If you have a balloon payment coming due on your commercial property, or if you are trying to buy an investment property, and you don't have a whopping 42% of the purchase price to put down in cash, this article is super-important to you.

If you have a balloon payment coming due on your commercial property, or if you are trying to buy an investment property, and you don't have a whopping 42% of the purchase price to put down in cash, this article is super-important to you.

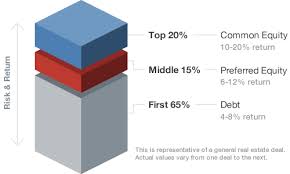

Preferred equity is a wonderful form of commercial real estate capital that can save your bacon, whether you're a commercial loan broker or a commercial real estate investor. Some examples will hammer home this critical concept.

Let's suppose that you're a commercial real estate investor. You make your living buying and leasing out office buildings and shopping centers. In 2004, you paid $2.6 million for a strip center in Los Angeles. You put down $650,000 (25%) and took out a $1,950,000 new first mortgage from Ruby Bank. This new commercial first mortgage had a 10-year term.

It's now the year 2014. Your $1,950,000 first mortgage is ballooning, and you realize that you have a problem. During the trough of the Great Recession, your $2.6 million strip center had fallen in value to just $2 million. Fortunately, with the recovery, your strip center is now worth $2.5 million; but that's not enough.

The problem is that few commercial banks will make commercial real estate loans in excess of 58% to 63% loan-to-value today. Even if you could convince a bank to make you a loan of $1,575,000 (63% of $2.5 million), the proceeds of the loan won't be enough to pay off your $1,950,000 existing first mortgage. Yikes!

Even forgetting about points and closing costs, you will be short a whopping $375,000. The bank will expect you to bring the shortfall to the closing; but you don't have $375,000 in cash! You barely survived the Great Recession without losing any property. To make matters worse, you personally guaranteed the loan from Ruby Bank. You're in deep trouble. Your dog could leave you, and your wife could bite you.

You sit down with your banker, and you ask him, "What if I could find a hard money lender to make a $375,000 second mortgage?" The banker replies, "Commercial banks won't allow second mortgages behind their commercial first mortgages these days. They don't want the propety overburdened with debt. The danger is that if the owner's cash flow gets tight, he might be tempted to use the money earmarked for repairs and maintenance to make the payments on the second mortgage. The property will fall into disrepair, the tenants will move out, and the bank will end up foreclosing on a run-down, vacant strip center with a leaking roof and mold all over it."

"What am I going to do?" you ask the banker. The banker replies, "You need to find a partner to contribute $375,000 in cash to the deal, in return for a partial ownership of the building." So you go to your brother-in-law, begging for cash, only to find out that he is as impoverished as you are.

Fortunately you find Blackburne & Sons, the only realty capital provider in the country making small preferred equity investments (its easier to think of them as preferred equity loans), from $100,000 to $600,000. Most preferred equity providers won't even look at deals smaller than $3 million.

Blackburne & Sons agrees to invest $300,000 in preferred equity into your property, bringing the preferred equity capital stack (the sum of the first mortgage plus the preferred equity) up to 75% of value. This means that you, the owner, still have to bring to the closing table $75,000 in cash, but this smaller amount is far more manageable. It sure beats defaulting on your balloon payment and getting sued for the deficiency.

Here's another example of how preferred equity can save your bacon:

You're a commercial loan broker. You have a wealthy commecial real estate investor who wants to buy an office building in Pleasanton, California for $3 million. Your customer is insisting on a new permanent loan of 75% loan-to-value, but of the 13 banks that you have approached, none of them would lend more than 63% of the purchase price. Your buyer refuses to put down more than $750,000, but the bank won't lend more than $1,890,000. You are short $360,000, but the bank won't even allow the seller to carry back a second mortgage. You're at loggerheads.

A $360,000 preferred equity investment from Blackburne & Sons can save this deal, along with your $22,750 commission (1 point).

Why would the bank allow a $360,000 preferred equity investment, but not a $360,000 second mortgage from the seller? Preferred equity is NOT a loan. If the buyer doesn't have the cash flow to make the preferred equity yield payments, he doesn't have to make them. They simply accrue and defer. The buyer doesn't have to neglect the needed repairs on the property in order to make the payments. This is the critical distinction between a second mortgage loan and a preferred equity investment.

Preferred equity is not cheap. It will cost the borrower between 16% and 22% annually, plus an 8 point investment banking fee to raise the capital. The investment term is five years. If the buyer does not pay us off at that time, the property will be sold to pay off the preferred equity investment. Any remaining profit goes to the buyer.

Why is preferred equity so expensive? Preferred equity competes against private money first mortgage investments, which can yield up to 12% to 14%. Clearly a $300,000 preferred equity investment behind a $2.5 million first mortgage from the bank is far-far more risky than a $300,000 hard money first mortgage investment. Suppose the tenants move out? The monthly payments on the underlying first mortgage from the bank could be $14,000 per month. Imagine making $14,000 monthly payments, month after month, as you deperately try to find new tenants.

But there is good news. Blackburne & Sons can be bought out at any time for what is "owed"; i.e., its original investment, any advances, interest on the advances, plus a 17% per annum preferred equity yield on the original investment. If our deal were a loan, you would say that our loan had no prepayment penalty.

An example will make this more clear. Let's suppose that Robert Buyer teams up with Blackburne & Sons to buy for $1 million a small row retail building in downtown Palo Alto, California. Mr. Buyer puts up $250,000 and Blackburne & Sons puts up $120,000 in a preferred equity position. The bank makes a new commercial loan of $630,000. The agreed-upon preferred equity return is 17%.

Just weeks after we buy the property, Apple Computer decides to buy this entire block in Palo Alto as part of their campus. Apple agrees to pay a ridiculous sum, a whopping $2 million. The all-cash deal closes just 10 days later. The equity holders get to split a cool $1 million profit. But who gets what?

The profit distribution plan of an equity venture is called a waterfall. In this case, the first equity investor to be repaid its $120,000 principal investment is Blackburne & Sons. Is there any more left over? Yup, there's TONS of money left over. Okay, so Robert Buyer gets back his $250,000 principal investment. Is there any money left over? Yes.

Therefore, Blackburne & Sons earns its preferred return of 17% annually (prorated for 37 days), so we earn a whopping $397. The balance of the $1 million profit ($999,603) goes to Robert Buyer!

Preferred equity capital is expensive. Therefore the wise borrower will repay Blackburne & Sons at the fastest possible pace.

Are you a commercial mortgage banker? If so, you would be wise to heed my words here. This is a brand new program, and no one in the marketplace knows about it. Using our preferred equity, you can give your buyers and borrowers more leverage that any other mortgage banker in the country. This gives you a HUGE marketing advantage. In commercial real estate finance, the commercial mortgage banker who wins the deal and earns the fee is often NOT the guy with the lowest rate, but rather the guy who offers his borrowers the most dollars.

So be smart here. Promote the heck out of this program!

A Special Use Property (aka: Single-Purpose Property) is a property whose design, construction, and use precludes uses other than that for which it was built.

A Special Use Property (aka: Single-Purpose Property) is a property whose design, construction, and use precludes uses other than that for which it was built.

If you have a balloon payment coming due on your commercial property, or if you are trying to buy an investment property, and you don't have a whopping 42% of the purchase price to put down in cash, this article is super-important to you.

If you have a balloon payment coming due on your commercial property, or if you are trying to buy an investment property, and you don't have a whopping 42% of the purchase price to put down in cash, this article is super-important to you.

Commercial loans are still quite hard to close these days. Here are ten practical tips that will help you qualify for a commercial loan:

Commercial loans are still quite hard to close these days. Here are ten practical tips that will help you qualify for a commercial loan:

If you are a conventional buyer of commercial real estate, or if you are a commercial broker, this article is VERY important to you. The reason is because you are about to discover a BIG problem with your next commercial real estate loan.

If you are a conventional buyer of commercial real estate, or if you are a commercial broker, this article is VERY important to you. The reason is because you are about to discover a BIG problem with your next commercial real estate loan.