If you are a conventional buyer of commercial real estate, or if you are a commercial broker, this article is VERY important to you. The reason is because you are about to discover a BIG problem with your next commercial real estate loan.

If you are a conventional buyer of commercial real estate, or if you are a commercial broker, this article is VERY important to you. The reason is because you are about to discover a BIG problem with your next commercial real estate loan.

It is very hard these days for a buyer or a commercial broker to put together a conventional purchase of an investment property, like an office building or a shopping center. Banks today will only make commercial mortgage loans up to around 58% to 63% loan-to-value. This means the buyer of a commercial property - assuming he can't get an SBA loan - has to put 37% to 42% down in cash. Who has that kind of money?

The good news is that Blackburne & Sons has a wonderful new commercial loan product - more precisely a preferred equity investment - that will solve this problem for you.

Why are the banks so conservative when underwriting commercial real estate loans today? Many commercial banks lost a ton of money in commercial real estate loans during the Great Recession. These banks watched in horror as commercial real estate fell in value by 45%. In addition, the portfolios of many commercial banks are too heavily invested in commercial loans today. Why? They can't get these legacy loans (loans written before the Great Recession) off the books. Although the vast majority of these legacy loans are current, a great many of them are past maturity, and they exceed 85% loan-to-value, based on today's lower values. Yikes!

To make matter worse, not only will few banks make commercial loans that exceed 58% to 63% loan-to-value, these banks will NOT allow junior financing (a second mortgage). In other words, the seller cannot carry back a second mortgage. The banks don't want to see these commercial properties over-burdened with debt.

"Okay, George, you promised me the cure for this problem. Let's hear it."

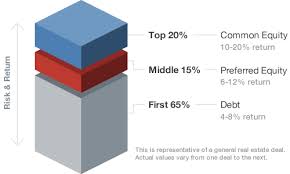

Blackburne & Sons will add its dough to the buyer's downpayment to come up with the 37% to 42% required by the bank. Typically the buyer will come up with the first 20% to 25%, and we'll come up with the rest. In return, Blackburne & Sons will take a preferred equity investment in the property.

A preferred equity investment is NOT a second mortgage or even a mezzanine loan. It's an equity investment. The buyer of the property is not promising to pay any interest rate to the preferred equity investor, nor is he promising to even repay the preferred equity investor's original investment. Repayment is dependent on the success of the real estate venture.

If the real estate venture is successful, however, the first equity investor to be repaid is the preferred equity investor. He's special (said in the voice of the Church Lady from Saturday Night Live). The original buyer of the property - who owns what is known as the common equity - only gets paid any profit after the preferred equity investor gets repaid his original investment, plus the agreed-upon preferred return.

An example will make this more clear. Let's suppose that Robert Buyer teams up with Blackburne & Sons to buy for $1 million a small row retail building in downtown Palo Alto, California. Mr. Buyer puts up $250,000 and Blackburne & Sons puts up $120,000 in a preferred equity position. The bank makes a new commercial loan of $630,000. The agreed-upon preferred equity return is 17%.

Just weeks after we buy the property, Apple Computer decides to buy this entire block in Palo Alto as part of their campus. Apple agrees to pay a ridiculous sum, a whopping $2 million. The all-cash deal closes just 30 days later. The equity holders get to split a cool $1 million profit. But who gets what?

The profit distribution plan of an equity venture is called a waterfall. In this case, the first equity investor to be repaid its $120,000 principal investment is Blackburne & Sons. Is there any more left over? Yup, there's TONS of money left over. Okay, so Robert Buyer gets back his $250,000 principal investment. Is there any money left over? Yes.

Therefore, Blackburne & Sons earns its preferred return of 17% annually (prorated for 37 days), so we earn a whopping $397. The balance of the $1 million profit ($999,603) goes to Robert Buyer!

An important and very favorable point to notice here is that Blackburne & Sons can be bought out at any time for our original principal, plus its preferred return (17% annually in this example) since inception, compounded, with no prepayment penalty!

Let's look at another example. Let's suppose we buy together a multi-tenant office building. Unfortunately two of the seven tenants move out. Therefore the property is not bringing in the kind of income that we projected. Fortunately the property is making enough money to service the first mortgage, plus there is enough to pay the preferred equity investors a 5% return, but not the agreed 17% preferred return.

What happens? Can Blackburne & Sons sue Robert Buyer? No! Remember, Mr. Buyer never promised Blackburne & Sons any sort of return, not even a return of its $120,000 principal investment. All Blackburne & Sons can do legally is fire Mr. Buyer and bring in a more competent property manager.

What happens to the unpaid preferred return? It accrues, defers, and compounds at 17%. When the property sells, any profit will first be applied towards these arrearages.

"Okay, George, what you're describing is pretty garden-variety preferred equity. What's so special about your program?"

The unique thing about Blackburne & Sons' Preferred Equity Program is that we will make TINY deals. Most preferred equity providers have a $3 million minimum. Blackburne & Sons will only make preferred equity investments of between $100,000 and $600,000.

"How much does your equity cost?"

Each deal is individually priced, so a lot depends on the deal. Deals in California are much cheaper. Attractive properties are cheaper. In these equity investment deals, the CV (curriculum vitae or the business resume) of the buyer matters a lot.

That being said, most deals will cost between 16% and 22% annually and eight origination points. Keep in mind that these preferred equity investments are tiny-tiny amounts, especially when compared to the bank's new first mortgage. If he can borrow $630,000 at only 4.75% and $120,000 at 17%, the buyer's weighted average cost of funds is dirt cheap (6.71%). Also remember that the buyer can buy out Blackburne & Sons at any time.

"How do we get started?

Just call your Blackburne & Sons loan officer or call Angela Vannucci, Vice President and Equity Division Manager, at 916-338-3232.