This may be the most instructive training article that I have written in several years, so I strongly encourage you to study it. (Note: This is NOT the subject vet clinic.)

This may be the most instructive training article that I have written in several years, so I strongly encourage you to study it. (Note: This is NOT the subject vet clinic.)

Sometimes in the commercial loan business, you have to value a property based strictly on a capitalization rate ("cap rate").

Several years ago, I took on a commercial loan on an owner-occupied veterinary clinic. The vet had gone through a divorce, and he had been forced to file for bankruptcy three years earlier. He could therefore not qualify for a SBA loan.

The property was located in a town of over 75,000 people, so he could not qualify for a USDA business and industry loan either. USDA B&I loans are very similar to SBA loans; but they are designed for rural areas. Any town with a population of 50,000+ people is not considered sufficiently rural.

The loan had to go to a bank or credit union, so I was forced, absent an appraisal (always let the bank order the appraisal), to somehow create a pro forma operating statement on an owner-occupied veterinary clinic. Hmmm. How could I do that without having any idea of the market rent of a vet clinic? Here is what I came up with, and I must say, it was brilliant.

I knew that the vet had bought the facility for $500,000 two years earlier. To add in some property appreciation over the past two years, I multiplied $500,000 by 103%, which assumed a 3% annual appreciation rate. To get the second year's value, after more appreciation, I multiplied the result by 103% again, producing a value after two years of $530,450.

Then I pulled a cap rate of 8.5% out of thin air. Poof. Remember, I am trying to get my client a commercial loan here, and any commercial broker (a commercial real estate salesman who specializes in selling commercial-investment real estate) will tell you that my cap rate assumption was probably about right. I might have used 5.5% for a nice apartment building and 6.5% to 7.5% for a retail or industrial property.

You are reminded that a cap rate is just the return on his money that an investor would earn if he paid all cash for the property, assuming you built in a replacement reserve of around 3% of the Effective Gross Income. The Effective Gross Income is the number you get after taking off 5% for vacancy and collection loss.

Now please remember where we are going. We are trying a create a believable pro forma operating statement on an owner-occupied vet clinic, when rental comp's cannot be found. You could look for a week and not find another vet clinic within 50 miles that was simply rented from some passive investor.

You will recall that a pro forma operating statement is just an operating budget for the upcoming year, assuming you built in a replacement reserve to eventually replace the roof and the HVAC unit.

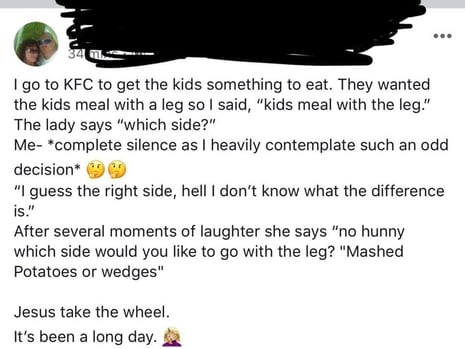

Quick Joke:

My wife and I had just finished a meal at one of our local restaurants when I realized I'd left my wallet at home. As the wife headed to the door to retrieve her purse from the car, she told the waitress what had happened, adding, "But don't worry, I'm leaving my husband for collateral." The waitress took one look at me and asked her, "What else you got?"

If you are not working towards building your own loan servicing

portfolio, get out of the business. The money is in servicing.

Back to the Lesson:

Even though we have absolutely no rental rate comparable's, we can now compute the net operating income ("NOI") on the vet clinic. We simply multiply the value of the building ($530,450) times the cap rate (8.5%) to arrive at the NOI ($45,088).

Confused?

To value any commercial-investment

property using the income approach, we

simply divide the NOI by the cap rate.

For example, if an apartment building had a net operating income of $300,000; and we knew that apartment buildings in the area were selling at 5.5% cap rates, we would simply divide $300,000 by 5.5% to arrive at a value of the apartment building of $5.45 million.

To value a commercial property -

Value = Net Operating Income / Cap Rate

Now let's get back to our veterinary clinic. We are trying to build a pro forma operating statement, while hampered by the fact that we have no rental comp's.

To get a net operating income, we simply move the formula around -

NOI = Value of the Property x Cap Rate

NOI = $530,450 x 8.5%

NOI = $45,088

We're getting there! But your commercial lender will want to see a Gross Income, a 5% Reserve for Vacancy and Collection Loss, some expenses, including a management fee, and a 3% Reserve for Replacement.

The expenses are easy. We just assume that the property is leased on a triple net basis ("NNN")! The tenant (our vet) pays the taxes, the insurance, the repairs, the utilities, etc. Poof. Suddenly we have no expenses to worry about. Am I good or what? Haha!

But your commercial lender will still want to see you taking off 5% for Vacancy & Collection Loss. He will want to see you taking off 3% for Management and another 3% for Reserves for Replacement.

We know that the NOI is just 94% of the Effective Gross Income, after taking off 3% for Management and 3% for Reserves. Therefore to get the Effective Gross Income, we simply divide the NOI by 94%.

To get the Gross Income, we start by knowing that the Effective Gross Income is 95% of the Gross Income, because we have to take off 5% for Vacancy and Collection Loss. Therefore we simply divide the Effective Gross Income by 95%. Voila! We've done it.

PRO FORMA OPERATING STATEMENT

Gross Income: $50,364

Less 5% Reserve for Vacancy: $ 2,398

Effective Gross Income: $47,966

Less 3% For Management: $ 1,439

Less 3% Replacement Reserves: $ 1,439

Net Operating Income: $45,088

Take pride in your understanding of today's lesson.

Did I lose you? Remember, I had to create a pro forma operating statement, so the lender could compute the debt service coverage ratio on your commercial loan request.

The problem was that there were only about twenty veterinary clinics within 50 miles of the subject property, and all of them were owner-occupied. There were no rental comparable's, so I couldn't just say, "Steve's Vet Clinic is leased for $3.00 sf, so the market rent of the the subject property must be $3.00 sf as well."

By assuming a reasonable and believable cap rate, we were able to work backwards to create a reasonable pro forma operating statement.

By the way, this commercial loan successfully (and easily) closed with a credit union, despite the recent bankruptcy. Hoorah!

This is the perfect time to talk about the "quality" of income. Real estate crashes seem to strike about every ten to fourteen years, and it has been thirteen years since the Great Recession. If we were to have another commercial real estate crash, would you rather own a building leased to Betty's Gift Shop or one leased to Amazon.com?

This is the perfect time to talk about the "quality" of income. Real estate crashes seem to strike about every ten to fourteen years, and it has been thirteen years since the Great Recession. If we were to have another commercial real estate crash, would you rather own a building leased to Betty's Gift Shop or one leased to Amazon.com?

The date was around 50 years before the birth of Christ. The Roman Republic had wonderfully prospered under a truly republican form of government for almost 400 years. At the time, there were no kings, no emperors, no dictators, or no Caesars in Rome. The Senate alone ruled the city-state.

The date was around 50 years before the birth of Christ. The Roman Republic had wonderfully prospered under a truly republican form of government for almost 400 years. At the time, there were no kings, no emperors, no dictators, or no Caesars in Rome. The Senate alone ruled the city-state.

The Big Boys, the ladies and men who make and arrange the really huge commercial real estate loans, have their own specialized language. You can think of it as advanced commercial mortgage-ese. Today we'll discuss one of their underwriting terms, mark-to-market (MTM) accounting in real estate.

The Big Boys, the ladies and men who make and arrange the really huge commercial real estate loans, have their own specialized language. You can think of it as advanced commercial mortgage-ese. Today we'll discuss one of their underwriting terms, mark-to-market (MTM) accounting in real estate.

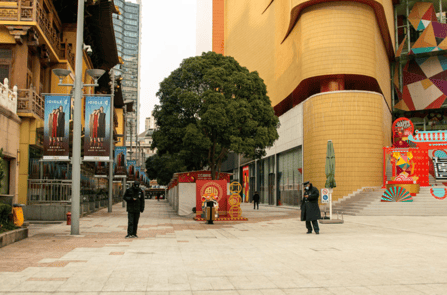

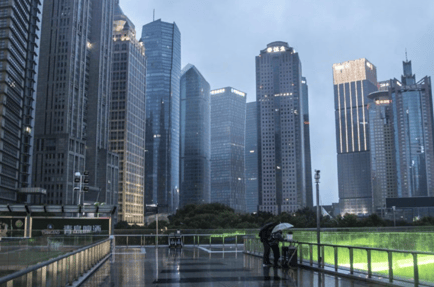

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

I have not included many funny memes today. Instead, I need for you to appreciate just how deserted are the streets of Shanghai, a city of 24 million. Guys, these pictures are NOT of Wuhan. They're pictures of Shanghai, the biggest city in China!

Why do almost all gas stations now have convenience stores? Answer: A convenience store is an extra profit center. The gas pumps pull in the customers, and while they are waiting for their tanks to fill, the convenience store sell them sodas, snacks, lotto tickets, and hot dogs.

Why do almost all gas stations now have convenience stores? Answer: A convenience store is an extra profit center. The gas pumps pull in the customers, and while they are waiting for their tanks to fill, the convenience store sell them sodas, snacks, lotto tickets, and hot dogs.

Today's article contains

Today's article contains

A buddy of mine - an old veteran in the commercial loan business - sent me an email marketing flyer last week. He had just closed a big commercial loan, and he was telling me about his special new program - a sort of

A buddy of mine - an old veteran in the commercial loan business - sent me an email marketing flyer last week. He had just closed a big commercial loan, and he was telling me about his special new program - a sort of