are Federal laws designed to give borrowers advance disclosure of the costs of the loans for which they are applying. Under the new Dodd-Frank regulations, t

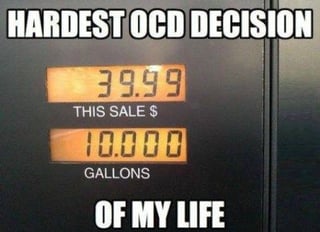

This is going to be a very short training article because the Chinese were right. A picture is worth a thousand words. Today a mortgage broker submitted the attached picture on his

This is going to be a very short training article because the Chinese were right. A picture is worth a thousand words. Today a mortgage broker submitted the attached picture on his